EFET Allowances Wikitext: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (5 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{EFET Allowance Annex Preamble}} | |||

I. '''General Terms''' <br> | I. '''General Terms''' <br> | ||

{{EFET Allowance Annex 1}} | {{EFET Allowance Annex 1}} | ||

| Line 21: | Line 22: | ||

{{EFET Allowance Annex 20}} | {{EFET Allowance Annex 20}} | ||

{{EFET Allowance Annex 21}} | {{EFET Allowance Annex 21}} | ||

{{EFET Allowances Annex Definitions}} | |||

§ {{efetaprov|1}} '''{{efetaprov|Subject of Allowances Appendix}}''' <br> | § {{efetaprov|1}} '''{{efetaprov|Subject of Allowances Appendix}}''' <br> | ||

| Line 26: | Line 28: | ||

§ {{efetaprov|3}} '''{{efetaprov|Concluding and Confirming Allowance Transactions}}''' <br> | § {{efetaprov|3}} '''{{efetaprov|Concluding and Confirming Allowance Transactions}}''' <br> | ||

§ {{efetaprov|6}} '''{{efetaprov|Delivery, Measurement, Transfer and Risk}}''' <br> | § {{efetaprov|6}} '''{{efetaprov|Delivery, Measurement, Transfer and Risk}}''' <br> | ||

§ {{efetaprov|8}} '''{{efetaprov|Remedies for Failure to Transfer or Accept}}''' <br> | § {{efetaprov|8}} '''{{efetaprov|Remedies for Failure to Transfer or Accept}}''' <br> | ||

§ {{efetaprov|9}} '''{{efetaprov|Suspension of Delivery}}''' {{as per efet}} <br> | § {{efetaprov|9}} '''{{efetaprov|Suspension of Delivery}}''' {{as per efet}} <br> | ||

| Line 44: | Line 46: | ||

§ {{efetaprov|21}} '''{{efetaprov|Representation and Warranties}}''' <br> | § {{efetaprov|21}} '''{{efetaprov|Representation and Warranties}}''' <br> | ||

§ {{efetaprov|22}} '''{{efetaprov|Governing Law and Arbitration}}''' <br> | § {{efetaprov|22}} '''{{efetaprov|Governing Law and Arbitration}}''' <br> | ||

II: '''Elections for customization of provisions in the Allowances Appendix''' | II: '''Elections for customization of provisions in the Allowances Appendix''' <br> | ||

{{efetaprov|Annex 1}} to the Allowances Appendix: {{efetaprov|Defined Terms}} | |||

Latest revision as of 14:42, 12 September 2023

to the

Applicability of Allowances Appendix. This Allowances Appendix to the General Agreement (inclusive of this Allowances Appendix’s Annexes) modifies, supplements and amends, to the extent set forth herein, certain provisions of the General Agreement (which, pursuant to § 1.1 of the General Agreement, includes its Annexes and Election Sheet) and shall only apply to and govern all Individual Contracts entered into by the Parties for and concerning the Transfer and acceptance of Transfer of Allowances (each such Individual Contract an “Allowance Transaction”, and collectively, the “Allowance Transactions”) save as expressly provided to the contrary with respect to any Section or Sections of the General Agreement or this Allowances Appendix. Any and all future Individual Contracts between the Parties that constitute Allowance Transactions specifying the Fourth Compliance Period as the applicable Compliance Period shall be automatically subject to the General Agreement, as it is modified, supplemented and amended by its Annexes, Election Sheet and this Allowances Appendix, without any further action by the Parties, unless the agreed upon terms of such Individual Contract expressly provide that it shall not be. For all other types of Individual Contracts, the General Agreement shall remain unchanged. The provisions of the General Agreement are hereby modified, supplemented and amended (except as expressly noted to the contrary herein) only in respect of such Allowance Transactions in accordance with the following:

I. General Terms

1 Subject of Allowances Appendix

The EU and the Member States as well as some Non-Member States plan to establish or have established Rules under which participants may trade Allowances. The purpose of this Allowances Appendix is to modify certain provisions of the General Agreement in order that its terms facilitate the entering into Allowance Transactions between the Parties that include, but are not limited to, forward, spot and swap transactions. In addition to the provisions of the General Agreement, the provisions of this Allowances Appendix shall therefore be applicable to Allowance Transactions between participants of Emissions Trading Scheme(s in Member States and, with certain modifications, between participants in Member States and Non-Member States.

