Archegos

|

Equity Derivatives Anatomy™

Index: Click ᐅ to expand:

|

No. It’s still too soon.

- —JC, June 2019.

Later...

It is no longer too soon, for on July 29, 2021 the Credit Suisse Special Committee to the Board of Directors has presented its Report on Archegos Capital Management to the board and, for reasons known only to the board,[1] they have published to it to the world, a final act of self-harm from an organisation whose serial acts of self-harm the report catalogues in clinical detail.

That said, it is an act of self-harm for which the watching world should feel tremendously grateful. Not only a sizzling read, arriving just in time for Bank executives as they head for a fortnight to the sun loungers of Mykonos and Ibiza, but a beautifully clear explanation of the equity prime brokerage business in particular and global markets broking in general, and a coruscating indictment of the way large organisations of all kinds operate.

- —JC, July 2019

In the months leading up to March 2021, Archegos Capital Management took synthetic positions on margin on a handful of comparatively illiquid stocks — ViacomCBS, Tencent Music, Baidu and Vipshop — in sizes that, across multiple prime brokers, were big enough to move the market sharply up. As the stocks appreciated, so did Archegos’ profit, and thus the net equity it held with its prime brokers. Archegos used that net equity to double down, buying the same stocks, pushing them up yet further. The higher they went, the thinner their trading volume, and the more of the market Archegos represented.

Now, hindsight is a wonderful thing, but really there was only one way this was ever going to turn out.

On 22 March, Archegos’ position in Viacom had a gross market value of US$5.1bn.[2] In a cruel irony, Viacom interpreted this to mean market sentiment was so strong that it should take the opportunity to raise capital.[3] Alas, no one was buying. Not even Archegos, since it was tapped out of equity with its prime brokers.

Viacom’s capital raising therefore failed, and all hell broke loose.

Prologue

We like to imagine the conversation went a little bit like this.[4]

It is early March 2021. A ZOOM CALL, conducted between the home office of a RISK OFFICER at CS, who is wearing PPE, wiping his monitor and disinfecting his hands every ten minutes, and a TRADER at ARCHEGOS, who is perched at a bar in the Bahamas nursing a pina colada and multitasking with a game of online poker.

CS: Hi, guys. Listen, we are a bit concerned that your risk has got out of hand. We’re badly under-margined.

ARCHEGOS: Oh, I see.

CS. Yeah. If it’s okay with you, we want to exercise our contractual right to lock up some of your free cash.

ARCHEGOS: Hmmm. How much?

CS: About half of it? Say $1.3 billion? If we treat that as initial margin, your risk comes down quite a bit.

ARCHEGOS: Let me think about it.

Later that morning

ARCHEGOS: Hey can I withdraw some of my free cash?

CS: I guess so. How much?

ARCHEGOS: All of it.

CS: Okay.

Later that morning

ARCHEGOS: Hey good news. I’ve just come into some money. Can I put on another billion and a half in risk?

CS: Okay.

Two weeks later

CS: Hey what about that increased margin we were talking about?

ARCHEGOS: Yeah, about that.

Armageddon ensues.

CURTAIN

Intro

This is a proper horror story, make no mistake: Stephen King has not a patch on this.

Everyone involved in the business of prime services, and global markets broking generally, should read the Credit Suisse Report. And while the goings on it recounts were class-leadingly chaotic — it is hard to believe that the same organisation could have made so many basic errors, in such scale, for so long, so consistently, missing so many opportunities to cotton on, without catching even one lucky break as the apocalypse unfolded around it — the makings of all these joint and several blunders is imprinted in the structure of every multinational organisation.

After all, this broker was not alone in taking a hammering. It just took the worst hammering, and has been the most candid about how.

This is not an institution that was out of its depth in a market it did not understand. Most of its missteps have a curiously sociological, human cast to them. Some speak of bad management: poor organisation, unclear responsibilities, fiefdoms and silos, under-communication of what mattered, over-communication of what did not; others speak just to ordinary mortal frailty: the thrall of rank and status, the fear of speaking up, making management reports and dashboards accommodate the risk, rather than making the risk accommodated the models; backside-covering as a primary goal, inexplicable insouciance in the face of steadily escalating risk and, when it comes to it, outright mediocrity in senior personnel.

