Oubliette: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 12: | Line 12: | ||

So let’s look at the classic case: [[DUST]]. Warning: we are about to drop into an unseemly amount of detail about something that is very, ''very'' [[Tedium|dull]], but that is the very point: by seeing how dull these holes in the ground are, we can learn how to avoid falling into them. Remember: [[Tedium is particular, not generic|tedium is ''always'' specific, never general]]. | So let’s look at the classic case: [[DUST]]. Warning: we are about to drop into an unseemly amount of detail about something that is very, ''very'' [[Tedium|dull]], but that is the very point: by seeing how dull these holes in the ground are, we can learn how to avoid falling into them. Remember: [[Tedium is particular, not generic|tedium is ''always'' specific, never general]]. | ||

===The classic negotiation oubliette: | ====The classic negotiation oubliette: Default Under Specified Transaction==== | ||

{{dust as an oubliette}} | |||

As all [[ISDA ninja]]s will well know, {{icds}} left the door open on a bit of chicanery in its conceptualisation of {{isdaprov|Default Under Specified Transaction}}. | As all [[ISDA ninja]]s will well know, {{icds}} left the door open on a bit of chicanery in its conceptualisation of {{isdaprov|Default Under Specified Transaction}}. | ||

[[DUST]] a form of limited bilateral [[Cross acceleration|cross-acceleration]] by dint of which one may close out transactions under ''this'' master agreement because your counterparty has defaulted on transactions under that one. A simple enough concept, and a prudent [[credit mitigation]] tool, even if it is rarely<ref>Um, ''ever''.</ref> used in practice. | [[DUST]] a form of limited bilateral [[Cross acceleration|cross-acceleration]] by dint of which one may close out transactions under ''this'' master agreement because your counterparty has defaulted on transactions under that one. A simple enough concept, and a prudent [[credit mitigation]] tool, even if it is rarely<ref>Um, ''ever''.</ref> used in practice. | ||

Revision as of 07:40, 25 August 2024

|

Negotiation Anatomy™

|

Oubliette

/ˌuːblɪˈɛt/ (n.)

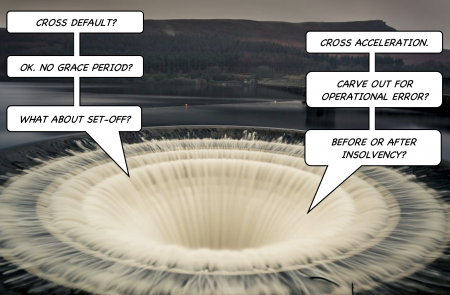

A naturally occurring subterranean cavern that forms when the opinionated gather to argue about trifles. Given enough nest-feathering, posturing and guano, even the most robust topic will tend to fray and weaken and may in time collapse: those discussing it suddenly find themselves in a dungeon of their own making, not knowing how they got there, but rather enjoying it all the same.

Oubliettes have a cosmological quality: like any black hole, they are impossible to see directly. We detect them only by their signature detritus: crushed aspirations of clarity and elegance, swirling around an event horizon of pedantry like so many gossamer dreams of greatness, gurgling around a galaxy-sized plughole. We enter these space-tedium singularities often, but always unwittingly, and it is only when scrabbling desperately for a way back out that we realise just what we have fallen into.

Negotiation oubliettes

Oubliettes are common when negotiating quotidian commercial agreements. They are a consequence of the agency problem. While this can be alarming for commercial counterparties themselves, their negotiators will carry on, oblivious, sometimes for months or even years, as long as there are rules to follow, details to tease out and contingencies to address, however microscopic or improbable.

An inter-affiliate stock lending agreement famously fell into an oubliette in Zurich in 2014. None of the negotiators have been heard from since though, as far as anyone “on the outside” knows, discussions are still ongoing and progressing well.

Negotiation oubliettes are often prompted by the lawyer’s equivalent of the “clabby” conversation:[1] one struck up by an agent to appear busy while avoiding difficult work, wasting time and provoking maximum forward confusion. Into the oubliette you will go, taking the whole negotiation with you, the moment anyone proposes to accommodate any of the infinite tail events that in logical theory could but in recorded history never have come about. Seeing an oubliette coming early is vital, as is the right response, since falling into it is very easy to do. The notion of a “clabby conversation” translates very well into the world of contract negotiation.

