Document risk

The usual way of defending against document risk is to treat each customer contract as if it were a communiqué between hostile nations, drawn up in a last-ditch bid to avoid bloodshed on the eve of war.

Document risk

/ˈdɒkjʊmənt rɪsk/ (n.)

The risk to an organisation — overstated in the collective, but wildly understated in the particular — that it loses money because its legal contracts with its customers aren’t “strong” enough.

Of course— this is the lesson of the Stanford Prison Experiment, after all — when you treat a customer like a presumptive criminal, it will tend to behave like one. That being the case, by the time it is concluded, your contract will tend to look less like the exchange of lavender-scented love letters you would expect, and more like downtown Beirut in 1976 just after a particularly vigorous shelling.

Now, one incomprehensible, bullet-riddled tract is a tragedy; a hundred thousand of them are a statistic: a healthy statistic, a collective mass that conceals each ugly instance.

Yet believing one has a colossal portfolio of battle-tempered contracts bestows great comfort on senior personnel in credit and legal. It tells them the firm has laboured hard to defend its interests: all bad things that might come to pass have been anticipated by the battery of preternaturally paranoid negotiation specialists they have at their disposal.

At steercos and opcos they will hold forth, at the merest invitation, about the imperative of having “strong docs”. They will cite in support of their proposition the military industrial complex the firm has deployed in consummation of its customer documentation effort.

Now, only a fool rushes in to pop a credit officer’s balloon, but foolishness has never stopped the JC before, so here goes: we say this is a false comfort.

Our evidence is purely, but compendiously, anecdotal: client documents are wonderful in the abstract, just as long as you never have a concrete need to look at them.

Actually reading negotiated customer contracts, especially with a view to doing something with them, is a chastening experience.

They were forged, as we have said, in a series of guerrilla skirmishes in a white-hot urban conflict. The parties to this conflict are battle-hardened commandos, on both sides, learned in all manner of calamities that, in the history of the world, have ever befallen a trading relationship. Each carries a potted history of her own firm’s calumnies called a “playbook”.

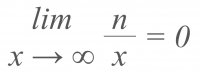

But if you divide all of recorded history (n) by the infinity that is yet to pass (x), the quotient is nought. The of the future bear no necessary resemblance to the disasters of the past.

But when the fog of war rolls in, unspeakable things happen. The normal rules of polite society give way to the furious, pragmatic, law of the jungle. You do not stand on ceremony when you are shipping sniper fire in a bombed-out basement: there is a single objective: to get out alive. A negotiator knows, faintly, that once this fire-fight is over the documents over which she labours will be put away, and no-one will look at them again.

For the great majority of all negotiated contracts, this is but practical common sense. They will never be looked at again. No one may know, we cannot tell, what pains they had to bear.