Template:EFET Allowance Annex Definitions

Terms used in this Allowances Appendix shall have the following meanings:

“Administrator Event” means the suspension of all or some of the processes in respect of a Registry or the EUTL in accordance with the Registries Regulation by the National Administrator or the Central Administrator (as applicable) (i) where that Registry is not operated and maintained in accordance with the provisions of the Registries Regulation, or any other applicable law, or (ii) for the purposes of carrying out scheduled or emergency maintenance, or (iii) where there has been or following reasonable suspicion of, a breach of security which threatens the integrity of the registries system (including any back up facilities);

“AEUA” means a unit of account that is an “allowance” as defined in the EU ETS Directive and is issued under Chapter II thereof;

“Affected Allowance” means an Allowance which is or is alleged to have been the subject of an Unauthorised Transfer as confirmed by an Appropriate Source;

“Aircraft Operator” means an “aircraft operator” as defined in the EU ETS Directive;

“Allowance” means an allowance to emit one tonne of carbon dioxide (C02) equivalent during a specified period, or such other type of unit as may be recognised as, valid for the purposes of meeting the requirements of applicable law and the relevant Emissions Trading Scheme on the Delivery Date, including, without limitation, for the purpose of meeting emissions’ related commitment obligations under the EU ETS;

“Allowances Appendix” means this Allowances Appendix to the General Agreement (inclusive of its Annexes);

“Allowance Type” means a specific type of Allowance as defined by the Applicable Rule(s) including, without limitation, an AEUA, an EUA or other Allowance Type which the Parties have specified as applying in Part II of this Allowances Appendix or in an Individual Contract which may be used for determining compliance with emissions related commitment obligations under the EU ETS;

“Allowances Termination Amount” shall have the meaning given in § 10.5 of this Allowances Appendix;

“Allowance Transaction” shall have the meaning given in the first paragraph of this Allowances Appendix;

“Applicable Rule(s)” means that subset of the Rules which govern, relate to or otherwise concern the valid Transfer of Allowances to Buyer’s Holding Account in satisfaction of Seller’s obligation under an Allowance Transaction and, when applicable in context, which govern an entity’s emission-related obligations under the EU ETS to its Relevant Authority;

“Appropriate Source” means any “competent authority” and/or the “Central Administrator” (as those terms are defined in the Registries Regulation), National Administrator or any other authority having power pursuant to the Directive and/or the Registries Regulation to block, suspend, refuse, reject, cancel or otherwise affect the Transfer (whether in whole or in part) of Allowances, any recognized law enforcement or tax authorities of a Member State, European Anti-fraud Office of the European Commission or Europol;

“Central Administrator” means the person designated by the EU Commission to maintain the EUTL pursuant to Article 20(1) of the EU ETS Directive;

“Compliance Period” means the Fourth Compliance Period unless otherwise specified by the Parties in the Confirmation to the Allowance Transaction;

“Compliance Year” means that period of time between each Reconciliation Deadline (if more than one) in respect of a Compliance Period;

“Contract Price” means, in respect of an Allowance Transaction (and, where applicable, for a particular Compliance Period) the amount agreed to be the purchase price for that Contract Quantity, excluding applicable taxes;

“Contract Quantity” means, in respect of an Allowance Transaction, the number of Allowances (of one or more Compliance Periods, where applicable, as agreed to be bought and sold between the Parties;

“Cost of Carry Amount” has the meaning specified in § 7.5(d) (Cost of Carry);

“Cost of Carry Calculation Period” means the number of calendar days from and including the original Due Date which would have applied but for delayed delivery to, but excluding, the delayed Due Date resulting from delayed delivery;

“Cost of Carry Rate” means the “EUR-EuroSTR-COMPOUND” interest rate in respect of each day in the Cost of Carry Calculation Period, provided that if the interest rate would otherwise be less than zero, the interest rate shall be floored at zero and any margin applied thereto;

“Default Cost of Carry Amount” has the meaning specified in § 8.5(a)(ii);

“Default Cost of Carry Calculation Period” means the number of calendar days from and including the original Due Date which would have applied but for delayed delivery to, but excluding, the delayed Due Date that would have applied assuming that the Seller sent an invoice at the earliest date it would have been entitled to do so in accordance with the methodology elected in § 13.2 (Payment) in Part II of the Allowances Appendix;

“Default Cost of Carry Rate” means the “EUR-EuroSTR-COMPOUND” interest rate in respect of each day in the Default Cost of Carry Calculation Period, provided that if the interest rate would otherwise be less than zero, the interest rate shall be floored at zero and any margin applied thereto;