The end game sums up how dire the whole sorry business was: In March, 2021, the broker gingerly asked Archegos to consider a new proposal under which it would recharacterise $1.35 billion of the $2.4 billion in excess variation margin it currently held for Archegos as initial margin: asked, that is, when it was contractually entitled to demand that, and more, on 3 days’ notice. And, while thinking about it, Archegos systematically demanded CS disburse the entire $2.4 billion.

Archegos’ reputation and competence

What emphasis should you place on a record of misfeasance and bad management?

A lot, you would think. All other things being equal, be more careful with those who have proved themselves cavalier with ethical boundaries than those who have not (though, pace Nassim Nicholas Taleb: “he who has never sinned is less reliable than he who has only sinned once”).[6]

Archegos had plenty of form for misfeasance — outright criminality, in fact — and mismanagement.

Between 2012 and 2014 Archegos’ principal was convicted of wire fraud, settled charges of insider trading, and was banned from the Hong Kong securities industry, and was only able to continue to trade by returning all outside capital and “rebranding” as a family office:

The SEC alleges that Sung Kook “Bill” Hwang, the founder and portfolio manager of Tiger Asia Management and Tiger Asia Partners, committed insider trading by short selling three Chinese bank stocks based on confidential information they received in private placement offerings. Hwang and his advisory firms then covered the short positions with private placement shares purchased at a significant discount to the stocks’ market price. They separately attempted to manipulate the prices of publicly traded Chinese bank stocks in which Hwang’s hedge funds had substantial short positions by placing losing trades in an attempt to lower the price of the stocks and increase the value of the short positions. This enabled Hwang and Tiger Asia Management to illicitly collect higher management fees from investors.

- —SEC press release, 12 December 1012 [7]

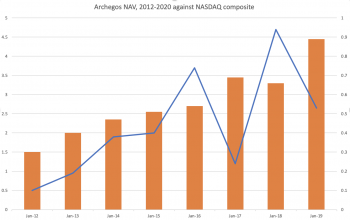

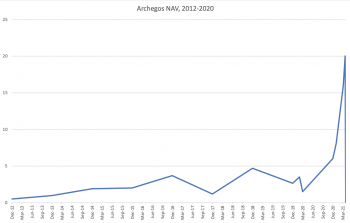

And nor was Archegos’ performance (before or after that time) anything to crow about. Over the 10 years between Hwang’s insider trading debacle and the final collapse, Archegos suffered multiple massive drawdowns (see right). Archegos’ published net asset value[8] gyrates wildly. If someone asked you to imagine the pattern you might expect from a blindfolded, monkey throwing darts at the financial pages while hopped up to the eyeballs with gradually increasing leverage (thanks, Credit Suisse!), this is pretty much exactly what you’d expect it to look like.

To be sure, over time, it does trend up, but there are gaping chasms between the peaks — and in any case that’s survivor bias right there: the game stops the moment you hit zero. So Archegos looked — always looked — decidedly flakey.

Now, I dunno about you, but if one of my customers was that erratic, trading in that size, I’d have a S.W.A.T. team positioned on every nearby roof. Especially a customer with form for insider trading: isn’t the point that you are backing surefire winners?

Yet this was not how CS saw it. Archegos got to reputational committees, but the business portrayed Archegos to as a client with “strong market performance” and “best in class” infrastructure and compliance. Even though, as early as 2012 the credit team had identified Archegos’ key man risk, volatility, mediocre operational management practices, fraud risk, and poor risk management as “significant concerns”.

Mis-margining

Credit Suisse’s margining methodology for swaps was, from the outset, not great. The JC is a legal eagle, not a credit guy, but even he could spot the flaws in this.

Static margin

For one thing, CS seems to have documented the trades as “total return swaps” under a standard equity derivatives master confirmation, and not as “synthetic prime brokerage” under a portfolio swap master confirmation. The differences are subtle, but important.

Firstly, total return swaps tend to be “bullet” swaps with a fixed term and a scheduled termination date. As such, often they do not “restrike” their notional before maturity, and are statically margined.

By contrast, portfolio swaps are designed to replicate “physical” prime brokerage: there is no specified maturity date (in the same way there is no maturity date when you buy a stock: you just sell it when you think it won’t go up any more), and investors may keep swaps on for a day or five years: the swap dealer is completely in the dark as to the likely tenor of the trade. This makes fixing an amount of margin upfront fraught.

