Dividends - Equity Derivatives Provision

|

2002 ISDA Equity Derivatives Definitions

Section 10 in a Nutshell™ Use at your own risk, campers!

Full text of Section 10

|

Content and comparisons

Article 10 Dividends

Section 10.1. Dividend Amount

Section 10.2. Dividend Payment Date

Section 10.3. Dividend Period

Section 10.4. Re-investment of Dividends

Section 10.5. Dividend Payment Obligations Relating to Physically-settled Option Transactions

Section 10.6. Extraordinary Dividend

Section 10.7. Excess Dividend Amount

- 10.7(a) Record Amount (Excess Dividend Amount)

- 10.7(b) Ex Amount (Excess Dividend Amount)

- 10.7(c) Paid Amount (Excess Dividend Amount)

Summary

What is a “dividend”?

ISDA’s crack drafting squad™, usually so unquenchable in their yen to define the living daylights out of any concept, however quotidian, is strangely mute on the question of what exactly a dividend is. A dividend is just — you know, a dividend.

The ’squad also threw in the concept of an “Extraordinary Dividend”, but — rest a while before heading in that direction — that definition, truthfully, will leave you none the wiser.

What of cash distributions to Shareholders that aren’t described as, or generally in the nature of, dividends? Is there such a thing? By the lights of the 2002 ISDA Equity Derivatives Definitions you would be inclined to conclude there is not. In any case, you are in your Calculation Agent’s hands.

What about some court-ordered compensation payment a Share issuer is obliged to pay to a class of its shareholders as a result of some ignominy perpetrated on the company’s behalf at some point in the past (a panicked, and ultimately negligent misstatement about its the real extent of its exposure to Russia/Argentina/The Millennium Bug/The Sub-Prime Market/LIBOR/Archegos/Russia (again)[1] which induced panicky investors not to sell, and which turned out to be a mistake for which those investors were entitled to compensation? This one we feel more confident about: this is not a dividend, for reasons which we go into in greater detail when discussing the parallel concept of Income under the 2010 GMSLA.

Manufacturing dividends under an equity swap

You will quickly come to realise that the equity derivatives definitions regarding payment of dividends might as well have come from a dungeon deep in the brain of MC Esher. ISDA’s crack drafting squad™, with its yen for infinite particularity and optionality, has formulated alternate mechanisms to manufacture dividends by reference to three key stages in the dividend distribution process in an underlying security:

- The record date (being the date on which a holder of record becomes entitled to a dividend payment);

- The ex date (being the date on which the underlying shares trade clean of the dividend payment in the market, which will be one settlement cycle before the record date), and

- The dividend payment date[2] itself (being the date on which the underlying dividend distributions actually hit holders’ bank accounts).

None of them, in the JC’s purblind view, works.

The only one you should ever need is the Paid Amount, as it references the date of actual payment of the underlying dividend, and no Equity Amount Payer with a sensible idea in its head will want to pay you sooner than that — but even that misses the significance to its payability of the earlier record date. You only are entitled to a dividend on the dividend payment date at all if you were the holder of record on the record date.

Much of the fear, loathing and confusion in these definitions arises from sloppy drafting in relation to this and the other two options, which don’t make sense anyway.

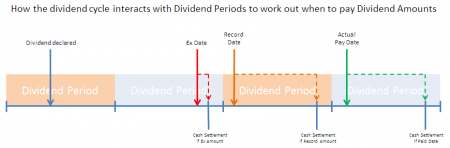

Also, note this: the ex date and the record date logically come before the dividend payment date. They will usually precede it by weeks, or even months. So if your Dividend Periods are short (e.g., monthly), it is quite likely that the ex date and record date will fall in an earlier Dividend Period than the dividend payment date.[3]

If you elect Ex Amount or Record Amount, this would mean your equity swap would pay its Dividend Amount before the underlying share paid its actual dividend.

Spoiler: that’s stupid.

If you elect Paid Amount, it is conceivable[4] you could be expected to manufacture a dividend payment for a dividend whose record date fell before the Trade Date of your equity swap Transaction.

Spoiler: that’s even stupider.

The point of a derivative is to replicate, as closely as possible, the economics of its reference asset. Not only does electing Ex Amount or Record Amount introduce arbitrary[5] timing “basis” between the derivative and its underlying security, it also potentially introduces credit “basis”, because an underlying issuer which has declared a dividend may not ultimately be able to pay it — if it has become insolvent in the meantime, which could be a period of months. Now some timing basis between a derivative and its underlying is inevitable — the derivative payment will lag the underlying payment[6] — but credit basis is certainly not. Derivatives are not meant to guarantee the performance of the underlying securities they reference.[7] In fact, that is utterly antithetical to the very definition of the word “derivative”.

