Mozambique tuna bonds fiasco: Difference between revisions

Amwelladmin (talk | contribs) m Amwelladmin moved page Mozambique tuna bonds to Mozambique tuna bonds fiasco |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 7: | Line 7: | ||

When the Mozambique government found out what had been going on, in 2016, it assumed the debt admitted the full scale of the borrowing. This triggered an economic meltdown during which Mozambique’s currency lost a third of its value. | When the Mozambique government found out what had been going on, in 2016, it assumed the debt admitted the full scale of the borrowing. This triggered an economic meltdown during which Mozambique’s currency lost a third of its value. | ||

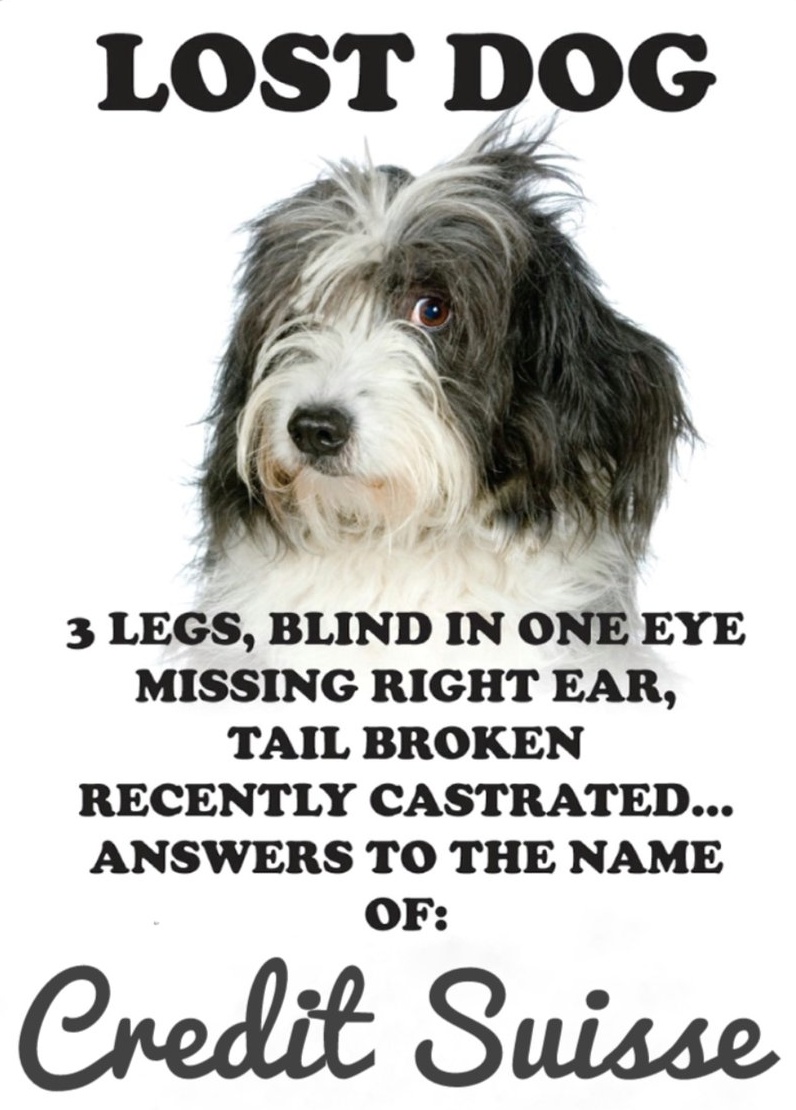

Three ''former'' Credit Suisse bankers copped to US money laundering charges. Credit Suisse was fined nearly £350m by global regulators, itself copped to wire fraud charges, and agreed to forgive hundreds of millions of dollars worth of debt owed by Mozambique in an attempt to draw a line under the long-running “tuna bonds” loan scandal. | Three ''former'' [[Credit Suisse]] bankers copped to US money laundering charges. Credit Suisse was fined nearly £350m by global regulators, itself copped to wire fraud charges, and agreed to forgive hundreds of millions of dollars worth of debt owed by Mozambique in an attempt to draw a line under the long-running “tuna bonds” loan scandal. | ||

Like a pound shop 1MDB, really. | Like a pound-shop [[1MDB]], really. | ||

{{sa}} | {{sa}} | ||

*[[Credit Suisse]] | *[[Credit Suisse]] | ||

*[[Roll of honour]] | *[[Roll of honour]] | ||

Latest revision as of 15:58, 15 June 2023

|

The tuna bonds scandal arose from $1.3bn loans that Credit Suisse arranged for the Republic of Mozambique between 2012 and 2016.

Between 2013-2014, three state-owned companies borrowed $2.2bn from Credit Suisse and VTB, guaranteed by the Republic of Mozambique, but without the the knowledge or approval of the government, purportedly to buy a tuna factory and a maritime security fleet, and to finance other state-owned enterprises.

A portion of the funds — half a yard, by one estimate — vanished. The borrowers had also arranged “significant kickbacks” worth at least $137m, including $50m for bankers at Credit Suisse.

When the Mozambique government found out what had been going on, in 2016, it assumed the debt admitted the full scale of the borrowing. This triggered an economic meltdown during which Mozambique’s currency lost a third of its value.

Three former Credit Suisse bankers copped to US money laundering charges. Credit Suisse was fined nearly £350m by global regulators, itself copped to wire fraud charges, and agreed to forgive hundreds of millions of dollars worth of debt owed by Mozambique in an attempt to draw a line under the long-running “tuna bonds” loan scandal.

Like a pound-shop 1MDB, really.