To assist with nerves in the risk department, the synthetic equity swap re-strike periodically (like, monthly), meaning you rebase your initial margin, even if static, to the prevailing price of the stock each period, undoing any “margin erosion” that might otherwise have occurred due to the appreciation of the position. Not only that, but initial margin isn’t static: it is dynamic; calculated daily against the prevailing “Final Price” rather than the original “Initial Price”.

When variation margin attacks

Since the swaps were static margined, as they appreciated, the margin value as a proportion of position’s market value eroded. Archegos apparently used the variation margin it was earning through those appreciating positions to double down on the same trades — also static margined — pushing the equity price further up, further eroding the average margin coverage, thus exacerbating the problem. His swap portfolio was a ticking time-bomb.

They didn’t keep an eye on the direction of the portfolio

Archegos at first used the swap book to put on short positions that offset the long bias on its cash book. It used this bias to argue for lower margins — a request the business accommodated, provided the combined portfolio bias did not exceed 75% long or short. Over time Archegos frequently exceeded these limits, often for months at a time, but CS took no action, accepting Archegos’ promises to correct the bias.

They didn’t take enough margin

Archegos pressured CS to lower its swap margins, citing more favourable margins it was getting from other brokers due to the effect of cross-margining. Worried it might lose the revenue, CS complied.

The greatest fool theory

Archegos’s long bias was driven by the evolution of its swaps portfolio. Given the substantially reduced swap margin, Archegos began putting on long swaps (at the new lower margin) with CS, whereas it had historically held its long positions in Prime Brokerage (at a higher margin rate). The lower swap margins—which Archegos assured CS were “pretty good” compared to what its other prime brokers required—no doubt led Archegos to trade more swaps with CS, and Archegos’s holdings at CS increased markedly.

Here is a sort of convexity risk: If you offer the most favourable terms on the street, then customers will tend to put their positions on with you. If your swap margins are lower than your cash brokerage margins, your customers will tend, all other things being equal, to put their positions on swap. Water runs downhill.

You read variations of the following a lot in the Archegos report: “if we increase margins [to risk-acceptable levels], we will lose the business”. Indeed, you will hear variations of that theme, every day, uttered by anxious salespeople in every brokerage in the City. Salespeople would say this: their role is to say things like this: they speak for their clients, and their own bonus prospects, at the table where business is discussed. But others at that table — notably risk — should be taking the other side of that conversation.

So should your risk team be led, as CS’s was, by ex-salespeople with no experience in risk management? Probably not. Should it be business-aligned at all? Interesting question.

In any case it seems the fears of CS risk executives, that they might be uncompetitive if they raised margins, was flat out wrong.

There is an argument that the guy who wins an auction is the stupidest guy in the room. To the broker who lowballs more circumspect peers, the spoils, but at a price its peers consider beyond the pale. Brokerage is an annuity business: it is picking up pennies in front of a steamroller. Credit Suisse found 20 million dollars’ worth of pennies in front of the steamroller in a year. The steamroller did it five and a half billion dollars of damage overnight. Fact: to earn back $5.5 bn in clips of $20m would take two hundred and seventy-five years.

Archegos switched positions away from other brokers and to Credit Suisse because CS offered the tightest margins.

Let this be the lesson: sometimes losing business is not such a bad thing.

Had weapons. Didn’t use them.

At the same time, the contractual protections CS had negotiated with Archegos were illusory, as the business appears to have had no intention of invoking them for fear of alienating the client.

There is much to say on the topic of prime brokerage margining. Generally,[9] prime brokers have very broad rights to adjust required margin, on short or immediate notice, and to call for more margin, which they can do (at least) daily. You cannot say it loudly enough: margin is a prime broker’s only meaningful defence. If you have enough margin, none of your other protections matter. If you don’t, none of your other protections work.

Margin falls into two categories: margin your broker legally requires you to post — “required margin” — and margin over and above that, that it doesn’t require as such, and which it will return to you if you ask it, but which it is rather pleased you have given it to hold all the same — this is “margin excess”.

Adjusting margin is the process of (re)calculating how much margin you think you’d need, were the world to go to hell overnight and all of Satan’s angels to trample on your Monte Carlo simulations. Having made that calculation, it usually becomes live immediately,[10] meaning you can repurpose any margin excess standing to the credit of your own accounts instantly. If a broker has agreed to “lock up” its margin calculations, it may not be able to convert margin excess to required margin, and therefore will have to give it back.

