Regulatory perimeter

When you are a financial pirate of the high seas, in your black-sailed ship, opportunistically pillaging passing galleons, stealing princesses, offering retail structured products to high net worth individuals and so forth, occasionally you might take time out to wonder:

|

The JC’s Reg and Leg resource™

UK Edition

|

“As I ply my piratey trade, in the mountainous oceans of money that separate the nations of Guilder and Florin — as I offer my “services” to local princes, trust fund babies and unicorn hunters and other juicy UNHW client prospects — at what point do I become subject to the laws of the lands they inhabit?

“Must I register my vessel with their port authorities? Do I need permission to enter their territorial waters?

“Would it make a difference if I anchored a mile outside their territorial waters, and invite rich people to sail out on their yachts to see me, for all their investment needs?”

The buccaneer who asks herself these sorts of things considers, whether she knows it or not, the regulatory perimeter.

At what point, in her dealings with the people of Florin, does she become subject to Florin’s laws, customs and most importantly, the authorisation requirements of its six-fingered financial services regulator?[1]

When — if at all — must she be registered as a Florinese broker-dealer?

Just how aggressively a country polices its border, and how presumptuous it will be about what products foreigners may offer its citizens when they are away from home differs, nation to nation. The Americans are quite forthright: Uncle Sam’s taxmen span the globe; his securities and derivatives regulators have their own ideas about who or what counts as a “U.S. person”. For all their enthusiasm for a single market for financial services, Europeans are hit and miss. Many of the Caribbean nations are quite relaxed. The Marshall Islands don’t seem to even want to know what its people get up to beyond its borders, as long as they stay there and don’t set foot home: a capital state of affairs for its offshore financial services industry, none of whom have any interest in visiting the Marshall Islands. Can you even visit the Marshall Islands?

So much detail; so little time. Expertise in regulatory perimeters rewards handsomely those the weapons-grade boredom threshold that can sustain an interest in such matters. It is generally more than the JC can muster. For our purposes, it is enough to know it is there, it is never as simple as common sense would suggest it should be, and happily the legal community is stocked with earnest souls prepared to tell you, and if they don’t yet know, find out.

When virtual worlds collide

The recent Ashes series illustrates both the pitfalls of the regulatory perimeter, and the conceptual challenges presented to it by the naturally borderless character of the world wide web.

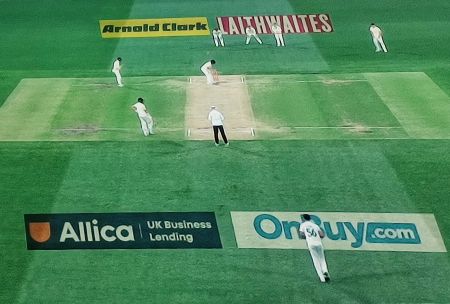

In the image we see the Adelaide Oval during the second Ashes test of 2021. Allica Bank is, as far as we know, a UK lender to small and medium-sized enterprises in the British Midlands, and it must operate on the theory that its potential customers like cricket. We dare say it has no more interest in the custom of cricket fans half a world away in Australia, than do Laithwaites, Arnold Clark or OnBuy — all of them resolutely British undertakings — but, like them, is advertising for the Uncle Vernon Dursley types who do the finances for drill-bit companies in and around Wolverhampton.[2]

Nevertheless, the Australian financial services regulator ASIC has firm ideas who may offer financial services on Australian soil, and how they may describe themselves.[3] In particular, those without the right kind of ASIC licence to operate in Australia may not describe themselves as a “bank” in Australia, even if that is what they are by the lights of their own home jurisdiction. This causes international financial services organisations no end of bother, by the way. Here we see how Allica has solved this conundrum: it has described itself as “Allica UK Business Lending”.

But hold on: Allica’s advertising is virtual. Though it might look like it to viewers back home in Blighty, nothing is actually painted on the grass. Allica’s trade mark is inserted into the UK broadcast feed using some digital wizardry.[4] We dare say that Australian viewers see something quite different: marsupial supplies, crocodile hunting kits and so on.

So has this communication really been made in Australia, even though it looks like it? Does it make a difference where the digital wizardry is inserted? Does pretending to use the word “bank” in Australia, to people outside Australia, comprise a transgression of the regulatory perimeter?

Unlike a fourth-day pitch in Adelaide, nothing really turns on it, but it is an interesting conundrum to consider. Perhaps one of those regulatory perimeter experts with a high boredom threshold might know?

See also

References

- ↑ So the next time we meet, I will not fail. I will go up to the six-fingered man, and I will say, “Hello. My name is Inigo Montoya. You killed my father. Prepare to die.”

- ↑ I did half heartedly reach out to Allica Bank to see if my theory of the Australian regulatory perimeter on their advertising is right, but they didn’t answer. I don’t blame them.

- ↑ See, for example: this entry on ASIC’s website.

- ↑ This is called “virtual advertising”. It is rather clever.