Custody assets

|

Prime Brokerage Anatomy™

|

English law custody model

The standard English law custody model is a trust arrangement. That means legal title to securities is owned by the custodian, but the beneficial interest is held by the client. As against the rest of the world, the custodian owns the assets, but its contract with its client obliges it to follow the client’s instructions when dealing with custody assets.

Because of the trust, the custody assets do not form part of the custodian’s insolvency estate and (subject to any amounts owing to the custodian that secured by lien or security interest over the custody assets) they not available to the custodian’s creditors and are returned to the client. The Lehman insolvency showed that untangling the custodian’s books and records is a trial in itself, and navigating security interests a whole other ball of wax. Hence the CASS cutody rules (CASS 6) have been tightened, and the FCA (and hence, your own firm’s CF10A) takes an extraodinarily dim view of lax book keeping.

Delegate versus sub-custodian

Be warned: There are people more learned in the ways of the world than your correspondent who do not share this view. Let’s call it a dissenting judgment therefore. Or a piece of contrarianism. But it’s a cracker.

The difference betwixt

Delegation, according to a natural definition, means “to entrust (a task or responsibility) to another person, typically one who is less senior than oneself.”[1] So:

- Dear Sir/Madam: Let me introduce you to my glamorous assistant, Igor, who will carry out this work for you under my supervision. while your day-to-day interaction will be with Igor, I remain your loyal servant, and shall be answerable to you for Igor’s timely and competent performance.

Being delegated a custody function — agreeing to act, as AIFMD puts it, “at the first level of a custody chain”, as the direct custodian to a fund on behalf of the depositary whom the fund has appointed to carry out that function is, in this old fool’s view, not the same being the depositary’s sub-custodian. It is really quite different:

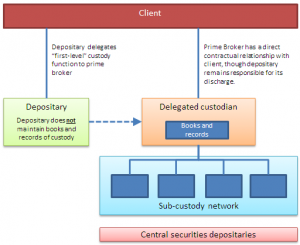

- Delegate: A depositary who delegates its custody function steps out of the custody chain. It won’t hold the client’s assets at all. It will instead pass that responsibility to the delegate — usually, a prime broker with designs on a spot of rehypothecation. The delegate will record the end-client’s interests in the custody assets directly in its own books and records — that is, the delegate itself, and not the depositary, will be “at the first level of the custody chain”.

- True; the delegate may have to report everything it does to the depositary, but the delegate’s record, not the depositary’s will be the “golden source” record of the safekeeping client’s assets. The depository might copy the delegate’s report, but the delegate’s books will be what count.

- Note that a custody delegate can see the ultimate client and, should it have lent money to that end client, it has enough control over that client’s assets to (i) take security over them, and (ii) defray its financing costs by rehypothecating them. For someone in the business of margin lending — say, a prime broker — these are pretty fundamental abilities, so expect prime brokers to be very enthusiastic about being delegated a depositary’s safekeeping function. They will be a lot less keen on being the depositary’s sub custodian, on the other hand.

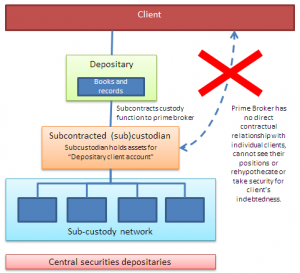

- Subcustodian: A subcustodian, by contrast, stands behind the “first level” custodian. The ultimate client cannot (directly) see it, and it cannot see the ultimate client. A sub-custodian holds the custodian’s client assets in a single omnibus account, in the custodian’s name but marked as “client assets” and therefore unavailable for the main custodian’s creditors. If the main custodian were not obliged to tell you about its sub-custodians, you would not even know they were there. A sub-custodian holds assets for the main custodian, only sees the main custodian, and won’t know who its individual clients even are, let alone which assets it holds for the main custodian belong to which clients, much less have a direct interpersonal or contractual relationship with those clients. Since it doesn’t know to whom they belong, a sub-custodian won’t be in a position to take security over or rehypothecate any assets it holds[2] — hence it ought to be happy enough signing a no lien letter.

Careful though: Both CASS and AIFMD/UCITS are a little sloppy in their use of the word “delegation”, using it on occasion to mean something that is probably meant to refer to a subcontracting arrangement[3]. CASS only really talks about subcontracts, though AIFMD and UCITS deal with true delegation and subcontracts.

Why delegate?

Why do depositaries delegate their custody functions under AIFMD and UCITS then? Market structure is why.

- AIFs and UCITS funds are required to have a local depositary to look after the fund’s interests, make sure it is properly managed, and to look after its assets. The depositary must be independent and must avoid conflicts of interest with the fund, such as would arise if the depositary lent to or traded with the fund. A depositary typically cannot act as a prime broker (a bank who lends on margin to hedge funds).

- Funds — particularly hedge funds and AIFs, but sometimes UCITS too — like to invest “on margin”, borrowing funds from a prime broker against the security of the assets it purchases with the margin loans.

- Prime brokers like to have assets to it can use them, defray its funding costs and manage its balance sheet.

- Structural problem therefore: Depositary is meant to hold the assets, but it can't lend against them. PB wants to lend against assets, but the depositary is meant to hold them.

- “Hold on,” says the PB. “If the depositary holds the assets, then I can hardly rehypothecate them, can I, and we know how important rehypothecation is to my business model, don’t we?”

- The depositary shrugs. “So, I'll make you my sub-custodian,” he says, “There: rehypothecate to your heart’s content.”

- “No can do,” says the PB. “I can only rehypothecate against indebtedness, and you, dear depositary, don't owe me anything. Only the fund does. And besides, as a sub-custodian I only see an omnibus account. I don't know who owns what inside it. For rehypo to work, I have to have a direct contractual relationship with the fund. That’s the deal.”

- Answer: the depositary delegates the custody function to the prime broker. Both AIFMD[4] and UCITS[5] allow this in certain circumstances, but there are complicated rules as to whether the depositary can shift responsibility to the PB.