So let’s look at the classic case: DUST. Warning: we are about to drop into an unseemly amount of detail about something that is very, very dull, but that is the very point: by seeing how dull these holes in the ground are, we can learn how to avoid falling into them. Remember: tedium is always specific, never general.

The classic negotiation oubliette: Default Under Specified Transaction

Template:Dust as an oubliette As all ISDA ninjas will well know, ISDA’s crack drafting squad™ left the door open on a bit of chicanery in its conceptualisation of Default Under Specified Transaction. DUST a form of limited bilateral cross-acceleration by dint of which one may close out transactions under this master agreement because your counterparty has defaulted on transactions under that one. A simple enough concept, and a prudent credit mitigation tool, even if it is rarely[2] used in practice.

But. There are idiosyncrasies in some markets. In securities financing arrangements (e.g., stock loan and repo) settlement failures are common, and have nothing to do with credit stress: pure operational fails happen every day, get quickly sorted out by buy-in, and the parties move on. But a buy-in is, technically an early termination of the transaction and — depending on your master agreement[3] — may technically be an event of default. In many cases it is a matter of market convention, not documentation, that these are not treated as events of default.

Now the 2002 ISDA deals with this, a little inexpertly, by classifying the default as

- Any default during a Specified Transaction — except a simple delivery failure — that leads to the acceleration of that Specified Transaction only

- Any default at scheduled maturity of a Specified Transaction — except a simple delivery failure — this is to cover off the pedantic point that you can’t accelerate an obligation that is already due, so ISDA’s crack drafting squad™ perceive some kind of category distinction between a performance breach before maturity and one at maturity

- Any default at any time that is a simple delivery failure that results in the acceleration of all outstanding transactions under the same master agreement — this, therefore, carves out simple delivery fails that the parties sort out by themselves without accelerating anything else.

This is so tedious as to be hard to even write about.

Your counterparty objects, picking any one of a multitude of small holes in the arrangement. Why should even payment failures count if you are not closing out the other Specified Transactions? A fair question. Your own credit officer might counter: what if there is only one outstanding Specified Transaction, and it fails at only at maturity, by means of a delivery, but the failure is credit-related? What then? This is a peculiar view, shared by few in the market, and lacking a solid base in common sense, but of such gems of incongruous conviction propel many a livelihood in the Square Mile and we should not gainsay them. They are inexplicable brute facts of the universe, like the cosmological constant or the popularity of golf.

Your credit officer will say, “well, it won’t hurt to just ask”, but just asking will prompt a discussion the parties needn’t otherwise have had, about the sorts of fantastic calamities that might come about in the possible universes that risk managers visit in their delirious dreams. The hypotheticals thrown into this debate will be as imaginative as they are tendentious: there will be a tangible air of prepostery emanating from either side’s submissions. But such is the path-dependency of negotiation: had no-one started this ball rolling, on a whim, none of imaginative perversity would have been given voice.

Before you know it, the parties will be reciting the 14 stations of set-off. Perhaps someone will have the idea of importing some definitions from the ISDA Master Agreement, and from there all hope is lost. There is one way back, an infinite number of ways forward, into the abyss, and negotiators have no reverse gear.

It might jazz your risk colleagues, and it will doubtless appeal to your own Rube Goldbergian instinct — every transactional legal eagle has one, however deeply buried, and it will overjoy your opponent legal eagle.

But, as as you descend into the abyss, it will drive your clients up the wall.

See also

References

- ↑ The Meaning of Liff: The Original Dictionary Of Things There Should Be Words For, by Douglas Adams and John Lloyd.

- ↑ Um, ever.

- ↑ The GMSLA, a settlement fail is specifically not an Event of Default. there is no such carve-out under the Global Master Repurchase Agreement or the American equivalents the Master Repurchase Agreement and Master Securities Lending Agreement.