The timing of dividends

There are four crucial dates: in order, these are the “declaration date”, the “ex-dividend date”, the “record date”, and the “Dividend Payment Date”.

- Declaration date: The declaration date (also called an announcement date is the date on which the issuer announces there will be a dividend. They usually happen quarterly, for those stocks which are regular dividend payers. This comes first. The dividend declaration will include the size of the dividend (the Dividend Amount), the ex-dividend date (being the last date on which, if you buy the stock, you get the dividend), and the Dividend Payment Date — the date on which a dividend is actually paid. Timings are likely to be (these are indicative — I just made them up okay):

- Declaration date = D

- Ex-dividend date = D+9

- Record date = D+10

- Dividend payment date = D+30

- Ex-dividend date actually keys off the record date, and is set based on stock exchange rules — usually a business day before the record date. If you buy a stock on or after its ex-dividend date, you won’t get the dividend because the trade won’t settle until after the ...

- Record date, being the date you actually have to be on the register of shareholders to qualify for the dividend, which will be paid to whoever was the holder of record on the record date, whether or not they have subsequently sold the share, on the

- Dividend payment date which may be as much as a month or more after the original dividend declaration date.

Interest and accruals

While the definitions provide that the Equity Amount Payer must manufacture Dividend Amounts on the Cash Settlement Payment Date, (typically at the end of a Dividend Period) and therefore structures in a period between receipt of underlying and payment on the swap, the definitions do not provide for any interest accrual over that period.

In practice, users tend to “pay when paid”, settling Dividend Amounts the business day following receipt on the underlying, notwithstanding the text of the 2002 ISDA Equity Derivatives Definitions. No-one complains about this. Indeed, we imagine no-one is any the wiser. If you are anything like the JC, you will quietly wonder why we bother negotiating contracts in the first place, if operations personnel are just going to ignore them in practice. If you are an operations person, you may quietly wonder exactly the same thing.

Dividends on Index Transactions? No, sir. But yes, sir.

We shouldn’t really need to say it, but we will: You don’t — well ~ cough ~ shouldn’t — get dividend payments on an Index Transaction. The Index calculation methodology will either replicate the effect of dividend reinvestment on Index constituents, by proportionately re-weighting constituents when they pay dividends — in which case you will get the effect of those dividends just through “price return” of the Index level — or it won’t, in which case you won’t get the effect of those dividends, BECAUSE YOU BOUGHT A DERIVATIVE OF AN INDEX THAT DOESN’T REPLICATE THE EFFECT OF ANY DIVIDENDS.[8]

Either way, the dividend provisions of the 2002 ISDA Equity Derivatives Definitions aren’t — well ~ cough ~ shouldn’t be — relevant to Index and Index Basket Swap Transactions. So they don’t really countenance the idea of an Index paying through dividends. While, in the Russian-doll defined terms schema confected by ISDA’s crack drafting squad™ an Index Swap Transaction is a kind of Equity Swap Transaction, and therefore can have a Type of Return applied to it, when you dive down the rabbit hole, through the Total Return star-gate, along the Re-investment of Dividends axis and into the Dividend Amount portal, you hit the hard black nothingness of dark energy: A Dividend Amount is defined, of course, by reference to a Share’s Record Amount, Ex Amount or Paid Amount, and not that of an Index, for the compellingly straightforward reason that Indices are abstract numbers. They don’t pay dividends.

Now ISDA’s crack drafting squad™ made a half-hearted swipe — actually, it a was more like a full-blooded, half-hour long drubbing — in one of the Pan-Asia MCAs to build in manufactured dividends to Japanese index products, but it is fiendishly complicated, not to mention wrong-headed, and no-one uses it as far as we know.

However.

There is a fairly common market practice, for indices that don’t re-weight to replicate dividend reinvestment, for dealers to manufacture dividends on the Index constituents anyway. This is because a common means of hedging indices is by buying the underlying stocks, so since the dealer is getting the cashflows in and can pay them out. This is hard to reconcile with the drafting of the 2002 ISDA Equity Derivatives Definitions, unless either (i) for Index transactions, you rather wilfully deem “Shares” to mean “constituents of the Index”, or (ii) you treat the Index Transaction as really a dynamic custom Share Basket Swap Transaction. Your front office guys won’t like that suggestion, so do you know what the JC’s approach is? Just leave it. This is one of those beautiful places where the lawyers — who have only the faintest grasp of that the front office does at the best of times — do one thing, and the business — which broadly could not care a row of buttons what legal contracts say until it suddenly all goes Pete Tong — does another, ne’er the twain meet, and the respective groups carry on in blissful ignorance of the a gaping conceptual chasm between them.

