Sustainability-linked derivatives

Sustainability-linked derivatives

/səsˌteɪnəˈbɪlɪti lɪŋkt dɪˈrɪvətɪvz/ (n.)

|

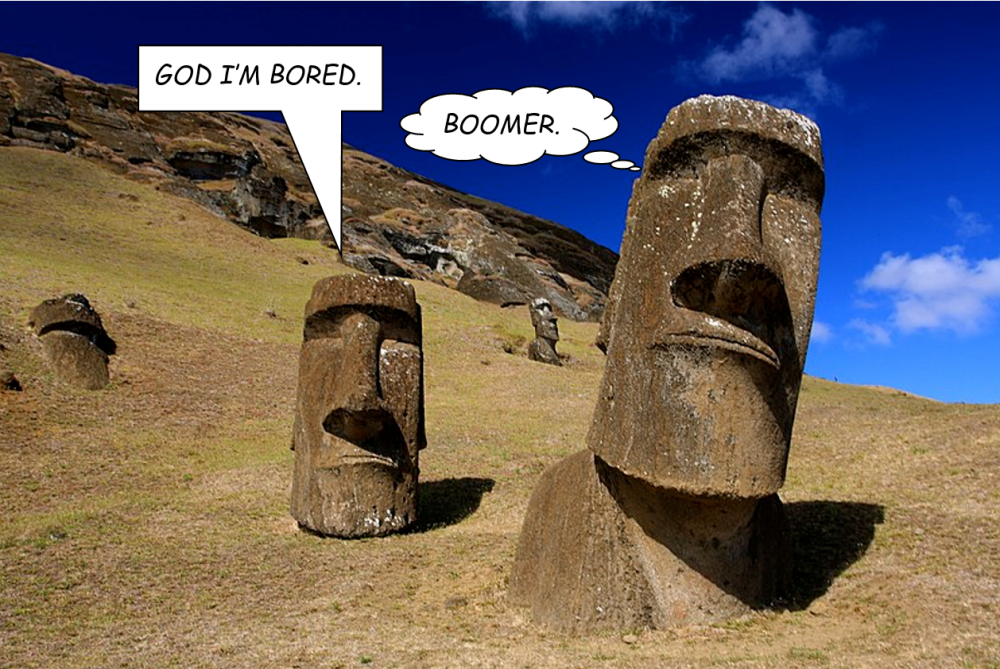

It is said that the ancient people of Easter Island felled every tree on the island while erecting statues to their Gods and ancestors. The root systems decayed, the soil eroded, nutrients washed away, plants did not grow. Eventually the whole ecosystem was wrecked. The island became all but uninhabitable. It has not recovered in 400 years. Nice statues though.

Quite the disaster in the service of trying to please imaginary people.

This “ecocide” theory, popularised by Jared Diamond a generation ago,[1] is out of favour with hand-wringing snowflakey academic types nowadays. ISDA’s council of elders may feel the same way about the JC’s corresponding “swapicide” theory[2] in which a community of earnest toilers, meaning to vouchsafe everyone’s onward prosperity, but caught in the throes of a voguish collective delusion about how everything is different this time sets about demolishing every tree in sight in the pursuut of mad, hypercomplicated, illogical schemes to please imaginary investors who no-one has seen, let alone heard expressing such an interest.

What is ISDA up to? Is It trying to stay relevant? Recent clumsy land-grabs of ICMA/ISLA territory, and forays into crypto give that impression. In any case, the irony that its latest foray into the new normal — “sustainability-linked derivatives” — should so strikingly resemble such a notorious environmental disaster is rich.

And yet, this feels like a step further through the looking glass; a tumble deeper down the rabbit hole. The ’squad’s prior follies at least tried to cater to existing use cases, markets and regulatory imperatives, however cack-handedly.

Sustainability-linked derivatives feel like an attempt to create a new market out if — well — hot air.

How “SLDs” are meant to work

If its own discussion paper is anything to go by, not even ISDA has a clear idea what a sustainability-linked derivative would look like. The best guess is that it would be a sort of plug-in to a normal swap — say an IRS — containing a ratchet device to adjust the parties’ respective spreads dependent on their own compliance (or not) with certain pre-agreed ESG key performance indicators. It is hard to see how this incentivises anything.

Now, objectively measuring environmental impact is hard,[3] and open to abuse even when you aren’t talking your own book. But even so greenwashing risk is the least of the problems here. Higher up the list is basic intellectual incoherence.

For a start, this is not a derivative in any normally understood sense. It is more like an arbitrary penalty clause: a payment derived not from some observable third party indicator, but an internal metric entirely within the counterparty’s gift to game: it knows what targets it can and cannot plausibly meet; its counterparty has — short of due diligence no-one will care to do to execute a rate swap (among other things, it might bugger up your marginal carbon footprint) — no idea at all. If it is a derivative, it is a self-referencing one. They don’t much like those, usually, at ISDA. There is a reason they don’t let athletes bet on games they are playing in.

So this becomes an open invitation to systematic insider dealing on ones own operations. And that is assuming a wily trader stays “long” her own firm’s sustainability performance at all times. But swaps are by their nature bilateral. What is to stop her shorting her own sustainability credentials, incentivising her employer’s transition towards carbon and modern slavery?

And why, exactly, should a counterparty firm’s swaps trader care? What has any of this to do with them? What benefit accrues to the environment when one city swaps desk does, or does not, pay sustainability-linked cash away to another? Why would my counterparties make themselves hostage to my ESG compliance effort? Why should they suffer a penalty just because I have cracked my gender pay gap? (Isn’t there reward enough in just doing that, by the way? What does it say about economic incentives to basically bribe people to promote staff fairly?)

In any case, commerce does not work by gifting emoluments to virtuous strangers just because they recycle shopping bags. Swaps traders certainly don’t. And besides, how are you supposed to hedge that?

The “sustainability” a counterparty should really care about is its counterparties’ solvency. That kind of good corporate governance — and sorry, millennials: the JC is with Milton Friedman on this: that means focus solely on shareholder return — is after all reflected in my credit spreads: how likely does the market regard my bankruptcy.

My brokers will not let me off my credit premiums just because I care about the polar bears. If they don’t get their money back the knowledge that I did my bit for African water scarcity will be cold (wet?) comfort.

This is coded into my spreads when I trade swaps. But once traded, these are not then adjusted during the life of the trade — hence a rich lifetime of employment for credit value adjustment traders. But in any case, my incentive is to manage my business as best I can so that when I trade I achieve the tightest spreads. That is all the incentive the market has needed, until now, to promote sustainability. Hardcore Libtards may differ — we are all libtards now — but nothing has changed.

There is force in the idea that carbon credits are derivatives not so much of environmental damage as much as of regulatory fashion. SLDs aren’t event that. These aren’t even derivative at all. They penalise, and reward, innocent parties.

See also

References

- ↑ Guns, Germs, and Steel: The Fates of Human Societies, Jared Diamond, 1997.

- ↑ Sunk without trace: 2011 ISDA Equity Derivatives Definitions, 2022 ISDA Securities Financing Transactions Definitions, 2023 ISDA Digital Asset Transactions Definitions. Those that did bear fruit were no great scream of exhilarating clarity: the 2014 ISDA Credit Derivatives Definitions, 2016 ISDA Regulatory VM CSAs and 2018 ISDA Regulatory IM CSA being cases in point.

- ↑ Readers are invited to Google it and note how many management consultancies are shilling to help you do it.