Double full stop

A sure sign a document has had a tortured gestation, during which it was feasted on by legal eagles from all quarters but — critically — before all was said and done deal fatigue set in, most of them lost interest, and someone said, “O.K., hang it, let’s just sign the damn thing.”

|

Towards more picturesque speech™

|

What is left is a tract with all the usual tedious legal tropes but improbably strewn with unextinguished blobs, square brackets and miscellaneous harmless typos, the most feckless of which is the double full stop..

The double full stop — a fossil record indicating the insertion, and then removal, of a sentence of which no other trace remains, but that you can be sure started, “for the avoidance of doubt, ...” is unusually acute in its bathos. It says,

“this mattered to me once, gravely, but now I am past caring. I hate you all. Just deliver me from this godforsaken project. Let me go. I don’t even want a tombstone.”

This may, but does not have to, arise during the end game of a vigorously-negotiated deal. Regulators are prone to it, too.

The Cayman double full stop

A celebrated example comes from the Cayman Islands Monetary Authority’s recent, bished, attempt to update its rules on asset segregation for investment funds. Yes, yes: I know what you are thinking: be still, my beating heart. But ride along with us for a while.

Now you can imagine, as no doubt CIMA did, that such a project was not calculated to attract world-wide attention. Perhaps they assigned it to their newest member, by way of initiation ritual, as a practical joke, or as an earnest means of learning the ropes. We speculate. In any weather, the new rules started off brightly enough:

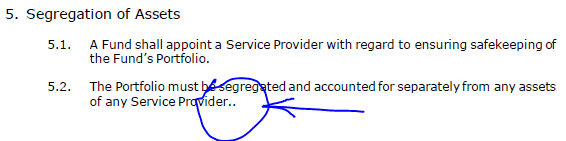

- “5.2. The Portfolio must be segregated and accounted for separately from any assets of any Service Provider.”

So far, so unobjectionable. But it did not take long for things to take a darker turn. Just a few paragraphs further on, the rules provided, almost by way of parenthetical note:

- 5.5. The overriding requirement of Rule 5.2 is that a Fund must ensure that none of its Service Providers use the Portfolio to finance their own or any other operations in any way.

We do not need to pause for long to observe that, on its face, this bears scant relation to the “overriding goal” of Rule 5.2, which says nothing of the kind. Rule 5.2 asks custodians not to commingle their clients’ assets with their own; an entirely workaday affordance that, to any half-competent trust and agency professional, would hardly need being said. But within a couple of paragraphs, our CIMA ingénue overreaches her tepid lagoon and seems to pry into the famously private affairs of her hedge fund constituents. Rule 5.5 seems to bar one such as a prime broker from rehypothecating a Cayman fund’s assets.

Now in a business as dependent on margin lending as is the Cayman Islands’ hedge fund industry, this is quite the intrusive bolt from the blue. The industry, and its professional advisers, rose up as one. “What,” they enquired, “on Earth do you think you are playing at?”

Of course, this was not what CIMA meant at all. There followed a hasty “reverse ferret”. But in that fascinating way of modern life, wherein it will no longer do to just admit to a cock-up and fix it properly, websites were updated, correspondence reissued, and the guidance was clarified. The offending sentence was deleted, hastily, you fancy, with some CIMA boxwallah standing over the poor website editor’s desk, temple veins throbbing.

“Fix it. Now.”

Time perceptibly accelerates. Its very geometry contracts. The keyboard clatters. Track changes. Select. Delete. Save. Circulate to chair of asset segregation regulatory working group.

“Please see attached herewith for your appr—”

“JUST PUBLISH THE GODDAMN THING OR SO HELP ME—”

And so our embattled webmaster accepts changes, saves down and uploads with the offensive sentence removed, but that obstreperous speck, that infinitesimal Biggs hoson still mendaciously there, a delicious tell-tale trace of the foregoing ruckus:

- 5.5. The overriding requirement of Rule 5.2 is that a Fund must ensure that none of its Service Providers use the Portfolio to finance their own or any other operations in any way..[1]

Sadly, the superfluous full stop has since been found and eradicated, but we like to commemorate it here all the same, a mute testament to the intractable vacuity of regulatory practice.

See also

References

- ↑ Emphasis added.