Calling for margin means demanding that your client pay you some more margin. This you only need to do if there is not enough margin excess to cover the whole of your margin adjustment.

Legal eagles will exercise themselves about what happens if a client draws first and asks to withdraw its excess before you have had a chance to adjust the margin you require, so it cannot. They will say, “well, this would look bad. Optically, you see. How would you explain that to a judge?”

I’m not so sure it would look bad. A commercial court would understand it quite simply. This is how service contracts work. It is a relationship business. One keeps one’s powder dry.

Firstly, we can take it as a given that no prime broker will adjust margins if it thinks it really doesn’t have to — why have a difficult conversation now, if things might be better in the morning? If you are running a large excess, generally, you are covered — the security package bites; possession is nine-tenths of the law and, In sha’Allah, things will look better in the morning.

It is only when the customer wants to take away that excess that you feel truly at the point of a pitchfork. The answer to the question, “okay so, if the margin was so important why didn’t you ask for it till now?” is easy: “Because I had it in the bank.” Who breaks a butterfly on a wheel? Who upsets a platinum client by asking for something she already holds, albeit lightly?

If, and only if — when, that is to say — the client asks for all its excess back must we confront our demons and deliver bad news. At that point, we can decide, do we blow up our relationship, now or not?

A prudent merchant defers the decision about which hill she is to die on as long as she can. To be sure, that calculus looks very different before the world implodes in a thousand points of light than it does with the benefit of cinematic hindsight — but that is what closing submissions are for. To be sure, however it looked at the time, CS got that calculus wrong. Perhaps they didn’t quite realise the moment of Zen that was upon them: if so, this is a different kind failing: of expertise, not commercial management. When you gingerly ask to adjust your margin up and the customer says, “leave that with me” and, with the same breath, asks for all his money back, your DEFCON alarms should be blaring.

Formal versus informal systems

And here we see the behavioural crux: we tell ourselves that what matters in risk management are the formal boundaries we draw; the official channels; the technical superstructure of the relationship; the architecture of the parties’ rights and obligations versus each other. But this isn’t true. In practice the relationship is governed by soft, morphing, invisible, informal boundaries, good and bad. Interpersonal relationships. Insecurities. Understandings. Misunderstandings. Past practices. Fear of screwing up. Precedents. Arse-covering. Expectations. Self-serving narratives. Trust. The commercial imperative.[11] These things don’t show up in org charts or on opco decks. You can’t measure them. To try is to get the wrong end of the stick.

Newsflash: bank executives make post facto rationalisations

Much was made of the unmonitored gap in responsibility between CS’s co-heads of prime services.[12] The guy in America was a stocks specialist. He wasn’t big on swaps. He thought he was covering physical prime brokerage only. The guy in London was an old-school European: he thought he was covering all of prime services, physical and synthetic, but only for EMEA.

No-one, ergo, had their eye on synthetic prime brokerage in America, being just the bit that happened to blow up. Thus the Special Committee identified a structural shortcoming in Credit Suisse’s management organisation: a formal black spot on the radar.

But, come on. This is no failure of organisation. This is no lapse in formal structure: this is two fallible, mortal humans doing what all fallible, mortal humans do: dissembling. Each man was desperate to duck his own patent responsibility for an utter balls-up.

This is plainly a post-facto rationalisation: The JC has known a lot of senior bankers in his time and never yet has he met one who didn’t run every business he could, and claim to run the nearby ones he couldn’t. Does anyone suppose, for a moment, that had Archegos made the bank a five-and-a-half billion profit, that either of these gentlemen would be disclaiming all the credit God showers on successful investment bankers?

Here is the category error: to substitute a formal structural flaw for an informal softness in the meatware. Executive boards understand formal structural lapses: they validate the Rube Goldberg machine that sits below them; they bestow primacy — vitality — criticality on those at the top, in a way that tendentious human mediocrity in some random elsewhere in the organisation doesn’t.

Board members can see, and eliminate, structural gaps. They can solve for them. But if a perfectly sound machine can be upended to the tune of of five billion dollars by the kinds of quotidian human failings that riddle every organisation; if the whole machine can be blown up by a moment of uncontrolled greed, fear, misunderstanding or just stupidity by anyone in the organisation,[13] however robust its formal structure, then what real value the members of that executive board? Are they master pilots, or chimpanzees strapped to a rocket?

