Suspension - Emissions Annex Provision: Difference between revisions

Amwelladmin (talk | contribs) Created page with "{{manual|DCE|2005|Suspension|Section||medium}}" |

Amwelladmin (talk | contribs) No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{ | {{euamanual|Suspension}} | ||

Latest revision as of 15:29, 22 May 2023

|

EU Emissions Allowance Transaction Annex to the 2005 ISDA Commodity Definitions A Jolly Contrarian owner’s manual™

Suspension in all its glory

Comparison See our natty emissions comparison table between the IETA, EFET and ISDA versions of emissions trading docs

Resources and Navigation

|

Overview

The definition of Suspension Event is more or less the same in all three emissions trading documentation regimes. Compare:

ISDA: Suspension Event

IETA: Suspension Event

EFET: Suspension Event

As an extra treat, here are some deltaviews:

IETA vs EFET: comparison

ISDA vs IETA: comparison

Suspension Event procedure

You will notice similarities between the way a Suspension Event and a Settlement Disruption Event. One can, and we do, bellyache about the way ISDA’s crack drafting squad™ goes about the task of rendering its fantastical ideas in the language of Shakespeare and Milton, but you can’t really fault them for consistency.

Here, in counterpoint to a normal Settlement Disruption Event if there is delayed performance the payment obligation is adjusted to include a Cost of Carry Amount.

Definition of Suspension Event

This a limited thing — some would say, arbitrarily limited — where regulatory/government fiat at the heart of the European Union stops the system functioning as it should, but not permanently. So, taking the Union Registry offline, an Administrator Event — but not some other regulatory driven externalities. It doesn’t include Abandonment of Scheme or an “executive decision” (however unlikely) that Phase 3 Allowances are no longer elibigle for surrender in Phase 4.

Interrelation

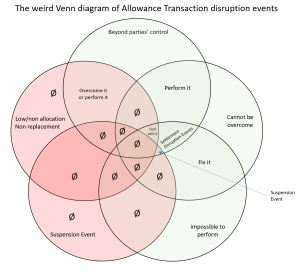

You may never thank us for producing this diagram of how the various Suspension Events and Disruption Events do, or don’t interact with each other: it is probably wrong and we will never get that two hours back. But here it is for whatever small crumb of enlightenment it may bring.

Summary

Someone has got a mind infested by nefarious phantoms, readers: either the ISDA’s crack drafting squad™ does, collectively, or the JC does. We are totally not ruling out the JC, to be clear. But this is too weird.

A Suspension Event happens when the official infrastructure falls over so that the parties can’t transfer Allowances to settle a Transaction. It is the fault of neither party — therefore to be distinguished from a Failure to Deliver, which generally will be. While there is overlap between Settlement Disruption Events and Suspension Events (in that both are things beyond the parties’ control) Suspension Event, being narrower and related to the failure of official infrastructure, trumps Settlement Disruption Event where they both apply to the same event. Generalia specialibus non derogant, I suppose.

Note the Long-Stop Date concept, which references 1 June in a year following a set of seemingly arbitrary two-year spells in the Fourth Compliance Period and relates only to Suspension Events, not Settlement Disruption Events, and also appears to bear no relation at all to the Reconciliation Deadline at the end of April in each year.

We have compared Settlement Disruption Events and Suspension Events here.

A curiosity to which the JC has not yet found a plausible answer is why there is a Cost of Carry adjustment for Suspension Events that run over the scheduled Delivery Date, but not for other, ordinary Settlement Disruption Events (or for that matter, Failures to Deliver).

There is no at-market termination provision at a Long-Stop

Also, the “then I woke up and it was all a dream” method of resolving irreconcilable suspensions. Unlike for Settlement Disruption Event, ISDA’s Carbon Squad did not provide for “Payment on Termination for Suspension Event”. We are baffled by this, as we have mentioned elsewhere: it defaults the position to one where the person who thought they had sold forward a risk finds, for reasons entirely beyond their control, that not only was that risk transfer ineffective, but the risk has come about and the asset is, effectively worth zero. If you consider the position of someone who was, for example, financing someone else’s Allowance allocation — hardly out of the question, since that is basically the point of a Forward Purchase Transaction this is transparently the wrong outcome, since the Seller — the person who is borrowing against its Allowances — gets to keep the money. Madness.

Premium content

Here the free bit runs out. Subscribers click 👉 here. New readers sign up 👉 here and, for ½ a weekly 🍺 go full ninja about all these juicy topics 👇

|

- The JC’s famous Nutshell™ summary of this clause

- The curious case of the “then I woke up and it was all a dream” method of resolving non-operartional ISDA Transactions

See also

- Settlement Disruption Event vs Suspension Event

- Physical Settlement

- Failure to Deliver

- Failure to Deliver (Alternative Method)

References

- ↑ We think this number is superfluous, in that there is not a (II).

- ↑ Since ISDA’s crack drafting squad™ elected to express a mathematical proposition on its own tortured prose, it is not entirely clear what is meant to be divided by 360: the stray comma suggests maybe it is meant to be a denominator for the whole sum, but we think it makes more sense to divide only the Cost of Carry Delay by 360, as that gets you an annualised day count fraction that the rest of the sum can be multiplied by. If you ignored the ambiguous comma, that is the most consistent with the paragraph layout.