“Delayed Delivery Date” has the meaning specified in § 7.5(b). In order that a two Delivery Business Day grace period and consequent obligation to pay compensation shall also apply to an Allowance Transaction when the Seller, on a Delayed Delivery Date, fails to Transfer to the Buyer or the Buyer fails to accept Transfer from the Seller of, all or part of the undelivered Contract Quantity of an SE Affected Transaction, for the purposes of § 8 (Remedies for Failure to Transfer or Accept), a Delayed Delivery Date shall be deemed a Delivery Date; provided, however, that such two Delivery Business Day grace period does not extend the Delayed Delivery Date in respect of an Allowance Transaction to a day that is either:

(i) on or after the Reconciliation Deadline following the relevant Delayed Delivery Date; or (ii) on or after the Long Stop Date in respect of the relevant Allowance Transaction;

“Delivery Business Day” means, in respect of an Allowance Transaction, and for the purposes of this Allowances Appendix only, any day which is not a Saturday or Sunday, on which commercial banks are open for general business at the places where each Party specifies as applying to it in Part II of this Allowances Appendix. In the event that a Party does not so specify a place in Part II of this Allowances Appendix, then (that/those) place(s) shall be deemed to be the Seller and the Buyer’s addresses, as applicable, specified in § 23.2 (Notices, Invoices and Payments) of the General Agreement or, if no such addresses have been specified in § 23.2, at the place(s) where (that/those) Party(ies) (has/have) (its/their) registered office;

“Delivered Quantity” means, in respect of an Allowance Transaction, the number of Allowances (of a Compliance Period, where applicable) of a Contract Quantity Transferred by the Seller and accepted by the Buyer at the Delivery Point;

“Delivery Date” means, in respect of an Allowance Transaction, the day agreed between the Parties on which the relevant Transfer from the Seller to the Buyer is to take place at the Delivery Point, subject to any adjustment in accordance with §7.5 (Suspension Event). If the Delivery Date is not a Delivery Business Day, it shall be deemed to be the first Delivery Business Day following the agreed day;

“Delivery Point” means, in respect of an Allowance Transaction, the Buyer’s Holding Account(s) that it has nominated in one or more Registry(ies) or such other Holding Account(s) as the Parties may agree in an Allowance Transaction;

“Delivery Schedule” means, in respect of an Allowance Transaction, the Schedule of Delivery Dates for the Transfer of (each) Contract Quantity(ies) as the Buyer and Seller may agree in an Allowance Transaction;

“Directive” means any EU directive or directives which govern the purchase, sale and Transfer of Allowances;

“Encumbrance Loss Amount” means an amount reasonably determined by the Buyer in good faith to be its total losses and costs in connection with an Individual Contract including, but not limited to, any loss of bargain, cost of funding or, at the election of the Buyer but without duplication, loss or costs incurred as a result of its terminating, liquidating, obtaining or re-establishing any hedge or related trading position. Such amount includes losses and costs in respect of any payment already made under an Individual Contract prior to the delivery of the written notice by the Buyer and the Buyer's legal fees and out-of-pocket expenses but does not include Excess Emissions Penalty or any amount which the Buyer must pay to a third party in respect of any such penalty payable to any other party (or Relevant Authority) by that third party. The Parties agree that in circumstances where there was a breach of the No Encumbrances Obligation by the Seller caused by the Transfer of an Affected Allowance, the Buyer will be entitled to recover any losses arising out of or in connection with any claim, demand, action or proceeding brought against the Buyer by a third party consequent upon the Transfer by the Buyer of an Affected Allowance Transferred to it by the Seller under an Individual Contract;

“End of Phase Reconciliation Deadline” means, in respect of an Allowance Transaction, the final Reconciliation Deadline determined in accordance with Applicable Rule(s) for the surrender of Allowances in respect of a Compliance Period;

“Emissions Trading Scheme(s)” means the scheme(s) to effect the Transfer of Allowances between participants in both or either of Member or Non-Member States as implemented by and including its Applicable Rule(s);

“EU” means the European Community as it exists from time to time;

“EUA” means a unit of account that is an “allowance” as defined in the EU ETS Directive and is issued pursuant to

Chapter III thereof;

“EU ETS” means the EU Emissions Trading Scheme established by the EU ETS Directive;

“EU ETS Directive” means the Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 establishing a scheme for greenhouse gas emissions allowance trading and amending Council Directive 96/61/EC, as amended from time to time;