It’s a client service business

Not only that, but there is a fundamental asymmetry in the degree of that softness between the parties.

The relationship, after all, is one of service provider and customer: the customer sees its rights and obligations largely as hard-edged economic options, which it is free to exercise without regret, regardless of their impact on “the house”. Thus, Archegos was entitled to withdraw excess variation margin, and its broker had little option but to comply without “blowing up the relationship”. On the other hand, the broker’s right to recalibrate initial margin, whilst framed as an equally clear option, was nothing of the kind. It was implicit in the commercial imperative that the right would lie untouched unless the conditions justifying exercise were so unbearably dire as to give the broker no plausible alternative.

Now clearly, this broker miscalculated how bad the conditions were. But this is not Archegos’ fault, nor the lawyers’.

The broker is a service provider; it wishes the client only well. It presents its risk management parameters (for example, rights to raise margin) not as targets it intends to hit mechanistically if their conditions are triggered, but last resorts it will deploy with a heavy heart and only if calamity otherwise awaits.

So while a contractual right held by the client more or less means exactly what it says, the broker it draws its formal boundaries well inside the area it is prepared to let the client, in practice, wander. NAV triggers are never exercised. If the client approaches the edge of that wider area — a real point of no return for the broker — the broker will not mechanistically pull triggers and detonate positions: instead, it will reason with the client, try to talk it down, realising that precipitous action means the end of that lovely stream of revenues.

Hindsight is a wonderful thing

Let us coin a maxim:

“Before an apocalypse becomes an apocalypse, it doesn’t look like an apocalypse.”

Risk-free, twenty-twenty hindsight is by definition not available to those who must make the decisions that lead to it. Only later does the reactor core melt down. Only later does the market crash. Beforehand, no-one knew or — at least until it was too late, even believed — that things would turn out like this. Q.E.D.

Why did people do what they did when it was so obviously stupid looking back at it? Well, As Sidney Dekker puts it in his excellent The Field Guide to Human Error Investigations:

“Forks in the road stand out so clearly to you, looking back. But when inside the tunnel, when looking forward and being pushed ahead by unfolding events, these forks were shrouded in the uncertainty and complexity of many possible options and demands; they were surrounded by time constraints and other pressures.”

Ergo, the decision calculus then was nowhere near as obvious as it appears now, as an object in the rear-view mirror: if it had been, the catastrophe would not have happened.

And it is one thing to have a right to pull your trigger, it is quite another to be prepared to use it. Especially if you don’t know how this all will play out.

After the event, all that remains is is a smoking hulk and twisted wreckage strewn across the landscape and it could not be more obvious that there was only ever one option.

Before it, there were twenty million dollars of annual revenues at stake.

Few individuals will blow up a significant business relationship without diffusing responsibility through some kind of institutional escalation. But that takes time. And escalations are fraught: to recommend affronting a platinum client is to invite a shellacking from someone a long way further up the tree than you.

Now: if these are the options, and our valiant risk manager doesn’t yet have that twenty-twenty hindsight of what might come about tomorrow, is it any wonder she’ll be tempted to do nothing?

Before an apocalypse becomes an apocalypse, it doesn’t look like an apocalypse.

The broker that didn’t bark in the night-time

Time for some more theatre.

KING LEAR: Now, our joy, Although the last, not least; to whose young leverage

Thine holdings in thinly traffick’d names, rich in outrageous voguery

Did bunch, distil, concentrate and conspire their margin lenders yet to o’er-extend;

How fared thy numbers, Sirrah? What can you say?

Will a grimace itself engrave upon that storied countenance? What did you lose? Speak.

GOLDMAN: Nothing, my lord.

KING LEAR Nothing?

GOLDMAN: Nothing.

KING LEAR: Nothing will come of nothing, fair squidly vampire: speak again.

- —Shakespeare: Tiger King Lear, I, iii

What follows is heavily derivative and based on assumptions and extrapolations from a single footnote and may — most likely is, in fact — entirely mistaken. Nevertheless, even if it is, it illustrates an interesting hypothetical.

While other brokers to Archegos shipped losses most conveniently measured in the billions, one — Goldman — yes, that Goldman — reported “immaterial losses”.

Be assured, other brokers will be stamping their feet, cracking their cheeks, cursing obstreperous ill fortune, beating their fists on the ground, beseeching whichever mischievous God looks after the fates of regulated broker-dealers and wailing “how in the name of all that is holy can it be that while I took a regular shellacking, again, that Goldman outfit got away with it, without so much as a crease in its trousers, again?”

