Triparty agent

|

|

“Tri-party.” It sounds such fun, doesn’t it?

One who manages a tri-party collateral arrangement. A useful fellow if you want to grant security over a revolving pool of collateral securities and retain a right of substitution. Some useful discussion there at Financial Collateral Regulations.

Often triparty agents are behemoth banks like JPMorgan, Bank of New York Mellon, or clearing systems like Euroclear.

Negotiating in a triparty arrangement can be quite the three-legged race. It can be like dealing with an architect and a builder who blame each other every time the ceiling collapses.

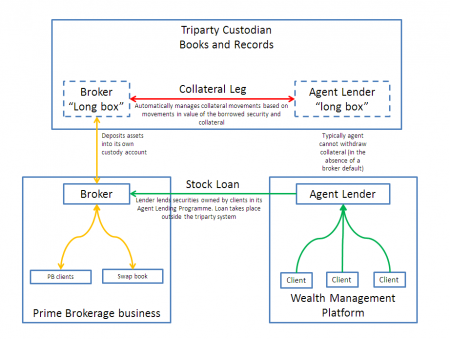

How it works

See handy diagram over yonder ==>. The triparty agent acts as a custodian. It opens separate accounts in the name of a borrower (usually a broker looking to “upgrade” securities in its equities and prime brokerage businesses, optimising its funding position for margin loans it has made) and lender — typically a large wealth manager whose clients have lots of government bonds and other high-quality securities they want to earn some extra yield), and transfers collateral between them at their joint instruction, in satisfaction of margin obligations under the stock loan between the lender and borrower, which will be documented under a separate master agreement. A 2010 GMSLA or something similar. So very popular with agent lenders and agent lending participants as a handy way of managing collateral received from brokers who are borrowing their securities to of their prime brokerage desk, as this handy diagram purports to illustrate.

The triparty agent acts as custodian and has legal title to securities which it holds as trustee for the broker, so at first broker is the beneficial owner. When the securities are transferred to a lender as collateral, the triparty custodian effects this in its own books and records by debiting broker’s account – whereupon broker ceases to have any legal or beneficial interest in the securities – and credits them to the Lender, whereupon the Lender holds the beneficial interest.

At all times while the securities are in the triparty system, the triparty custodian owns legal title. It moves securities by book entry in its own records – there is no physical movement of actual securities once they’re in the triparty system. The broker can credit and debit securities from its long box account more or less at will (as long as it keeps a sufficient collateral balance in there) in order to meet its own requirements for hedging (and its PB clients’ interests in rehypothecated custody assets)

Pledge GMSLA

Note - after the Basel III reforms, it has become expensive for brokers to post (haircutted) collateral by title transfer because they pick up LRD exposure to the Lender for the return of excess collateral - becuase they are an unsecured creditor, see? Many are moving to a pledge GMSLA for agent lending arrangements (ithe pledge GMSLA only makes commercial sense for a Lender (like an agent lender who has no need to reuse the collateral)