ISDA Anatomy

Here is the great landing page for the ISDA Master Agreement in all its beautiful articulations. There is a lot of information here: budding ninjas may just be amped up to dive in to the clause table a the bottom. For those seeking a gentler introduction to the world of derivatives — financial weapons of mass destruction (© Warren Buffett) after all, so to be handled with care — here is a quick overview:

The Anatomy

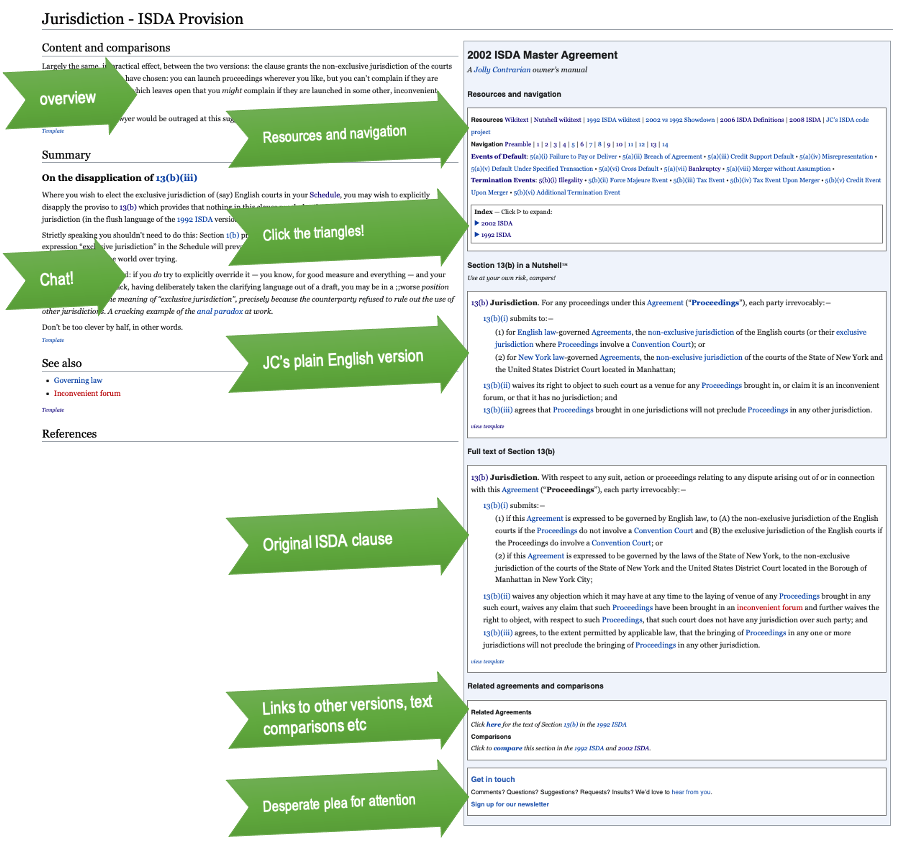

In the table below, your gateway to the in-depth clause-by-clause and subclause-by-subclause analysis. Each page contains:

- The actual clause of the ISDA agreement

- Our plain English “nutshell” summary of that clause

- A “comparison” section, summarising the differences between the corresponding clauses in the 1992 ISDA and the 2002 ISDA.

- A “summary” section, explaining what the clause does, how it works, frequent amendments to it, and controversies in the ISDA community.

- An optional “general” section, for those clauses of frequent controversy, going into a little more detail; and

- An even-more-optional “details” section, that dives into the paranoid beating heart of ISDA Ninjery — though this is reserved for really special occasions.

You can also access the clauses alphabetically from the nifty little dropdowns in the infobox on the right of every page.

the JC’s plain English ISDA

Ever thought it would be great to have a summarised, de-pedantified, ISDA Master Agreement in a single place you could read through without feelings of remorse, loathing and an incoming migraine? Fear not! There is one! Here is JC’s whole, nutshell, plain English ISDA in one place!

Okay, and what about a side-by-side summary of the whole pain-English, full ISDA and the JC’s lovely, airy, high fibre, plain-English nutshell summary? Well, for premium contentsubscribers we’ve got you covered.

Booklets and whatnot

We also have anatomies of some — not all — of ISDA’s product booklets and credit support annexes, the most developed of which (including Equity Derivatives and EU Emissions Allowances are in the side-bar on the right under “Anatomies”.

Introductory material

What is a swap, as explained to my neighbour Phil. We developed these explainers to help Phil swot for his exams to be a tour guide to the city of London. (He passed!)

Then there’s the history of the ISDA Master Agreement (some of which we freely admit we made up), and long, impassioned and liable-to-fall-upon-deaf-ears screeds about Close-out Netting, the need for netting opinions variation margin, and various other things.

Financial weapons of mass destruction™ corner

We are developing our own game of FWMD Top Trumps. It is what every neurotic millennial needs: Have fun and fret about forthcoming financial oblivion!

The ISDA rabbithole

Late, for a very important date? Then strap yourselves in, readers...

Structure of the 2002 ISDA |

Structure of the 1992 ISDA |

Preamble |

Preamble |

1 Interpretation |

1 Interpretation |

2 Obligations2(a) General Conditions (incl Section 2(a)(iii)) |

2 Obligations2(a) General Conditions (incl Section 2(a)(iii)) |

3 Representations3(a) Basic Representations |

3 Representations3(a) Basic Representations |

4 Agreements4(a) Furnish Specified Information |

4 Agreements4(a) Furnish Specified Information |

5 Events of Default and Termination Events5(a) Events of Default

5(b) Termination Events

5(c) Hierarchy of Events5(d) Deferral of Payments and Deliveries During Waiting Period5(e) Inability of Head or Home Office to Perform Obligations of Branch |

5 Events of Default and Termination Events5(a) Events of Default

5(b) Termination Events

5(c) Event of Default and Illegality |

6 Early Termination6(a) Right to Terminate following Event of Default6(b) Right to Terminate following Termination Event

6(c) Effect of Designation6(d) Calculations6(e) Payments on Early Termination

6(f) Set Off |

6 Early Termination6(a) Right to Terminate Following Event of Default6(b) Right to Terminate Following Termination Event

6(c) Effect of Designation6(d) Calculations6(e) Payments on Early Termination |

7 Transfer |

7 Transfer |

8 Contractual Currency8(a) Payment in Contractual Currency |

8 Contractual Currency8(a) Payment in Contractual Currency |

9 Miscellaneous9(a) Entire Agreement |

9 Miscellaneous9(a) Entire Agreement |

10 Offices; Multibranch Parties |

10 Offices; Multibranch Parties |

11 Expenses |

11 Expenses |

12 Notices |

12 Notices |

13 Governing Law and Jurisdiction13(a) Governing Law |

13 Governing Law13(a) Governing Law |

14 DefinitionsAdditional Representation |

14 DefinitionsAdditional Termination Event |