“What kind of second sight, what extra-sensory perception, what gift, what compromising photographs of the Almighty must Goldman have to lead such a honeyed life? What does the Vampire Squid have over the Fates that we other mortal dealers do not?”

Perhaps, I gingerly venture, nothing? Perhaps it is as simple as this: Goldman didn’t have much risk on in the first place. This may be prudent business selection; it may be that Goldman didn’t have much of a relationship with Archegos at all. According CS’s credit risk team in April 2020 — ten months before apocalypse — “Archegos had disclosed that its long positions with CS were “representative” of the positions Archegos held with its six other prime brokers at the time.”

Those six brokers, listed in the report, do not include Goldman.

If this is right, then less than a year before Götterdämmerung, Archegos wasn’t on Goldman’s books at all. If, as it claimed, Archegos preferred to “leg into” positions pro rata across its prime brokers, then a very-late-to-the-party prime broker would not have had much Archegos risk on its book. And with little risk, similarly few revenues to forfeit.

Without a long, deep, fearful, profitable client relationship, a broker had less skin in the game, may have treated Archegos with less reverence than its peers, may have declined to put positions on in such a cavalier fashion, and then been less bothered about upsetting its customer by closing it out at the first sign of trouble. This is consistent with how, by all accounts, Goldman conducted its book during Archegos’ end game.

Now whether this is what actually happened or not is, mostly, beside the point. But it points to another potential source of destabilising risk: a fellow broker who cares less about the commercial imperative than you do. Even a small block sale could have triggered, or amplified, a catastrophic run on concentrated holdings in a thin market with a single, incapacitated bidder.

Juniorisation of the meatware

Below them, and in conjunction with material reductions in headcount across the IB, overtime each and every PSR and CRM analyst became responsible for an ever-increasing number of clients. As employees left PSR, they were replaced with less experienced personnel, a process that one witnessed referred to as the “juniorisation” of PSR. PSR was thus hollowed out, both in terms of the experience of its personal as well as the attention they could devote to their duties.

There is a slight tension to this one because, on one hand, it seems utterly right that the systematic downskilling that CS, and every other broker, has carried relentlessly since the financial crisis must massively deprecate an institution’s ability to deal with existential crises like these ones: the JC has railed at length about the the folly of downskilling and outsourcing elsewhere, for exactly this reason. Yet, if there were heroes in this tale, they were the canaries in the coalmine — exactly those juniorised staff who said things like this hedge fund analyst in CRM:

“Need to understand purpose of having daily termination rights and ability to cause margin [with] 3-days notice on swap if client is not amenable to us using those rights.”

I mean, out of the mouths of babes. There was quite a bit of human wreckage at CS in the aftermath, but you really hope the author of that email wasn’t part of it. But the wider point is this: when all is plain sailing, you can, if you wish, operate a complex business through the agency of cheap staff in remote locations with an instruction manual, which you hope has been suitably translated into Bulgarian. But the thing about complex businesses navigating open water is that ocean weather can quickly change, and a quiet potter around the heads can turn into a Fastnet tempest, and then your Bratislavan school-leavers are going to be hopelessly out of their depth. Relying on rigid application of playbook, policy, processes, system, algorithm or work-to-rules especially when, as it happens, your senior management are disinclined to enforce them properly anyway, is no way to survive a hurricane.

How organisations work

The episode is a masterclass in how organisations work; how people in positions in responsibility are propelled by internally-constructed second-order derivatives of the risks they are meant to be monitoring: what matters is not what happens nor holding adult conversations with customers, even where that requires delivering unpalatable truths but that I should not be held responsible for what happens, a state of affairs one can vouchsafe by ensuring one follows internal models, policies and diktats regardless of their absurdity or fitness for purpose. There is a tension, between Sales on the one hand, whose north star is do not upset the client, and senior management, whose is make sure all the RAG indicators are green.

The job of reconciling this fundamental contradiction is left to those at the coal-face, who are obliged to come up with solutions that squeeze the balloon.

When the problem breaks your model, you don’t change the model. Fix the problem.

