Short sale

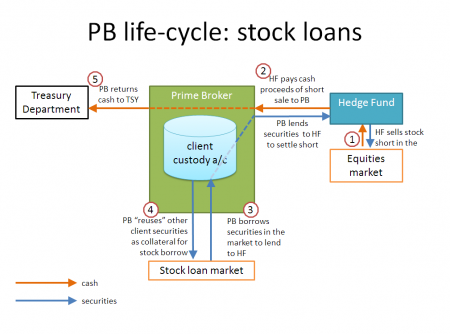

The practice of selling a security you don’t own in the first place, meaning you have negatively correlated exposure to the price of the security. To do this you will need to borrow the stock under a stock loan, and the agreement you will want for that, if you’re in the English speaking world outside America, will be the 2010 GMSLA. Note though that the stock loan isn’t the thing that makes you short, but your sale of the security you’ve just borrowed. Seeing as you have to return it, and you don’t have it, you will have to buy it. Obviously this works best for you if the stock declines in price in the mean time. That’s the point of your trade, see? During that period, you are paying the financing cost of that stock under your stock-loan.

|

GMSLA Anatomy™

“Short selling” as explained to my neighbor Phil

Financial concepts my neighbour Phil was asking about when I borrowed his mower. Index: Click ᐅ to expand:selling_-_layman&action=edit Edit

|

Short selling is risky for you — your losses can be conceptually infinite — and for the issuers of the securities you short sell, especially if they happen to be financial institutions. Therefore this activity is regulated in many jurisdictions, including the EU in their wonderfully entexted EU Short Selling Regulations.

It is risky for the prime broker too

Spare a thought for your much-maligned prime broker. On an ordinary margin loan the prime brokers maximum loss is capped at the value of the the loan: you can only lose what you have given away. This is not so with a stock loan: here the borrower theoretically unlimited exposure to the upside means the prime broker has unlimited second-loss exposure too. That is to say, once it's client is wiped out, the prime broker wears the remainder of the loss.

The unexpected emergence of the GameStop horcrux in early 2021 has undoubtedly provoked pause thought amongst prime brokerage risk managers across the city, especially as regards their margin lock-up arrangements with funds who who like to hang out in crowded shorts.

Other ways of going short

You can achieve a similar effect in a number of ways:

- Synthetic prime brokerage: By taking a short position under a synthetic equity swap or a total return swap

- Selling a credit derivative on an issuer’s reference indebtedness is a reasonably good proxy for a short position.

See also

- GameStop — When the internet explained to the hedge fund community the perils of shorting

- Long

- Prime brokerage transactions

- stock loan

- 2010 GMSLA

- EU Short Selling Regulations