2 Definitions and Construction

Capitalised terms used but not defined in this Allowances Appendix shall have the meanings as set out in Annex 1 to this Allowances Appendix and otherwise as ascribed to them in either this Allowances Appendix or the General Agreement. In the event of any inconsistency between definitions found in this Allowances Appendix and in the General Agreement, this Allowances Appendix’s definitions will prevail for purposes of all Allowance

Transactions. All references to “Electricity”, “Network Operator” and “Transmission” or “flows” in the General Agreement shall, in the context of Allowance Transactions, be construed as references to, respectively, “Allowances”, “Relevant Authority”, and “Transfer(s)”. References to a Section (§) or Sections (§§) in this Allowances Appendix shall be references to a Section or Sections in the General Agreement unless otherwise stated. In the event of any inconsistency between the terms of an Allowance Transaction (whether evidenced in a Confirmation or otherwise) and the provisions of either this Allowances Appendix or the General Agreement (as amended by this Allowances Appendix), the terms of the Allowance Transaction shall prevail for the purpose of that Allowance Transaction. References to any law or statute include any amendment to, consolidation, re-enactment or replacement of such law or statute.

3 Concluding and Confirming Allowance Transactions. All Allowance Transactions that are forward transactions shall contain the information stipulated in, and, if confirmed with a Confirmation, shall be substantially in the form of the sample confirmation sheet attached as Annex 2(A) to this Allowances Appendix or, with respect to other types of transactions, in such other form as the Parties may agree.

§ 4 Primary Obligations for Delivery and Acceptance of Allowances. For the purpose of Allowance Transactions, § 4 of the General Agreement is hereby amended by: (i) deletion of § 4.1 (Delivery and Acceptance) in its entirety and replacement with the new § 4.1 (Delivery and Acceptance and Scheduling Obligations) below; (ii) additions to the definition of “Schedule” found in § 4.2 (Definition of Schedule); (iii) the addition of a new § 4.3 (Physical Settlement Netting); and (iv) the addition of a new § 4.4 (Payment for Allowances) as follows:

- § 4.1 Delivery, Acceptance and Scheduling Obligations.

- (a) Seller shall Schedule, sell and Transfer to Buyer, or, if applicable in accordance with the relevant provision of § 4.1(a)(i) and 4.1(a)(ii), cause to be Transferred, and Buyer shall Schedule, purchase and accept Transfer of, or, if applicable in accordance with the relevant provision of § 4.1(a)(i) and 4.1(a)(ii), cause such Transfer to be accepted, the Contract Quantity at the Delivery Point, and the Buyer shall pay to the Seller the relevant Contract Price. Unless the Parties otherwise agree, the Seller shall Transfer the Contract Quantity at the Delivery Point during a Delivery Business Day between the hours of 10:00 a.m. and 4:00 p.m. CET and any Transfer taking place at a time after 4:00 p.m. CET on a Delivery Business Day shall be deemed to have taken place at 10:00 a.m. CET on the next Delivery Business Day.

- (i) For any Allowance Transaction in which no Transfer Point has been specified by the Seller, the Seller shall Transfer, or cause the Transfer of, the Contract Quantity to the Delivery Point from any Holding Account in any Registry.

- (ii) Parties may limit the scope of their Transfer and acceptance of Transfer obligations by designating one or more specific Delivery Points and/or Transfer Points for any Allowance Transaction:

- A. If one or more Delivery Points are specified by the Parties in respect of an Allowance Transaction, the Seller’s obligations shall be limited to the obligation to Schedule, sell and Transfer to Buyer, or cause to be so Transferred, and the Buyers’s obligations shall be limited to the obligation to Schedule, purchase and accept Transfer of, the Contract Quantity at the Delivery Point(s) so specified.