So, to deal with the problem that Archegos was persistently breaching its stress limits with one CS entity, the solution was to repaper it with another one that had a higher stress scenario appetite. This was an opportunity to head off a coming crisis a year out. Inflection point: wrong decision. When, after the migration, Archegos was still substantially in breach of its scenario limit, the business switched from the extreme “Severe Equity Crash” scenario to the more benign “Bad Week” scenario. Even then, six months from disaster, Archegos’ “Bad Week” exposure was still double the $250m limit. Another bad decision.

Quick! Form a committee!

As balloon continued to resist tactical squeezing, and in the wake of the Malachite hedge fund failure a year earlier, management adopted the “People’s Front of Judea gambit” and, in an initiative to “identify early warning signs of a default” and “enhance its controls and escalation framework across functions during periods of stress,” the broker created a new committee. The job of the Counterparty Oversight Committee (“CPOC”), was to “analyse and evaluate counterparty relationships with significant exposure relative to their revenue generation and to direct remedial measures where appropriate”.

But there was plenty of information, and plenty of oversight already at hand. Indeed, too much: the prime services had two heads (though conveniently, neither saw the US financing business as his responsibility) and, as the CS Report on Archegos puts it, each was “inundated with management information, underscoring the overall mismanagement of the business”.

As John Gall notes,[14] “prolonged data-gathering is not uncommonly used as a means of not dealing with a problem. ... When so motivated, information-gathering represents a form of Passivity”.

Sometimes, data and oversight gets in the way.

Silos

It was not only the co-heads who operated in silos. Silos, as anyone who has worked in financial services will know, are endemic. They are no regrettable externality of a modern organisation, but a fundamental ideological choice that it makes. “Downskilling” and specialisation — and by “specialisation” I mean “atomising a process into a myriad of functions so limited in scope that they can be carried out by non specialists, following a playbook” — is no accident, but precisely what our modernist, reductionist, data-obsessed times demand. Not an accident, but one waiting to happen.

Silos also give everyone grand pooh-bah titles and diffused responsibility. Co-heads of anything is either a failure of nerve (the case here) or a Spartan fight to the death to see who is strongest (the Goldman approach), but the more practical point is that, quand l’ordure se frappe le ventilateur, it is not co-grand-pooh-bahs you want directing the traffic — far better to lock them in a dark cupboard, actually — but subject matter experts with time to think and space to act who can figure out what has happened, what needs to happen, and how best to make it happen.

Silos are kryptonite to subject matter experts: there is a reverse-emergence problem here though. If you diffuse one subject matter expert’s skills among five school-leavers from Bucharest, you lose something: you trade a somewhat expensive capacity for a small amount of magic for a whole lot of cheap faffing around: lateral escalation. misunderstanding; confusion. If you cut open the golden goose, you do not get an infinite supply of golden eggs.

Red flags

- Not answering calls

- Key person risk

- Volatile performance

- Mediocre operational management practices

- Fraud risk

- Poor risk management practices and procedures

See also

References

- ↑ What on Earth did they think they would achieve by releasing this report? It caused another precipitous drop in the firm’s stock price — nearly four percent — to go with the twenty percent drop it suffered when news of the default first broke.

- ↑ Report on Archegos Capital Management

- ↑ As it was a synthetic position, Viacom may not have realised that Archegos was the only buyer in town: if it had, it may never have tried to raise capital in the first place.

- ↑ Disclaimer: this dialogue is entirely made up, but based very loosely on a true story.

- ↑ Figures taken from the CS Report on Archegos

- ↑ Antifragile: Things that Gain from Disorder... but only because you know him to be a potential sinner; she who is entirely without sin may be a saint, or it may just be she hasn’t sinned — or been caught — yet.

- ↑ https://www.sec.gov/news/press-release/2012-2012-264htm

- ↑ Note: this data is incomplete: what I have all comes from the CS Report on Archegos.

- ↑ But see the vexed topic of margin lock-up, which significantly constrains the PB’s flexibility.

- ↑ Archegos had a three day notice period, which interposed some rather gristly squeaky-bum time between your adjustment and it going live, which the Credit Suisse risk team weren’t willing to endure.

- ↑ This isn’t the place for it, but note: these fundamental qualities of commercial life are utterly illegible to neural networks, policies and algorithms.

- ↑ “Co-heads is no heads”.

- ↑ None of Jerome Kerviel, Nick Leeson, Yasuo Hamanaka, Kweku Aboldoli were senior executives.

- ↑ In the wonderful Systemantics: The Systems Bible