And speaking of gaping chasms, you know what I’m going to say now, don’t you?

Clause-by-clause

Section 10.1(a) Record Amount

Referencing the Ex Amount or the Record Amount for a manufactured distribution under an equity derivative doesn’t make much sense. Referencing the Paid Amount would, had ISDA’s crack drafting squad™ drafted it properly. The JC has a proposed fix.

Section 10.1(b) Ex Amount

A key part of the Kafkaesque labyrinth you must navigate to work out how much, and when, your Dividend Amount (or, if you’re looking at paragraph 10.7(b), Extraordinary Dividend) will be paid.

Spoiler: referencing the Ex Amount or the Record Amount for a manufactured distribution under an equity derivative doesn’t make much sense. Referencing the Paid Amount would, had ISDA’s crack drafting squad™ drafted it properly. The JC has a proposed fix.

Note how an unexpected cessation of all non-essential economic activity in the western world has threatened to reveal embedded snafu drafting in the Equity Derivatives Definitions. See the “For completists” section below for more.

Section 10.1(c) Paid Amount

The Paid Amount problem. So we have two problems: what to do if the record date for a Dividend Amount falls before the trade date for a Transaction, and what to do if the dividend payment date falls after the Transaction terminates.

Neither of these contingencies, predictable though they seem to be, is addressed in the 2002 ISDA Equity Derivatives Definitions. But help is at hand: the JC — errors and omissions excepted, all usual disclaimers applying — humbly offers the following corrective for your Master Confirmation Agreement:

- “Paid Amount” will apply, provided that:

- (a) where the Share was trading “ex-dividend” as of the Effective Date, the Paid Amount will be zero; and

- (b) where the Transaction terminates after the Share commenced trading “ex-dividend” but before the scheduled Dividend Payment Date, the Equity Amount Payer will pay any Paid Amount one settlement cycle following payment of the corresponding dividend by the Issuer to holders of record of the Share.

Section 10.2 Dividend Payment Date

Just part of the monster truck motorway pile-up that was ISDA’s crack drafting squad™s’ attempt to provide for manufactured dividends on equity derivatives. Total disaster. See Dividend Amount for the full enormity of the situation.

The only relevance of the Cash Settlement Payment Date or Settlement Date is that the former relates to money payments and therefore cash dividends, the latter to physical delivery of securities, (i.e. scrip dividends), which are more fraught with disruptions.

So your cash payments will usually get paid on the intended Currency Business Day; scrip dividends might not get to you for a few days if the market is a bit salty.

Section 10.3 Dividend Period

Somewhat muffs what you do with a Paid Amount dividend that became due (i.e., had a record date before the termination date, but is not paid until after the termination date.

Section 10.4 Reinvestment of Dividends

This adds the value of declared and paid dividends to the value of the Equity Notional Amount. It references the Cash Settlement Payment Date which assumes a cash dividend and not a scrip dividend) because if you aren’t actually settling the dividend at all, you don’t have to worry about there being some kind of disruption, which worry is implied in the definition of Settlement Amount - being the date you get physical settlement of a scrip dividend — but not in the Cash Settlement Payment Amount, which is the date for a cash dividend. I don't think I explained that very well. But hopefully you can see what I mean. Sort of.

Section 10.5 Dividend Payment Obligations Relating to Physically-settled Option Transactions

There are some provisions of the 2002 ISDA Equity Derivatives Definitions that will cause extended, heated negotiation and a degree of enmity between even mild-mannered negotiators. This is not one of them.

Section 10.6 Extraordinary Dividend

You would be forgiven for thinking this definition a little circular, especially if you haven’t specified what an Extraordinary Dividend will be in the Confirmation. This is because — we venture — ISDA’s crack drafting squad™ felt it was all a bit hard.

“Because,” said they, “of the difficulties of determining in advance in any formulaic way what would constitute an Extraordinary Dividend, the details of this are left to parties to state in their Confirmations.”

Of course, the point about an Extraordinary Dividend is that it is extraordinary. Out of the ordinary; off the beaten track; beyond the mortal comprehension, and powers of prediction, not just of the sainted ISDA drafting committee, but of those poor saps, too, grinding out your equity derivative trade confirms in some mice-invested operations depot in suburban Almaty. How are they supposed to know what an Extraordinary Dividend is?

