Co-head

Co-head

kəʊ-hɛd (n.)

|

People Anatomy™

A spotter’s guide to the men and women of finance.

|

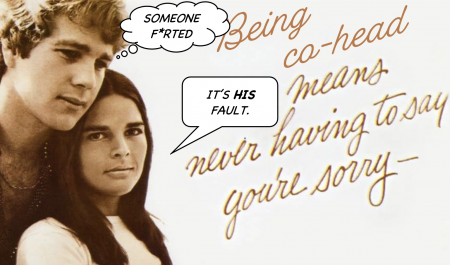

To appoint a co-head is to convey the impression one has overdone managerial responsibility whilst creating a vacuum of it. To be a co-head is to claim credit for the cake that is kept, and blame someone else for all the cake that is eaten.

A staple motif of multinational mis-management[1], the “co-head” speaks to the weakness and hubris which holds down the comfy chairs upper management.

“Co-head is no head”

To appoint co-leaders of a division, or the firm itself, is to settle a petulant inter-personal dispute that is, at best, only adjacent to the institution’s interest — but in all likelihood is positively hostile to it — by undermining the one thing such an appointment is meant to achieve: direct personal accountability. A sole head of business who presides over catastrophic loss may blame inclement weather, Brexit, or regulatory head-winds, but cannot evade the retort that managing external factors such as these is just the job she was empowered to do.

That dynamic changes should she share the hot-seat with someone else. If something goes wrong, there’s always a reason it wasn’t her fault. Her hands were tied; it was not her area; others were looking at it.

The greatest, most glaring example of this is at our old friends Credit Suisse, who found to their cost what happens when you have co-heads of prime services. For those without the stomach for a deep foray into hedge fund financing, you need know only this: prime brokerage generally splits into physical and synthetic components which are formally6 quite different but substantively the same; Europe and New York are major centres for prime services businesses. Now at the time a certain hedge fund blew up, trading synthetic products in the Americas causing Credit Suisse roughly $5billion in losses, the firm had co-heads of that business, one in the US and one in Europe. These men were duly summoned before the executive board to explain themselves. The one based in America explained that he was responsible only for physical prime services, so this was not on his patch. The one based in London said he was only responsible for European prime brokerage, so it wasn’t on his patch, either.

All credit, no responsibility

It will be a different story should the business be in rude health, of course. There are few banking executives who won’t claim credit for every iota of positive return, and it will be a rare bank which pays each of its co-heads exactly half what it would pay a single head.

But it should do: the only way a co-head arrangement could work is one that few investment bankers would entertain for a moment: that of partnership: joint and several liability, and therefore individual responsibility for the totality of any loss, and proportional sharing of any profit. This is, of course, to increase one’s vulnerability to one’s comrades in the service of the firm’s interests, and is not how the professional managerial class like to go about things.

Rationale

Purported rationales are to encourage a lean market inside the organisation for ideas, and to sort wheat from chaff. Pitting two young thrusters against each other is some sort of Spartan matriculation: soon enough, one will emerge and the other will expire in the cage, a mess of blooded feathers. This is how Goldman looks at it, anyway. If that is how you do your succession planning, fair enough — but you reap what you sow.

This is not how it works in kinder, lazier places where the co-head gambit is a sop from those without the heart for hard decisions that might damage fragile egos.

See also

References

- ↑ See here for a daily-updating hall of shame.