Prime brokerage transactions

|

Prime Brokerage Anatomy™

|

The classic prime brokerage transactions, illustrated in the panel:

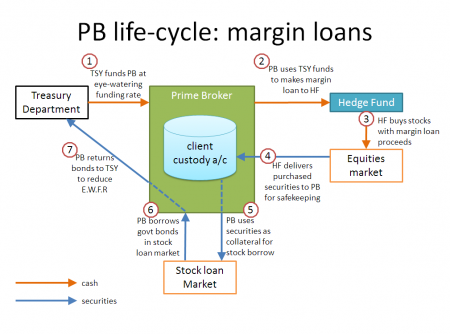

- Physical long: A physical long position financed with a margin loan.

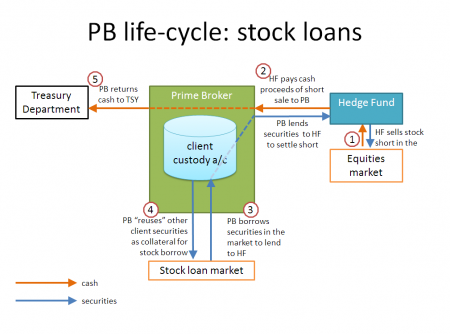

- Physical short: A physical short position created by selling a stock borrowed under a stock loan.

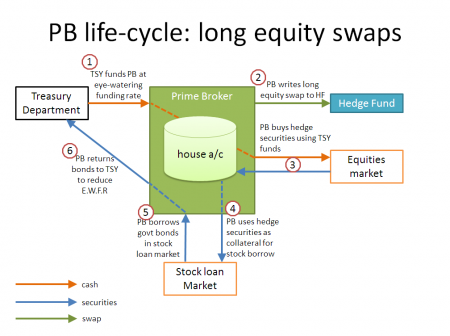

- Synthetic long: A “synthetic” economic equivalent of a physical long position created by entering a “long” equity derivative as a Floating Amount Payer.

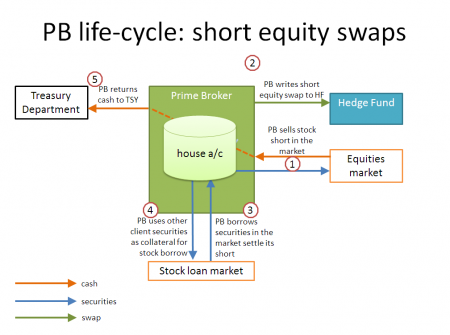

- Synthetic short: A “synthetic” economic equivalent of a physical short position created by entering a “short” equity derivative as a Equity Amount Payer.

The ideas to get your head around are four, and in this order:

Brokerage

The business of getting a broker/dealer, being a chap with excellent connections to the market and access to all the best juicy sources of liquidity, to buy or sell shares for you. This is exactly the same idea as when you sell buy or shares through — er — RobinHood (remember them?) or eToro: all that differs is the scale and volume. You give an order, the broker executes it, you are the proud owner of — or no longer the proud owner of — the shares.

Margin loan

In order to buy that share in the shop window, at which you’ve been gazing longingly each day as you pass on your way to and from work, you want to borrow some money. Good news: your broker — whom we will now call a “prime” broker — will lend you the wedge.

But there’s a catch: first, you have to pony up “margin”, and if the stock drops in value, you’ll have to pony up more —and second, you need to give your new shares to the prime broker so the prime broker can play with them. It does this to offset its costs of lending the money to you in the first place. Don’t fret: it will give them back if you want to sell them.

Short selling

Short selling is a means to anti-investing: it is what you do if you want to bet against the price of a stock rising.

So imagine you want to sell a share, because you think it is rubbish, but you don’t own it. An antediluvian, mall-based, physical retailer of computer games, for example. It’s trading at bugger all, it is unsalvageable, and there is totally risk-free money to be made betting against it.[1] If only you could sell it, but not have to buy it first, you could profit if — ahh, when, right? — the share went down in value. This is like the opposite of investing in a share. What you need is someone who will lend a security they own — this is called a stock loan — that you can then sell. When, as you are certain it will, the share plummets in value, you can buy another one in the market at the new low price, give it back to your friend, and everyone is happy! You will have made a bucket!

That friend is your prime broker. But, again, there is a catch. What if the share goes up in value? Your prime broker will want margin to cover against that risk. The more it goes up, the more you will have to pay. It is amazing how Redditors can make it go up. Mean time your prime broker will make you give it the sale proceeds of the shares to look after for you, as margin, and, to reduce that financing cost. If there turn out to be a lot of people on Reddit — even little, stupid ones who don’t have an MBA and don’t care for the subtleties of market fundamentals or, for that matter, even know there are any — you may find yourself running out of money to post as margin. Your prime broker will not see the funny side of this and you will find yourself living under a bridge while people on Twitter — stupid, misunderstanding people — will make fun of you. Think carefully before betting wildly against the internet.

Equity derivative (aka contract for difference)

Now imagine you wanted to do all the above, but without actually buying or selling any shares at all! Couldn’t you just have a “derivative” or swoppy thing of some sort, that paid you the same amount that you would have got had you bought or shorted the shares? This is known as “synthetic prime brokerage”.

See also

References

- ↑ You will note the ironic tone here, won’t you. Sarcastic, in fact.