Thirteenth law of worker entropy

The JC’s thirteenth law of worker entropy (also known as the “optimal complication theorem”): Over time, a given template will tend to a point of “optimal” complication, (c), which is a function of:

|

Office anthropology™

|

“Je n’ai fait celle-ci plus longue que parce que je n’ai pas eu le loisir de la faire plus courte.”[1]

— Pascal, Lettres Provinciales, 1657.

- (i) the highest plausibly chargeable fraction of the typical value, (vf), of contracts concluded on the template,

- (ii) the time, (t), required to manipulate the template so it reliably works to the satisfaction of one having the patience, skill and hubris to understand it, and

- (iii) the professional charge-out rate, (r), of such an unusually abled person.

The relationship between c, vf, t and r is as follows: c ↔ vf = tr.

The JC developed this over a series of papers [do you mean “beers”? — Ed] with sometime collaborator, poet, playwright and tropical disease victim Otto Büchstein when trying to understand how medium term note documentation could be so dreary despite (a) the underlying product being basically straightforward and (b) repeated efforts by market participants to make it easier.[2]

There are underlying dynamics here.

Firstly, r and t are positively correlated. This follows: the more patience, skill and hubris required to competently manipulate text, the fewer people can do it. So, by operation of ordinary principles of supply and demand, the more those who can do it can charge. Hence the charge-out rate tends to rise, not fall, with prolixity.

Similarly, v is actual, real world value, and not “notional fright value imbued by lawyers”.

Thus, a secured medium term note — typically in the tens of hundreds of millions of dollars — has high intrinsic value even though the basic premise of the transaction — “I lend you money, you give me a note, I can sell it, you repay whoever holds it later, with interest, depending on certain externalities” — is pretty simple. Thus, you can expect the documentation for a secured MTN drawdown to span several hundred pages of wretched text, and so it does, notwithstanding that one can, and parties typically do, trade on a one-page term-sheet.

By contrast, a confidentiality agreement is part of the traditional pre-trade appendage-measuring ritual of the pea-cocks and pea-hens of finance. You have to do it, it is meant to look spectacular, but no-one is meant to be seriously hurt by the experience, and nothing of lasting value is achieved by its negotiation. Even so, the abstract legal points of an NDA can be quite involved — the world is awash with misconceived NDA templates riddled with schoolboy errors — even though nothing of any commercial moment has ever depended on them.

Thus, NDAs — even for secret-squirrel event-driven family office types — rarely get past 5 or 6 pages. If you get stuck on one for more than a week, it is bound to be some other problem the business guys don’t want to face, so are blaming on the NDA.

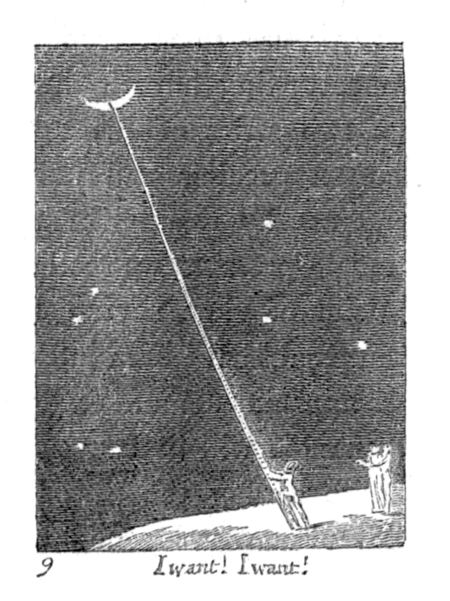

There appear to be local maxima and minima at play. An NDA, however important, complicated, and however many fanciful extraneous things you bolt onto it (exclusivity, non-solicitation, restraint of trade, punitive damages and so on) may generate aa few thousand pounds in billings, but even that is pushing it beyond all expectation. With a syndicated bond issue, on the other hand, one can write a ticket to the moon.

This is why most magic circle law firms do not have “confidentiality” departments as such — everyone muddles along independently — but may devote entire floors to debt capital markets.

Worked example

Take a USD500m loan. Even 0.05% of the deal value — as mere 5 basis points — is USD250,000. Is it any wonder the service economy is in such rude health? Who wouldn’t pay that to make sure nothing went wrong on half a yard of debt finance?

But even at USD500 an hour, that is five full working weeks of a legal eagle’s time:[3] it really wouldn’t do if all that was required was to top-and-tail the term-sheet with boilerplate and bang out an enforceability opinion. Nor would there be much prospect of stopping clients going to some other guy down the road who will do the job in a day and send a bill for a £500. So — well, have a butcher’s at this this 370-page beauty and allow me to rest my case on it, since it plainly wouldn’t fit in it.

See also

References

- ↑ “I have made this longer than usual because I have not had time to make it shorter.”

- ↑ For example, the patent applied for “MaJoR” Multi-Jurisdiction Repackaging Programme, which for a brief beautiful moment revolutionised the repack world, but inexplicably fell out of favour, to be replaced by earlier, crappier structures. Go figure.

- ↑ At 40 hours per week. Yes, we know that nowadays a transatlantic lawyer can expect to recover more billable hours per week than there actually are in the week, but we are assuming traditional laws of spacetime apply.