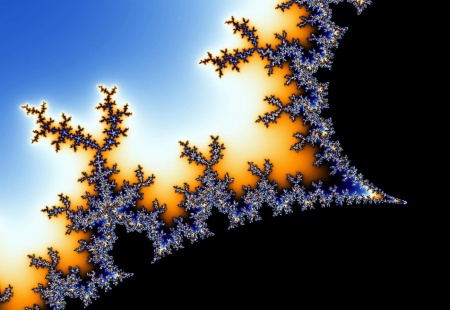

Fractal

Fractal

/ˈfrakt(ə)l/ (n.)

|

A fractal is a geometrical figure, each part of which has the same statistical character as the whole. Fractals are useful in modelling structures (such as snowflakes)[1] in which the same patterns recur at progressively smaller scales, and in describing partly random or chaotic phenomena such as crystal growth and galaxy formation.

As a metaphor

The fractal is also a useful metaphor to describe the legal eagle’s approach to risk-management through the medium of the legal contract, and the magnetic attraction that legal eagles feel towards negotiation oubliettes. The more powerful the lens with which you look at it, the more risk you will see.

In the mathematics of lexophysics

In the normal geometry of the space-tedium continuum, lexophysicists represent perfectly documented legal risk as a dead straight line and an unaddressed risk presents as a kink or bend in the line. Therefore, under the standard model, the fundamental objective of legal engineering is achieve a maximally straight line through space-tedium.

The legal challenge upon encountering a kink in such a line is to fix it. The smaller the risk, you might think, the easier the fix. But, alas, this takes no account of the fractal geometry of the space-tedium continuum.

Imagine we have seen and flattened out just such a kink, perhaps applying an unguent “notwithstanding anything to the contrary in the foregoing contained”, or some such placatory wording. For should one screw down the resolution on the ESPER machine to zoom in on that flattened kink — to make sure it is nice and straight now — we see to our consternation that there is a little kink in the middle of the old kink. For this kink is a fractal. However close we go; however elaborate our means of fixing the last kink, as we descend into the weeds to check our engineering, we will find further, smaller kinks.

Now note what is happening here: as we approach that asymptotic point of intolerable tedium (the tiniest measurable particle of which is the Biggs hoson, by the way), at the same time the legal superstructure we create to eradicate this ineradicable imperfection grows ever less wieldy. We are creating a monster. What is worse, we may pass through an event horizon, beyond which there is no lexophysical way out: we are sucked ever onward by the overwhelming gravitational forces inside a negotiation oubliette. We are compelled to continue even to our destruction, dashed on the infinitesimal, pointless rocks of tedium, propelled by the colossal weight of the markup we have generated.

Celebrated examples

There are some famous examples. Clifford Chance famously created its own little neutron star trying to define what wasn’t a company in a Luxembourg netting opinion in 2021. Some say that, in the centrifugally exploding spiral disc shape of the 2018 ISDA Credit Support Deed for Initial Margin, the heroic pedants of ISDA’s crack drafting squad™ finally bit off more than they could chew and created a galaxy-sized black hole, into which the entire financial system may already, for all we know, have fallen.

The joint and several indemnity

Even great catastrophes have their roots in innocuous trifles. Now, trifles do not get more innocuous than tri-party collateral arrangements, so it is fun to see how fractal arguments can arise even in this kind of soufflé. Indemnities, for example, are a common fractal trigger. Even harmless ones.

It is not uncommon for a custodian to seek an indemnity for extraordinary costs it incurs HEY! WAKE UP! in holding its clients’ assets and carrying out its clients instructions with regards to those assets.

Now in truth, the risk a custodian will suffer any such “extraordinary costs” is low. After all, what losses would they be? Outside of stamp taxes, it takes some talent for paranoia to come up with any. If a custodian does suffer losses, they are likely to be small in the grander scheme of things[2] There will be an obvious justice and fairness to these kinds of losses, the allocation is obvious, no-one objects to it, so whether or not there is an indemnity the parties will sort the custodian out quickly and on the strength of the commercial imperative, most likely without a backward glance to the legal contracts.

This is just the Custodian going “look, I’m doing you a solid, you don’t pay me a lot for it, so it’s only fair if I get hit with some unexpected cost for looking after your assets, I can pass it on to you.”

That said, there will be predictable skirmishes predicated on the width of the indemnity, which will be outrageous, and to fend these off the client-side legal eagle will engage some of her favourite tropes: good faith, commercially reasonable manner, absence of negligence, fraud and wilful default. All good, clean, harmless fun. But already, we may have passed that dastardly event horizon, and should our legal friends zoom a bit further in, quickly they will realise all is lost.

Someone notices the indemnity is joint and several, between pledgor and pledgee. Again, so much so reasonable: the custodian does not want to argue as between these two clients whose fault it was: the custodian knows it was not its fault. The custodian will just claim on either of them. As to who ultimately foots the bill, the custodian cares not one whit. Let the two of them slug it out.

But how shall they allocate responsibility? The legal eagle’s sacred quest is to solve now, for contingencies that will only come about in the future. There should be a concept of contribution. But should it depend on who instructed? Or whether one or other party was contributorily negligent in bringing the loss about? Should there be a relative contribution mechanism?

all the while they drift closer to the detail, the magnitude of the machinery they are designing to solve for it mushrooms, in complication and heft. So much so that it lends a gravity of its own to proceedings.