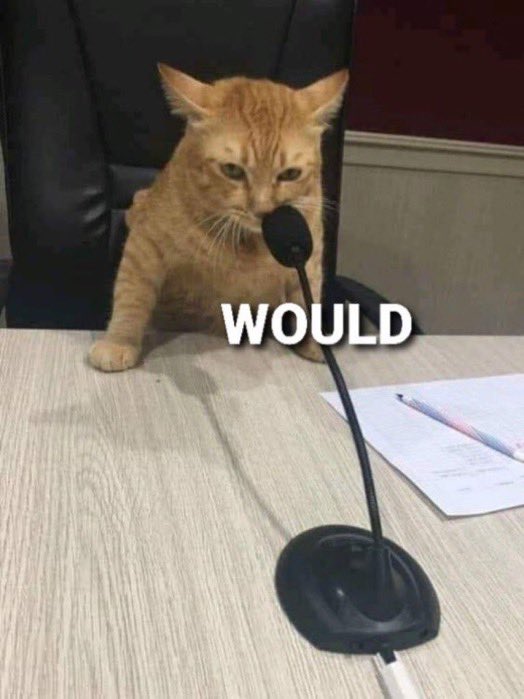

Would-level opinion

|

Office anthropology™

|

“Would level” is the strongest degree of assurance that an attorney can provide when opining on bankruptcy matters.

- —Legal isolation of transferred financial assets, PWC Viewpoint

A term of financial art: it once meant the highest possible degree of comfort things won’t go wrong, and therefore one won’t be fired — but worn smooth over time as all allocations of risk tend to be, by years of gentle polishing by the vicuña twill that houses a million well-heeled posteriors — these days really means one definitely will not be fired, even if things do go wrong, because one’s arse is, formally, covered.

“Formally” because, in our fickle times, form has vanquished substance to so great an extent that form is now all there is.

Until it isn’t.

The “would-level opinion” is a byword for safety; it is plausible deniability.

It speaks to prudent diligence, res ipsa loquitur, no (further) questions asked.

Technical uses

It has its technical uses, particularly when it comes to calculating capital charges. Did you really get that toxic waste off your balance sheet, for good, such that there really is no chance of it repeating on you, out of the blue, when you least expect it, as the whole market lurches into cataclysm. A would-level true sale opinion will say that you did; nothing else will do. Is it really the case that, in the wildest fantasies, a local insolvency court would respect and abide by your single agreement clause should your derivative counterparty go titten hoch with amounts due to it under different Transactions to those under which it owes you similar sums? Only a would-level netting opinion will do.