Risk taxonomy

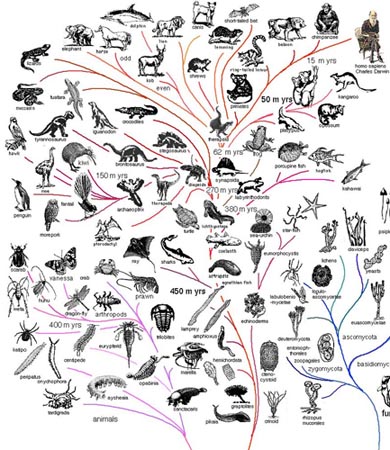

A fine occupation for the idle lawyer: Describing, and grouping in relation to each other, the entire catalog of risks that face your undertaking, as if unrealised legal hazards can be ranked, boxed and sorted like the phyla of butterflies, tits or thrush.

|

Risk Anatomy™

|

This exercise can occupy as little — a breakout session on an away-day — or as much — the permanent task of a dedicated division in the department — of your firm's intellectual capacity as you have going spare: organisations that run to the bureaucratic[1] may become so swooned by this notion that they can find little time to do anything else. For how can one assess a risk without knowing from which family of what genus in what species it hails?

The problem with risk taxonomies

Jolly Contrarian has two reservations about risk taxonomies:

The false comfort blanket

Any taxonomy, like a map, can only document the territory you already know, have raked over, surveyed and measured it. Known knowns. Stables from which the horse has bolted, so to say.

This is of a piece with the common lawyer’s usual mode of reasoning, the doctrine of precedent, whose organising principle is to move forward by exclusive reference to what lies behind. This is all very well in times of plenty, when the tide is rising, all boats are floating, those swimming nude are safely concealed from the neck down and all is well in the world. Here, the world behaves according to the narrative we have supplied it — we are in a period of “normal science”[2]. But by the same token, the acute risks are in abeyance. Aslan is not on the move. Even if you left the stable door open, Dobbin has a nosebag full of hay and isn’t going anywhere.

But what happens when our carefully constructed narrative falls apart? Those stressed scenarios in which, as the old saw has it, I’ll be gone, you’ll be gone, and black swans will be angrily flapping about. Then, your paradigm has failed. People around you are losing their heads and blaming it on you and your stupid taxonomy, which suddenly isn’t working.

See also: known knowns

It’s a narrative

Any taxonomy is a narrative. Like any hierarchical organising system, a taxonomy commits you to one way of looking at the world, at the expense of all others. Now this a necessary evil when it comes to concrete, physical things, like books: the Dewey decimal system is a single hierarchy — a narrative — by necessity: a physical thing cannot be in two places at once. So the curator of a library — libraries: remember them? — must settle on a single taxonomy (subject matter, not author, or title, or publisher) and, for better or worse, stick to it. Because one physical book can’t be in two places at once.

But legal risks aren’t physical things. They aren’t concrete. They are the must unconcrete things imaginable. They’re amorphous, will-o’-the-wisp, black swans: they emerge, coagulating in mid air like suffocating ectoplasms, from nowhere. These are obstreporous phantoms, silently incubating in harmless, dusty corners so dreary we can scarcely bring ourselves to even pay them attention.[3]

In the last twenty years the global finance industry has faced up to some proper, existential threats. It has looked long into the abyss. LTCM. LIBOR. Madoff. Dotcom. Lehman. None of these epochal shit-shows registered more than a faint pulse in the frame of consciousness of the most paranoid risk controller until they happened.

Nor will the next one. Risks happen “when” everyone is looking in another, wrong, direction. Risks happen because everyone is looking in another, wrong direction. So why will everyone be looking in another, wrong direction? BECAUSE THEIR RISK TAXONOMY IS TELLING THEM TO. Their risk taxonomy is that other, wrong direction.

In this way, the risk taxonomy, itself, is the risk. New risks will, by definition, inhibit the seams, cracks and weak joints of your present narrative — they will, post fact, prompt you to change your narrative. They will prompt you to build a new stable around the space where the horse you didn’t even know was there turns out to have been standing, before it bolted.

What to do? Sagely, the general counsel will mandate action to defend against this newly identified risk. “We must”, she will solemnly say, revisit our service catalog. We shall have a new steering committee to oversee that. And an operating committee to implement it. And with sound governance, we shall build a new, stronger, better, risk taxonomy.

See also

References

- ↑ You know who you are.

- ↑ Thomas Kuhn, The Structure of Scientific Revolutions. If you take one book recommendation from the JC, make it this one. Or The Origins of Consciousness in the Breakdown of the Bicameral Mind.

- ↑ Like the BBA’s process for setting the sleepy old London Inter Bank Offered Rate. Anyone remember that old yawnfest?