Client communication

When engaged in the business of one-way customer communications, bear a few things in mind. This applies whether you are a law firm writing client bulletins (or for presenting seminars), or a client outreach team designing mass-mailshots to comply with financial services regulation.

|

Speak it softly: these following principles apply, with like vigour, to customer contracts — you know, actual legal verbiage — but, while true, this is regarded as basically insane, and certainly a bridge too far, by most in the legal community.

Now: even if they are not specifically a damage-limitation exercise, if practice, client communications always are: if you are writing to all of your customers at once, your news is either outright bad — “we’ve screwed something up” — or tedious — “regulations have changed and there is some stuff you need to know, say or do” — or annoying — “there is something we forgot to tell you, or we need to correct in what we’ve already told you”.

If your customers care at all about your letter, they will care a lot less about it than you do. Perhaps they should be, but they won’t be.

So, since your tidings will be somewhere between irrelevant and exasperating, assume that if your customers react at all , being confused by them, being irritated by them, or being confused and irritated by, and therefore ignoring, them.

Your job is to minimise the risk of your customers’ confusion, irritation, and inattention. Here are some rules to help you.

Rule 1: be brief

It ought to go without saying, but it is a truism the modern professional seems unable to grasp: keep it short. Do not use two words when one will do. Do not use one word when none will do. Writing to customers is like flying on the cheapest budget airline in the world, your words are your luggage.

Sub-rule: get to the point

Presume that if a customer starts reading at all, it will stop reading far more quickly than you would. If you expect your client to do something, state it clearly, plainly and above all early in the communication.

| Don’t say | Do say |

|---|---|

|

The original fund status certificate needs to be in place at the Bank before the taxable income event is due to be paid. To avoid delay of certificate recording, customers are reminded to send the fund status certificates to the Bank. |

From 1 July, you must provide us with newly issued WHT certificates before the dividend record date. |

Sub-rule: don’t show your working

Your subject matter experts will understand all the details, and will barely be able to resist regurgitating them all over your letter. Don’t. Say what you need to say, as clearly as you can so that a non-specialist will grasp is straight away, and no more.

| Don’t say | Do say |

|---|---|

| The Upper House of the German Parliament on 28 May 2021 approved the bill pertaining to the modernisation of withholding tax relief procedures (“AbzStEntModG”; Abzugsteuerentlastungsmodernisierungsgesetz), parts of which are due to enter into force on 1 July 2021, especially amendments to the German Investment Tax Act. The bill foresees a change in terms of the relief at source procedure applicable to income payments subject to German withholding tax (for example dividend and taxable interest payments) paid to a foreign investment fund (“beschränkt körperschaftsteuerpflichtiger Investmentfonds”). In this context, newly issued fund status certificates will contain information on the corporation tax status (“Körperschaftsteuerstatus”) of the certified investment fund. Current valid certificates that are already submitted, however, will stay valid according to a letter issued by the Ministry of Finance on 1 June 2021 (BMF – reference GZ: IV C 1 - S 1980-1/19/10027 :006 DOK: 2021/0577184). | On 1 July, Germany changed its rules for claiming withholding tax relief on dividend income. These changes affect non-resident investment funds. |

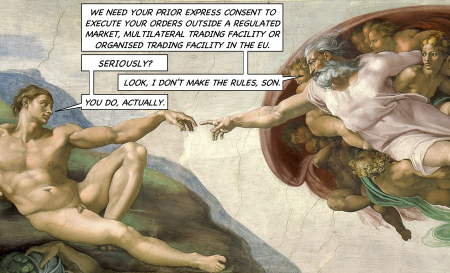

Sub-rule: don’t track regulatory language

It is highly fashionable among legal eagles to “track the language of the legislation” in client communications. This ensures utmost fidelity with the rules. It ensures a writer cannot be blamed for getting it wrong. This is lazy. It is timid. It rejects responsibility and puts it on the customer. It converts your regulatory problem into your customer’s. Your job is to to make your customer’s life easier, not harder. You are meant to internalise the ugliness of your regulatory environment, not to lay it on your client. It is not your client’s problem. It most likely meant to be for your client’s benefit. So: speak only in terms of consequences, and action. Where this points back to regulation, summarise. Extract. Contextualise. Put this in a format the customer can understand and relate to. Be a pr

Rule 2: be clear

Sub-rule: State consequences

Be clear what will happen if the customer doesn’t reply. Don’t be judgmental; just matter of fact.

| Don’t say | Do say |

|---|---|

| In accordance with the above-mentioned bill, any application for the reversal of overpaid tax, via presentation of a fund status certificate with retroactive validity, will no longer be possible via the Bank. Instead, the reclaim must be addressed directly to the Federal Central Tax Office (Bundeszentralamt für Steuern; BZSt). Consequently, as of 1 July 2021 customers providing a fund status certificate for a foreign investment fund after the payment date of the taxable income event cannot be refunded. Full tax must be withheld. The Bank will in turn issue a tax voucher upon customer request. | If you do not, you must file your WHT reclaim directly with the German tax authority. |

Rule 3: be persuasive

To the extent following rules 1 and 2 don’t get you there, remember you are writing with the idea of not just discharging some regulatory obligation to your customer — that’s a second order objective — but to make your customer think well of you. Frame your letter to appeal to your correspondents, so they are more likely to read it.

Remember Robert Cialdini’s six rules of persuasion. Deploy them where you can.

Sub-rule: be personal

Personalise it. don’t say “Dear Client” — don’t ever do that — but address an individual by name, and send from an individual, by name.

Yes, it is a mass mailshot to every customer in the book. But we are in 2021, friends. It is not beyond the wit of technology, anymore to use a freaking mail merge.[1] What’s stopping you? Oh, crappy client static data? Fix your damn client static data. If your salespeople aren’t keeping it up to date, they’re not doing their jobs. Either have good client static data, and use it to demonstrate you care enough about your customer to be justified in calling them “dear” — or don’t, accept your customers to you are a passive herd of cattle there only to be milked, and don’t try to be ingratiating while you do it.

Don’t say “please be advised”. Ever. Just don’t do it. These are your valuable customers, not truculent secondary school children plotting to burn down the staff room.

Sub-rule: be emphatic

say what you mean with strong, active, assertive nouns and verbs. Don’t use weasle words. Avoid “seems to”, “appears to be”, “slightly”, “almost”, “practically”, “virtually”.

Sub-rule: avoid disclaimers

Think first “what will my customer think of me if I say that”, rather than “what if I get it wrong and my customer sues me?” You are a professional. You are good at what you do. Trust yourself not to get it wrong. Disclaimers are like airbags. You only need airbags if you don’t steer straight. Concentrate on defensive driving, not crash mats. If you have to have a disclaimer — and I know, you will have to have one — keep it brief, to the point and put it at the end. If the first thing your customer reads is “Please be advised we take no responsibility for this, we are only doing this because someone said we have to, so on your own head be it”, your customer is going to think, “gee, what a douche”. Generally, that’s not how you want your customer to be thinking now, is it?

- ↑ You thought I was going to say “use neural networks to guess customer names” didn’t you?