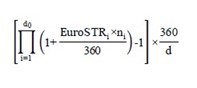

“EUR-EuroSTR-COMPOUND” where EUR-EuroSTR-COMPOUND will be calculated as follows, and the resulting percentage will be rounded, if necessary to the nearest one ten-thousandth of a percentage point (0.0001%):

where:

- “Calculation Period” means either the Cost of Carry Calculation Period or the Default Cost of Carry Calculation Period, as the context requires;

- “d” is the number of calendar days in the relevant Calculation Period;

- “d0”, for any Calculation Period, is the number of TARGET Settlement Days in the relevant Calculation Period;

- “EuroSTRi”, for any day “i” in the relevant Calculation Period, is a reference rate equal to EuroSTR in respect of that day as published on the website of the European Central Bank at https://www.ecb.europa.eu/home/html/index.en.html, or any successor source (the “ECB’s Website”);

- “i” is a series of whole numbers from one to d0, each representing the relevant TARGET Settlement Day in chronological order from, and including, the first TARGET Settlement Day in the relevant Calculation Period;

- “ni” is the number of calendar days in the relevant Calculation Period on which the rate is EuroSTRi;

“EuroSTR” or “€STR” means the euro short term rate administered by the European Central Bank (or any successor administrator) as administrator of the benchmark and published on the ECB’s Website;

- No Index Cessation Effective Date with respect to EuroSTR[1]

If neither the administrator nor authorized distributors provide or publish EuroSTR and an Index Cessation Effective Date with respect to EuroSTR has not occurred, then, in respect of any day for which EuroSTR is required, references to EuroSTR will be deemed to be references to the last provided or published EuroSTR.

- Index Cessation Effective Date with respect to EuroSTR

If an Index Cessation Effective Date occurs with respect to EuroSTR, then the rate for a day on or after the Index Cessation Effective Date will be such rate as replaces EuroSTR pursuant to the prevailing fallbacks mechanics ISDA (the International Swaps and Derivatives Association), or any successor to ISDA, has in place (the “Applicable Fallback Rate”), as at the Index Cessation Effective Date, and all provisions in this section shall be read as though references to EuroSTR are instead references to the Applicable Fallback Rate.

“EUTL” or “European Union Transaction Log” means the independent transaction log provided for in Article 20(1) of the EU ETS Directive, the operation of which is further detailed in Article 5 of the Registries Regulation;

“Excess Emissions Penalty” or “EEP” means a financial payment required to be made to a Relevant Authority pursuant to and in accordance with Article 16(4) of the EU ETS Directive (which, for the avoidance of doubt, shall not include any costs relating to or arising from the obligation to purchase and/or surrender Allowances in the following Compliance Year), or its equivalent under any other Emissions Trading Scheme;

“Excess Emissions Penalty Equivalent” or “EEP Equivalent” means an amount which the Buyer must pay to a third party in respect of any amount payable by that third party which arose as a result of the Buyer’s failure to Transfer the required Allowances to that third party and which in turn was a consequence of the Seller’s failure to Transfer the Contract Quantity to the Buyer under this Agreement (which, for the avoidance of doubt, shall not include any costs relating to the obligation to purchase and/or surrender Allowances in the following Compliance Year);

“Expert” means a person qualified by education, experience and/or training with the applicable Emissions Trading Schemes, Applicable Rule(s) and Allowance Transactions who is able to review and understand the contents of a Party’s emission allowance trading portfolio and who neither is nor has been directly or indirectly under the employ of, affiliated with, or under the influence of either of the Parties or otherwise has any conflicting interest or duty;

“Fourth Compliance Period” means, with respect to EUAs and AEUAs, the period starting 1 January 2021 to 31 December 2030;

“Holding Account” means the form of record maintained by and in the relevant Registry to record the allocation (if applicable), Transfer and holding of Allowances;

“Index Cessation Effective Date” means, in respect of an Index Cessation Event, the first date on which EuroSTR, or if an Applicable Fallback Rate is being used, such Applicable Fallback Rate is no longer provided. If EuroSTR, or as the case may be, such Applicable Fallback Rate, ceases to be provided on the same day that it is required to determine the rate for a day pursuant to the terms of the contract, but it was provided at the time at which it is to be observed pursuant to the terms of the contract (or, if no such time is specified in the contract, at the time at which it is ordinarily published), then the Index Cessation Effective Date will be the next day on which the rate would ordinarily have been published.

