Template:Gmsla 9 summ

Mini close-out

This is the fabled {{{{{1}}}|mini close-out}} provision of the 2010 GMSLA. Mini close-out is the method of terminating an individual {{{{{1}}}|Loan}} under a 2010 GMSLA or an 1995 OSLA where there is a settlement failure without actually closing out the whole agreement. It applies therefore to a failure to return {{{{{1}}}|equivalent}} {{{{{1}}}|securities}} or (in the case of the title transfer GMSLA) equivalent collateral — these can be a function of market dislocations, upstream counterparty failures and liquidity events affecting the asset in question — but not to the failure to deliver {{{{{1}}}|collateral}} in the first place, seeing as if one kind of {{{{{1}}}|collateral}} is not available, it is in the {{{{{1}}}|Borrower}}’s gift to deliver something else that meets eligibility criteria, so its failure to pony up collateral always looks like a credit failure and will count as an {{{{{1}}}|Event of Default}}.

If the {{{{{1}}}|Lender}} decides to terminate, you are into the realm of the fabled and famous {{{{{1}}}|mini close-out}}, wherein the {{{{{1}}}|Lender}} exercises rights to terminate and value the {{{{{1}}}|Loan}} by itself as if it were an {{{{{1}}}|Event of Default}}, whilst not actually being an {{{{{1}}}|Event of Default}}.

So why isn’t a failure to return {{{{{1}}}|Securities}} (or {{{{{1}}}|Collateral}}) an {{{{{1}}}|Event of Default}}? Well, this reflects the reality that settlement failures in the equities markets are common and, seeing as the whole point of a stock loan is to provide the {{{{{1}}}|borrower}} with a security it can sell short, the {{{{{1}}}|Borrower}} is likely to be relying on someone else returning the security to it before it can return the security to the {{{{{1}}}|Lender}} — as such the {{{{{1}}}|Borrower}}’s failure is not necessarily evidence that it is about to auger into the side of a hill.[1]

The {{{{{1}}}|Lender}} has a self-help mechanism it can use to close out its market risk: a {{{{{1}}}|buy-in}}.

Non-affected party’s option

Note that {{{{{1}}}|mini close-out}} is the non-affected party’s option: If a {{{{{1}}}|Borrower}}, on terminating a {{{{{1}}}|Loan}}, cannot then redeliver the borrowed {{{{{1}}}|Securities}} (because of an upstream failure), it cannot force a {{{{{1}}}|mini close-out}}.

Failure to return Collateral or Securities is not an Event of Default. What is then?

The GMSLA is deliberately designed so that the return of Equivalent Securities, or the return of Equivalent Collateral, is not an Event of Default.

These failures are designed to be caught by the Mini-Closeout section, which gives the party expecting the redelivery a self-help, pre-default, remedy of buying in, liquidating Securities or Collateral that it holds, valuing the offsetting positions and calling for a cash payment. A failure to make that payment would be an Event of Default (under 10.1(c)).

The deficiency seems to be in not allowing for the 9.2 close out right to attach to failures to return Collateral during the currency of a loan. I am not sure why that is missing, but it seems to me the correct approach should be to amend 9.2 to say:

“If Lender fails to deliver Equivalent Collateral comprising Non Cash Collateral in accordance with paragraph 5.4, 8.4 or 8.5…”

Noting the exception for redelivery of Equivalent Securities or Collateral,[2] the failure to pay or deliver Events of Default under the 2010 GMSLA are:

- Cash Collateral failures: Any failure to pay or repay cash Collateral when required — the theory being that you can’t blame an upstream counterparty for your failure to deliver cash.[3]

- Non-cash Collateral delivery failures: Any failure to deliver non-cash Collateral (either at inception of by way of further Collateral). Here the Borrower has discretion[4] on what Collateral it delivers, so again doesn't have the excuse that it has suffered an upstream failure. Where it is a Collateral return, the Lender has less discretion, so is more prone to upstream settlement failures. Note that non-delivery of Securities at the commencement of a Loan is not a failure to pay, also for “potential upstream failure” reasons: it just means the Loan doesn’t happen.

- Mini-closeout failures: Any failure to pay following exercise of a mini closeout under Paragraph 9. That is, not a failure to redeliver Equivalent Collateral or Securities themselves, but a failure to settle any mini close-out or buy-in following the mini closeout.

Default interest

Are references here to interest to, like default interest under Clause 11.7? And if so are we in a world of LIBOR remediation?

Clause 11.7 of the 2010 GMSLA is specific to costs following actual close out on an Event of Default (a Buy-in isn’t an Event of Default), and only on professional expenses. The vibe here is you reimburse me my actual costs. So, the actual interest cost I incurred in funding the securities I bought in, rather than some abstract derivative notion of my costs represented by a benchmark.

Replacement costs and ISDA hedging language

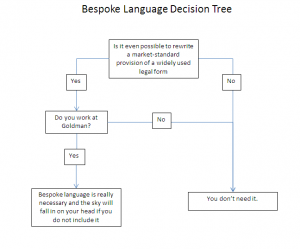

Does it make sense to replace this clause with some convoluted shtick about the costs of Replacement Transactions or otherwise hedging the innocent party’s exposure? To determine follow this flow chart:

GMSLA netting

Since prudential requirements to have netting opinions do not apply within single transactions, one does not need a mini close-out provision to net within transactions under a GMSLA. That happens as of right. Therefore if, as is often the case, your loan portfolio is all the “same way round” — if you are borrowing from, but never lending to, a lender in a gross jurisdiction, then netting doesn’t really do anything for you. Your problem will be your {{{{{1}}}|collateral}} haircut, for which you will be an unsecured creditor of the lender. To fix this, a pledge GMSLA is what you are looking for.

Odd spot

See the peculiar impact mini-closeout has on Default Under Specified Transaction under the ISDA Master Agreement.

- ↑ The same is generally true of {{{{{1}}}|Collateral}} returns (though not {{{{{1}}}|Collateral}} deliveries - see paragraph {{{{{1}}}|9.2}}.

- ↑ See 9.1(b) and 9.2(b).

- ↑ For a jauntily metaphysical examination of the nature of hard cold folding green stuff — why it is, by nature, profoundly different to any other financial instrument, see our article on cash.

- ↑ From those assets that meet the eligibility criteria in the Schedule; moral of story: don’t allow yourself to be too tightly constrained on eligibility criteria.