Carry trade

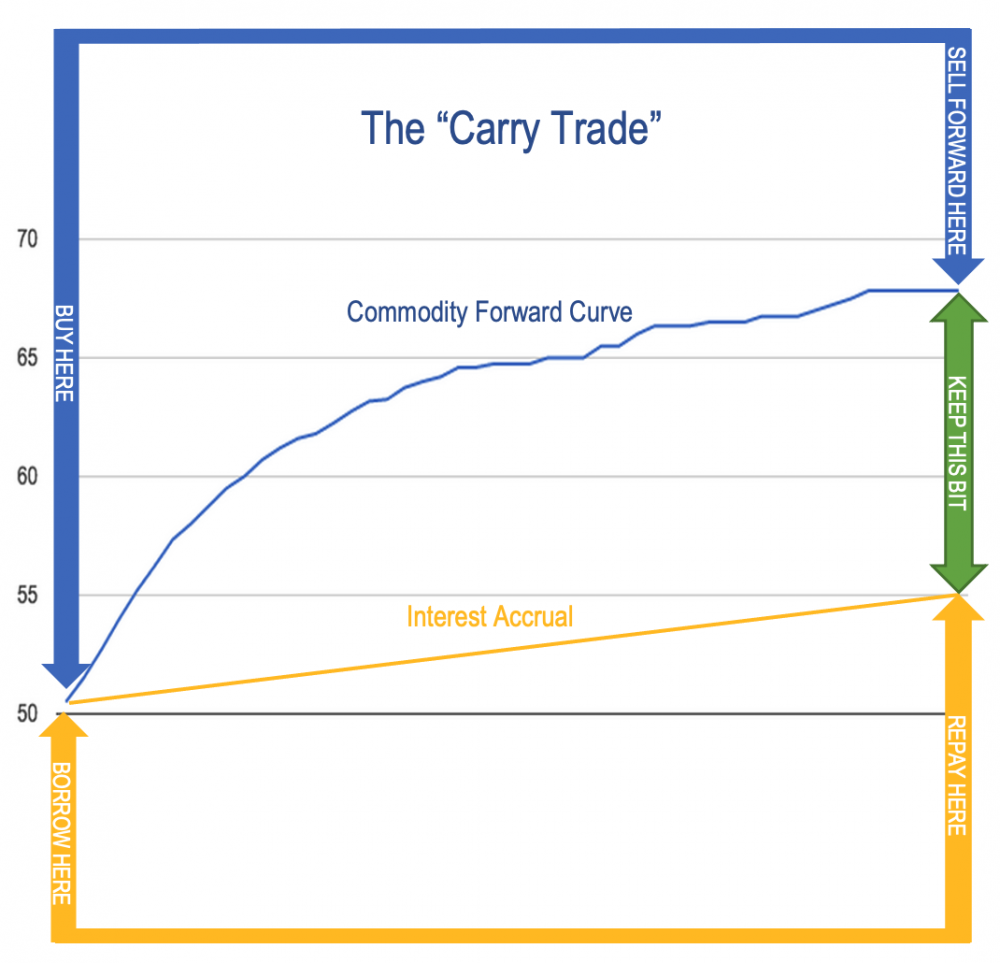

A transaction where one takes advantage of the futures market. “Positive carry” describes the state of affairs when the expected return on an asset is greater than the cost of owning it — being the implied cost of financing it, as well as actual costs of holding and insuring it. This means you can do a carry trade: borrow money to buy the asset and arrange to sell it forward later, and pay down your loan.

|

Carry doesn’t live here anymore

Carry used to price at flat LIBOR

Sorry that she left no forward address

Because her main financing was in distress.

- —Riff Clichard, Carry (1982, needless to say, a time of usurious interest rates)

If you can see that the spot price of an asset today is lower than its forward price (as implied by the futures price) — that is, the forward curve is in contango — buy an amount greater than your cost of funding, then all you have to do to make money is

- Today, borrow the money you need to buy the spot asset at your cost of funding for a term until your desired point in the future

- Today, buy the asset in the spot market at its spot price;

- Today, agree to sell it forward at that point in the future when your term funding matures, at its forward price

Then, just sit on the asset and wait. When the point in the future comes:

- On expiry, deliver the asset against payment of the agreed forward price (which may or may not be the prevailing spot price)

- On expiry, from the proceeds of your sale, repay principal and interest on the loan you borrowed in step 1.

- Keep the rest.

Works with any asset that has an observable forward market. Things that can go wrong:

- Your asset can go off, get lost, or be nicked (especially if a commodity in some warehouse in the Sudan)

- You have to pay the costs of holding it, so don’t forget those

- The person to whom you sold it forward may have blown up in the meantime (but hopefully you’ll be taking margin from them so less of a bother).

- Don’t forget to make sure the forward curve is in fact in contango, and the yield exceeds your cost of funding. Schoolboy errors, but these do happen.

Happy days!