“Index Cessation Event” means, in respect of EuroSTR or, in the event an Applicable Fallback Rate is being used, such Applicable Fallback Rate:

- (a) a public statement or publication of information by or on behalf of the administrator of the index announcing that it has ceased or will cease to provide the index permanently or indefinitely, provided that, at the time of the statement or publication, there is no successor administrator or provider that will continue to provide the index; or

- (b) a public statement or publication of information by the regulatory supervisor for the administrator of the index, the central bank for the currency of the index, an insolvency official with jurisdiction over the administrator for the index, a resolution authority with jurisdiction over the administrator for the index or a court or an entity with similar insolvency or resolution authority over the administrator for the index, which states that the administrator of the index has ceased or will cease to provide the index permanently or indefinitely, provided that, at the time of the statement or publication, there is no successor administrator that will continue to provide the index.

“Long Stop Date” means, in respect of a Suspension Event[2] that occurs in relation to a Transfer or acceptance obligation that would otherwise be required to be performed within the period:

- (i) from (and including) 1 May 2021 to (and including) 31 December 2022, it shall be 1 June 2024;

- (ii) from (and including) 1 January 2023 to (and including) 31 December 2024, it shall be 1 June 2026;

- (iii) from (and including) 1 January 2025 to (and including) 31 December 2026, it shall be 1 June 2028;

- (iv) from (and including) 1 January 2027 to (and including) 31 December 2028, it shall be 1 June 2030;

- (v) from (and including) 1 January 2029 to (and including) the twenty-fifth (25th) calendar day of the month in which the End of Phase Reconciliation Deadline is scheduled to occur, it shall be the twenty-fifth (25th) calendar day of the month in which the End of Phase Reconciliation Deadline is scheduled to occur;

“Loss” means an amount that each Party reasonably determines in good faith to be its total losses and costs (or gain, in which case it shall be expressed as a negative number) in connection with the termination of the applicable Allowance Transaction(s), or any unperformed portions thereof, including, if applicable, any EEP or EEP Equivalent, any loss of bargain, cost of funding (based on the actual costs of such Party whether or not greater than market costs) or, without duplication, loss or cost incurred as a result of its terminating, liquidating, obtaining or re-establishing any related trading position (or any gain resulting from any of them). Template:EfetaprovLoss shall not include legal fees or similar out-of-pocket expenses. Each Party may (but need not) determine its Template:EfetaprovLoss by reference to quotations of average relevant rates or prices from two or more leading Dealers;

“Member State” means any one of the signatories to the EU from time to time;

“National Administrator” means the entity responsible for managing, on behalf of a Member State, a set of user accounts under the jurisdiction of a Member State in the Union Registry as designated in accordance with Article 7 of the Registries Regulation;

“Negotiation Period” has the meaning specified in § 14.4 (Termination for New Tax);

“New Tax” means in respect of an Individual Contract, any Tax enacted and effective after the date on which the Individual Contract is entered into, or that portion of an existing Tax which constitutes an effective increase (taking effect after the date on which the Individual Contract is entered into) in applicable rates, or extension of any existing Tax to the extent that it is levied on a new or different class of persons as a result of any law, order, rule, regulation, decree or concession or the interpretation thereof by the relevant taxing authority, enacted and effective after the date on which the Individual Contract is entered into;

“Non-Member State” means any state that is not a Member State with whom a Participating Agreement has been signed;

“Non-Taxed Party” has the meaning specified in § 14.4 (Termination for New Tax);

“Operator” means an “operator” as defined in the EU ETS Directive;

“Original Affected Party” means the person from whose account the first Unauthorised Transfer of any Allowance occurred;

“Other Tax” means any energy Tax or excise duty but not including Taxes targeted at end users;

“Participating Agreement” means any agreement, rule, procedure, instrument or other law or regulation which governs a Non-Member State’s participation in and the Transfer of Allowances to the Emissions Trading Scheme(s of a Member State or another Non-Member State, as applicable;

“Paying Party” has the meaning specified in § 14.5 (Withholding Tax);

“Payment Cycle” means either Payment Cycle A or Payment Cycle B as defined in § 13.2 (Payment);

“Physical Settlement Netting Accounts” shall have the meaning given in § 4.3(a) of this Allowances Appendix;

“Receiving Party” has the meaning specified in § 14.5 (Withholding Tax);

“Reconciliation Deadline” means, in respect of an Allowance Transaction, 30 April in any calendar year in relation to the immediately preceding calendar year, or as otherwise specified under the EU ETS;