But look on the bright side: “Dividend” is not defined in the 2002 ISDA Equity Derivatives Definitions at all![9]

Anyway, the definition boils down, as best as I can fathom, to this:

“An Extraordinary Dividend is whatever the Calculation Agent jolly well says it is.”

Which, in its way, is fine, especially if you happen to be acting for the Calculation Agent, but if you are the Calculation Agent and the question before you is “is this really weird thing that’s just happened to the voting stock of some obscure trucking company in Panama an Extraordinary Dividend or not?” you might feel anchored a little high up the beach as the tide goes out.

Look, I don’t make the rules, folks.

Section 10.7 Excess Dividend Amount

See paragraph 10.1(b) Ex Amount, which applies to normal, unremarkable dividends and 10.7(b) Ex Amount which applies to Extraordinary Dividends (or you could really go to town and compare them).

Most of the time you’ll be using the normal one under paragraph 10.1(b), but (except for the reference to “gross cash dividend” on one hand and “extraordinary dividend” on the other.

General discussion

Careful: it’s (meant to be) about timing, not amount

So what is the difference betwixt a Record Amount, Paid Amount and Ex Amount? To be clear, it is not about whether you get paid, nor how much, but when. A Dividend Amount is a Dividend Amount: in each case “100%[10] of the gross cash dividend per Share”, end of the day. What this is all to do with is when a Dividend Amount is deemed to occur, which in turn is a function of which Dividend Period the trigger for the dividend falls in.

- The trigger where Record Amount applies is the record date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the record date falls.

- The trigger where Ex Amount applies is the ex date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the ex date falls.

- The trigger where Paid Amount applies is the payment date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the dividend is paid.

Hang on a minute. “Paid”? Is that, like, different to “declared”? On purpose?

Is Paid Amount meant to be different from Record Amount or Ex Amount, in referencing not what is declared, but what the Issuer actually physically, real-world, paid out?

On one hand, on a natural reading it seems so: Record Amount and Ex Amount specify an amount by reference to the amount “declared by the Issuer to holders of record of a Share”, whereas Paid Amount references the amount “paid by the Issuer during the relevant Dividend Period to holders of record”. On the other hand there’s no sensible reason for supposing an Equity Amount Payer would want to keep the risk of solvency of an Issuer if it pays early[11] but not have it if it pays on the payment date. Examination of the world wide web seems to offer little help.

But here’s a common-sense explanation. Remember the timing of the dividend process: first it is declared, then, a short settlement cycle before the record date the share trades “ex-div” (this is the “ex date”), and only then, two or three weeks after the record date, is the actual Dividend Payment Date. And remember this whole farrago is to determine in which Dividend Period the Dividend Amount gets paid.

Now, if you chose Ex Amount, your Cash Settlement Payment Date may well fall before the actual Dividend Payment Date, in which case it doesn’t make sense to talk about the dividend paid by the issuer, because it won’t have been paid yet. If you selected Paid Amount, the Cash Settlement Payment Date necessarily will fall after the Dividend Payment Date, so it is safe to talk about the dividend having been paid. Because it must have been — and in the disaster scenario where it hasn’t — ie, the corporate failure of the underlying issuer — the Equity Amount Payer won’t want to be paying out a Dividend Amount anyway.

But as for the very good question why would any equity derivative purport to pay out a Dividend Amount before the actual real-world payment date for the Dividend it is synthetically replicating? This is a question only ISDA’s crack drafting squad™ would be placed to answer, and they’re not talking.

Dividend clawback: if the Issuer doesn’t actually pay a declared dividend

The User’s Guide to the 2002 ISDA Equity Derivatives Definitions suggests, without saying when, that you might need a claw-back right if you don’t want to be on the hook for a declared but unpaid Dividend Amount[12]:

- Dividend Recovery: If the amount an Issuer actually pays to Shareholders of record in respect of a gross cash dividend is less than the amount declared (a “Dividend Mismatch”) the Calculation Agent may calculate a payment under the Transaction to account for Dividend Mismatch and compensate for interest incurred by the party that made the relevant payments. Where the amount actually paid by the Issuer to Shareholders of record for any such dividend is paid or (scheduled) after the Termination Date, this provision will still apply even though relevant settlement date has passed. If the Issuer subsequently corrects the under-payment, the Calculation Agent may make a further adjustment.

“Parties should consider,” further it further ruminates, in typically passive-aggressive fashion, “the potential credit risk created by this provision and may wish to consider whether such amounts are adequately covered under the definition of “Exposure” under any relevant credit support document.”

But on what planet would an Equity Amount Payer want to be liable for a dividend declared but not ultimately paid by the Issuer? And why? That would be to do something equity derivatives are designed not to do.

