Non-fungible token

|

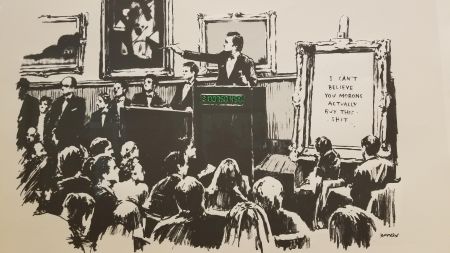

New York, 8 March 2021. “Morons,” a “tokenized” artwork by Banksy, has sold for over $394,000 on the Open Sea NFT marketplace. The piece — burned by an unnamed group of cryptocurrency enthusiasts last week — was sold at an auction for 228.69 ethers (CRYPTO: ETH), which at press time traded at $1724.

- —JC NEWSWIRE

Non-fungible token

/nɒn-fʌnʤəbl/ /ˈtəʊkən/ (n.)

A unique reference to an external thing — for example, a Banksy artwork — that has been cryptographically encoded on a blockchain. The “NFT” does not, in itself, confer ownership on thing it represents, but — and unlike any of the millions of other copies and images of the work online — it is a unique token of your non-actual ownership — there is no other token of non-ownership quite like it (hence, “non-fungible”) and given its unique status on the bollockchain, no theoretical possibility another one that could be created that could be confused with it. It is not to stop someone else from creating a different unique representation of the same artwork n the block chain; they would just be different representations of it. Not identical: each unique. With me? So this token — each of them, I guess —somehow magically bootstraps itself to some kind of intrinsic value. The problem they seem to have solved is “how to make a non-copyable thing on the internet.” This is not quite the same thing — it’s not, er, fungible with — the idea of “making a non-copyable artwork on the internet”.

Hence some people — clearly possessed of a devastating sense of irony — hatched the idea of taking an already subversively self-referential artwork — one that plays with the idea of its own lack of intrinsic value, being a print — print 325 of 500 created! — of a graffito which is called “Morons”, and which directly addresses the gullibility of art buyers, and which actually has the words “I CAN’T BELIEVE YOU MORONS ACTUALLY BUY THIS SHIT” written in capital letters on it — and putting a (er, non-representational) representation of it on a blockchain and selling that.

Still, the (anonymous) token seller perceived a rather bricks-and-mortar-ish, old-economy sort of perceptual problem: what if potential buyers worried that the physical work might seem somehow more intrinsically valuable than its crypto-token?

The token-seller’s solution: destroy the original work:

If you were to have the NFT and the physical piece, the value would be primarily in the physical piece. By removing the physical piece from existence and only having the NFT, we can ensure that the NFT, due to the smart contract ability of the blockchain, will ensure that no one can alter the piece and it is the true piece that exists in the world. By doing this, the value of the physical piece will then be moved onto the NFT.

There are two words I want to pick out from the above: “smart”, and “morons”. One of them is apposite to the someone — also anonymous — who bought it, and you don’t even know for sure that that dude[1] isn’t the gimp in all of this because — who can say? — some even stupider person might buy it for more.[2] That is someone-call-Alanis-Morrissette-grade staggering.

It is not out of the question that the buyer and seller are in fact the same single person perniciously trying to create an artificial market. If so, so what if the only bid is 500 bucks? It’s still 500 bucks. That’s a week’s work in some places. If this is a scam — and I have no idea and make no assertion in that direction — it is clever, so ironic it is almost artwork in itself, and, well, fraud.

In any case, bitcoin in general and NFTs in particular throw into sharp relief some fairly metaphysical questions about value, identity and authenticity that the information revolution has been lobbing around for a while now and which, in most of us, haven’t generated much more that a nagging feeling that our conventional models of the world might be due an upgrade.

Creative destruction?

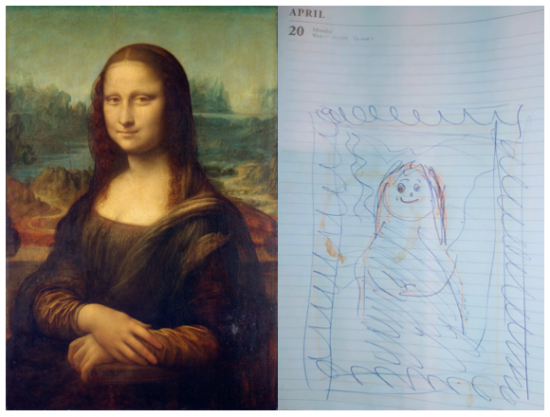

Let’s just work that logic through by analogy. Below, we have two images. One is La Gioconda. The other is a picture I just drew of it. I accidentally put my coffee mug down on it but I think that makes it look a bit more authentic. Now, both of these are unique representations: one is hanging in the Louvre, as we all know, the other is on the 20 April page from my desk diary from last year. Wikipedia estimates the 2019 value[3] of the Mona Lisa as USD 850 million. If we take that valuation as fair, I don’t think is is stretching things to say that the combined value of the real Leonardo original and my “unique token” of it — to be clear, that is the real thing, in my last year’s desk diary, not the feeble photographic facsimile you see below — is more or less exactly USD 850 million.

With me so far? Now for the krazy alchemical step: let’s say we burn the Mona Lisa. Obliterate it. We may need Robert Langdon to help with that, I grant you, but let’s just say. What is the value of my token now? EIGHT HUNDRED AND FIFTY BILLION BUCKAROONIES AM I RIGHT???

See also

References

- ↑ if it isn’t a sock-puppet for the original seller, of cour — WAAAAAAITAMINNUTE.

- ↑ At the time of writing said buyer does seem to be the gimp: it bought for 228.69, and the offers that have flooded in to date have been in the range of 0.001 - 2 ether coins (that is $500 more than it is worth, but it puts it in some perspective.

- ↑ Extrapolated from a 1962 valuation of USD100m: a suspiciously round number if you ask me, but still.