“Registries Regulation” means the Commission Regulation (EU) No. 389/2013 of 2 May 2013 establishing a Union Registry pursuant to the Directive 2003/87/EC of the European Parliament and of the Council, Decisions No. 280/2004/EC and No. 406/2009/EC of the European Parliament and of the Council and repealing Commission Regulation (EU) No. 920/2010 and No. 1193/2011, as amended from time to time;

“Registry” means the registry established by a Member State, Non-Member State or the EU, in accordance with Applicable Rule(s), in order to ensure the accurate accounting of the issue, holding, Transfer, acquisition, surrender, cancellation and replacement of Allowances. For the avoidance of doubt, references to a Registry shall include the Union Registry and the Holding Accounts within the Union Registry that are under the jurisdiction of a single National Administrator designated by a Member State and will together be deemed, for the purposes of this Allowances Appendix, to be a Registry for that Member State;

“Registry Operation” means, other than by reason of the occurrence of an Administrator Event:

- (a) the establishment of and continuing functioning of the Relevant Registry;

- (b) the establishment of and continuing functioning of the EUTL; and/or

- (c) the link between each of the Relevant Registry and the EUTL;

“Relevant Authority” means the body established by each Member State or Non-Member State from time to time to administer the relevant Emissions Trading Scheme and any emissions compliance responsibilities under the EU ETS;

“Relevant Registry” means the Registry through which a Party is obliged to perform a Transfer or acceptance of Transfer obligation under and in accordance with an Allowance Transaction. Where a Party has specified more than one Holding Account for Transfer or acceptance purposes, the Relevant Registry shall be identified in accordance with § 4.1(b);

“Rules” mean, as applicable, domestic laws, and any relevant decisions, guidelines, modalities and procedures made pursuant to them, the Directive, the Registries Regulation, Emissions Trading Scheme(s, Participating Agreement and all other applicable guidance, regulations, rules and procedures (whether made at the direction of a government, governmental body, regulator, competent authority or otherwise) as modified, amended and/or supplemented from time to time relating to the trade of Allowances as contemplated by this Allowances Appendix;

“SE Affected Party” has the meaning specified in § 7.5(a);

“SE Affected Transaction” has the meaning specified in § 7.5(b);

“Suspension Event” has the meaning specified in § 7.5(a);

“TARGET Settlement Day” means any day on which TARGET2 (the Trans-European Automated Real-time Gross settlement Express Transfer system) is open for settlement of payments in Euro;

“Tax” means any present or future tax, levy, impost, duty, charge, assessment royalty, tariff or fee of any nature (including interest, penalties and additions thereto) that is imposed by any government or other taxing authority (whether or not for its benefit) in respect of any payment, nomination and allocation under any Individual Contract or under this Agreement, and “Taxes” shall be construed accordingly. For the avoidance of doubt, Tax shall exclude; (i) any tax on net income or wealth; (ii) a stamp, registration, documentation or similar tax; and (iii) VAT;

“Taxed Party” has the meaning specified in § 14.4 (Termination for New Tax);

“Third Compliance Period” means, with respect to EUAs and AEUAs, the period referred to in Article 16 of Directive 2009/29/EC starting 1 January 2013 to 31 December 2020;

“Total Contract Price” means the aggregate price to be paid for all Allowances required to be Transferred on a Delivery Date under an Allowance Transaction;

“Transfer” means (whether used as a verb or a noun) the Transfer of Allowances from one Holding Account to another under and in accordance with and for the purposes of the relevant Emissions Trading Scheme(s and Transferable, Transferring and Transferred are to be construed accordingly;

“Transfer Point” means, in respect of an Allowance Transaction, the Seller’s Holding Account(s) that it has nominated in one or more Registry(ies) or such other Holding Account(s) as the Parties may agree in an Allowance Transaction;

“Unauthorised Transfer” means the Transfer by debiting of any Allowance from an account holder's Holding Account and the crediting of a Holding Account of another person, where such Transfer is not initiated by the relevant authorised representative or additional authorised representative (as referred to in the Registries Regulation) of the first account holder;

“Undelivered EEP Amount” or “UEA” shall have the meaning given in § 8.1(b)(ii)(A);

“Union Registry” means the Registry referred to as the 'Community Registry' in Article 19(1) of the EU ETS Directive;

“Unpaid Amounts” shall have the meaning given in § 7.4(b)(i); and

“Value Added Tax” or “VAT” means any value added tax or any tax analogous thereto but excluding any statutory late payment of interest or penalties.