House view: S.N.A.F.U.

The JC concludes this is simply a howler in the 2002 ISDA Equity Derivatives Definitions which ISDA hastily tried to cover up with that clawback malarkey. In any case, to be safe, reference the Paid Amount, with an amendment to cover ex dates occurring on or before the trade date, and dividend payment dates occurring after the trade date.[13] In any case, consensus amongst market professionals we have consulted is that Paid Amount does, as its drafting suggests, depend on the Issuer ponying up, so no need for that clawback language. That is where you want to be.

For details freaks

You are a counterparty to an equity derivative Transaction papered under the 2002 ISDA Equity Derivatives Definitions. Hard to imagine, I know, but just go with me. So what happens if you have selected “Ex Amount” as your Dividend Amount payment method, and the Issuer has duly declared a Dividend, the record date has passed as expected, the Share has started trading ex-dividend (as by rights it should do) and then something unexpected and properly epochal happens — like the world basically ceasing to rotate on its axis for a prolonged and indeterminate time, prompting said issuer to cancel its dividend. What then?

Judged by the lights of its basic metaphysical premise, the intention of a derivative is to, well, be derivative: to replicate as closely as possible the performance of the underlying Share. No equity derivative counterparty has it in its head that it is underwriting, or guaranteeing, an Issuer’s commitment to pay a dividend that the Issuer itself does not ultimately carry though — even if the Issuer were legally obliged to perform that obligation, whereas in fact it tends not to be (however unconventional not doing so might be). So, you would think, it would be odd to find a Transaction obliging an Equity Amount Payer to pay a Dividend Amount notwithstanding cancellation of the actual dividend on the underlying Share.

To be sure — we men and women of finance being homo economici and everything, you would expect anyone writing that kind of put option to be pretty categorical about it, and to demand quite some premium for it.

Yet a cold reading of the Ex Amount method (if not modified by some kind of clawback) suggests that it what it does:

- “100% of the gross cash dividend per share declared by the Issuer to holders of record of a Share where the date that the Shares have commenced trading “ex-dividend” on the Exchange occurs during the relevant Dividend Period”.

Dunno about you, but I can’t see any contingency on actual Issuer payment in there.

The above “cold reading” does not accord with the economic facts as market participants — homo economici all — understand them. The JC suspects that common sense will prevail and no one will be cavalier enough to take this point. But you just never know, and it is a hard one to crowbar into the present law of contractual mistake.

Template

See also

- Dividend Payment Date.

- Dividend Recovery which isn’t 2002 ISDA Equity Derivatives Definitions canon, as such, but more apocrypha or officially endorsed fan fiction. Something like that.

References

- ↑ Delete as applicable.

- ↑ Not to be confused with the Dividend Payment Date in the 2002 ISDA Equity Derivatives Definitions, being the date for the manufactured payment, not the payment of the underlying dividend itself.

- ↑ And may fall before the Transaction has even started.

- ↑ If a record date for a share is 1 January, the Trade Date for a Transaction on that share is 2 January, and the actual dividend payment date for that share is 10 January, then if you have elected “Paid Amount”, to these purblind eyes, you would be obliged to pay “100% of the gross cash dividend per Share paid by the Issuer during the relevant Dividend Period to holders of record of a Share” even though the Hedging Party could not possibly have (deliberately) held a hedge yielding that dividend on the record date, since the trade did not exist at that point in time.

- ↑ arbitrary because it is totally dependent on whether the ex date falls in the same Dividend Period as the actual payment date, which in turn will be a function of the registrar’s schedule and nothing to do with the Issuer.

- ↑ And note the 2002 ISDA Equity Derivatives Definitions envisages Dividend Amounts being paid on the Cash Settlement Payment Date, which is at the end of the Dividend Period — though many users ignore that and adopt a “pay-when-paid” approach, regardless of what the definitions say.

- ↑ Okay I realise that seems not to be true for credit derivatives. But even there, the credit protection “buyer” is effectively short the derivative exposure. It is simply confused because in the classic case, the protection “seller” was an investor buying a CDO which is an instrument which securitises a short credit derivative.

- ↑ The S&P 500 index, for example, does not factor in any dividend payments. Apparently.

- ↑ Try “Dividend Amount”, which refers to a “gross cash dividend” without further elaborating on what that might be.

- ↑ Or whatever other percentage you agree, of course.

- ↑ or ever, really: that defeats the purpose of an equity derivative

- ↑ This is a JC bastardisation of typically grim ISDA textical contortion, needless to say.

- ↑ Good news! The JC has had a go for you. See Paid Amount for more.