Bernie Madoff: Difference between revisions

Amwelladmin (talk | contribs) Created page with "See: {{br|No One Would Listen: A True Financial Thriller}}" |

Amwelladmin (talk | contribs) No edit summary |

||

| (7 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{a|disaster| | |||

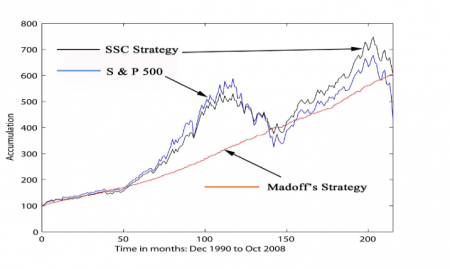

[[File:Madoff performance.png|450px|thumb|center|Um, [[credit officer|risk manager]]s? ''HELLO''. Hello? Anyone there?]] | |||

}}Wall Street grandee, former chairman of the NASDAQ and perpetrator of the [[ponzi scheme]] that almost certainly qualifies greatest fraud in history of this planet, and a walking advertisement for the power of cognitive dissonance: Not only did the heroic {{author|Harry Markopolos}} not repeatedly alert the [[SEC]] that Madoff was a fraud over the decade leading up to [[Madoff]]’s ''confession'' — note: they didn’t ''catch'' him: he handed himself in — but [[hedge fund]] pioneer {{author|Edward Thorp}} identified that Madoff was a fraud when a friend asked him to review Madoff’s returns in ''1992''. | |||

{{br|No One Would Listen: A True Financial Thriller}} | This is enough to make us wonder whether the problem of endemic fraud isn’t one of [[bad apple]]s so much, though for sure Bernie Madoff ''was'' a bad apple, but our innate susceptibility to bad actors which, in turn, might be a regrettable by-product of a laudable quality — like trust, for example. In which case, we wonder whether it isn’t better not to assume that laws and regulations can protect us against bad apples, when clearly they can’t, but instead to develop our own bullshit detectors. If you were going to do a podcast series about it, you might call it [[the dog in the night time]]. | ||

That renowned [[rent seeker]]s like [[Fairfield Sentry]] were caught properly with their pants down, private parts dangling hairily in the custard, revealing top the world another great ugly truth about fund management — perhaps an even more repellent one than Madoff’s fraud, which was at least daring, is something else to be thankful for, if it were not so dispiriting to think how much similar ticket clippetry carries on unchecked and unremarked upon. | |||

{{sa}} | |||

*[[The dog in the night time]] | |||

*{{br|No One Would Listen: A True Financial Thriller}} — our review of a remarkable book by Madoff whistleblower {{author|Harry Markopolos}} | |||

*{{br|A Man For All Markets}} — {{author|Edward Thorp}}’s autobiography | |||

*[https://www.stitcher.com/podcast/audible/ponzi-supernova Ponzi Supernova], a terrific seven-part podcast on the Madoff fraud. | |||

*[[Risk taxonomy]] | |||

Latest revision as of 11:23, 14 January 2023

|

Chez Guevara — Dining in style at the Disaster Café™

|

Wall Street grandee, former chairman of the NASDAQ and perpetrator of the ponzi scheme that almost certainly qualifies greatest fraud in history of this planet, and a walking advertisement for the power of cognitive dissonance: Not only did the heroic Harry Markopolos not repeatedly alert the SEC that Madoff was a fraud over the decade leading up to Madoff’s confession — note: they didn’t catch him: he handed himself in — but hedge fund pioneer Edward Thorp identified that Madoff was a fraud when a friend asked him to review Madoff’s returns in 1992.

This is enough to make us wonder whether the problem of endemic fraud isn’t one of bad apples so much, though for sure Bernie Madoff was a bad apple, but our innate susceptibility to bad actors which, in turn, might be a regrettable by-product of a laudable quality — like trust, for example. In which case, we wonder whether it isn’t better not to assume that laws and regulations can protect us against bad apples, when clearly they can’t, but instead to develop our own bullshit detectors. If you were going to do a podcast series about it, you might call it the dog in the night time.

That renowned rent seekers like Fairfield Sentry were caught properly with their pants down, private parts dangling hairily in the custard, revealing top the world another great ugly truth about fund management — perhaps an even more repellent one than Madoff’s fraud, which was at least daring, is something else to be thankful for, if it were not so dispiriting to think how much similar ticket clippetry carries on unchecked and unremarked upon.

See also

- The dog in the night time

- No One Would Listen: A True Financial Thriller — our review of a remarkable book by Madoff whistleblower Harry Markopolos

- A Man For All Markets — Edward Thorp’s autobiography

- Ponzi Supernova, a terrific seven-part podcast on the Madoff fraud.

- Risk taxonomy