- B. If one or more Transfer Points are specified by the Seller in respect of an Allowance Transaction, the Seller’s obligations shall be limited to the obligation to Schedule, sell and Transfer to Buyer and the Buyer’s obligations shall be limited to the obligation to Schedule, purchase and accept Transfer of, or cause to be accepted such Transfer of, the Contract Quantity from the Transfer Point(s) so specified.

- C. Where a Party, in its capacity as Buyer, has specified one or more Delivery Point(s), the other Party will, without delay, nominate each such Holding Account(s) specified by the Buyer as a 'trusted account' (for the purposes of the Registries Regulation) for each of its own Transfer Points.

- (b) Where the Parties have agreed upon a list of multiple Delivery Points and/or multiple Transfer Points for an Allowance Transaction:

- (i) the Delivery Points so specified shall be deemed to be listed in descending order of preference such that the Delivery Point for the Allowance Transaction shall be the first Holding Account so listed, unless the Seller is prevented from Transferring to that Delivery Point by an event which would be either an event of Force Majeure or a Suspension Event if that were the only Delivery Point specified by the Party affected by the event, in which case the Delivery Point shall be the next listed Delivery Point that can accept Transfer of Allowances, until such list of Delivery Points has been exhausted; and

- (ii) Seller shall have discretion to Transfer to Buyer the Contract Quantity on the Delivery Date from any one or more of the Holding Accounts which have been specified as Transfer Points in respect of Seller; provided, however, that where the Seller is prevented from Transferring from a Transfer Point by an event which would be either an event of Force Majeure or a Suspension Event if that were the only Transfer Point specified by the Party affected by the event, the Seller shall select another listed Transfer Point from which to Transfer the Contract Quantity to the Buyer on the Delivery Date, until such list of Transfer Points has been exhausted;

- (c) Where the Parties have agreed upon a list of multiple Transfer Points and/or Delivery Points for an Allowance Transaction:

- (i) Buyer may later:

- A. amend the order of preference in which the Delivery Points are listed; and/or

- B. nominate an additional Delivery Point;

- provided that, in each case, Buyer notifies Seller no less than thirty (30) calendar days prior to the relevant Delivery Date and Seller consents thereto in writing on or before the day that is five (5) Delivery Business Days after receiving such notice from Buyer; and

- (ii) Seller may later:

- A. nominate an additional Transfer Point without Buyer’s consent provided that Seller notifies Buyer of such nomination in writing on or before the day that is ten (10) Delivery Business Days prior to the relevant Delivery Date.

- (i) Buyer may later:

- (d) For the avoidance of doubt, specifying Delivery Point(s) and/or Transfer Point(s) in respect of any particular Allowance Transaction for purposes of this § 4.1 need not preclude the Parties from designating different Holding Accounts than the Physical Settlement Netting Accounts specified for the purposes of § 4.3 (Physical Settlement Netting) in Part II of this Allowances Appendix.

- (a) Seller shall Schedule, sell and Transfer to Buyer, or, if applicable in accordance with the relevant provision of § 4.1(a)(i) and 4.1(a)(ii), cause to be Transferred, and Buyer shall Schedule, purchase and accept Transfer of, or, if applicable in accordance with the relevant provision of § 4.1(a)(i) and 4.1(a)(ii), cause such Transfer to be accepted, the Contract Quantity at the Delivery Point, and the Buyer shall pay to the Seller the relevant Contract Price. Unless the Parties otherwise agree, the Seller shall Transfer the Contract Quantity at the Delivery Point during a Delivery Business Day between the hours of 10:00 a.m. and 4:00 p.m. CET and any Transfer taking place at a time after 4:00 p.m. CET on a Delivery Business Day shall be deemed to have taken place at 10:00 a.m. CET on the next Delivery Business Day.

- § 4.2 Definition of Schedule. The following words are added to the end of the last sentence of § 4.2 (Definition of Schedule): “For the purposes of Allowance Transactions, the definition of Schedule shall include, in accordance with Applicable Rules, those actions necessary for Parties to comply with all obligations and requirements contained in the Applicable Rules, including, without limitation, the standards of the relevant Emission Trading Scheme(s) and Registry requirements in order to ensure that all their respective Holding Accounts are properly established, and that all of their respective applicable requirements for effecting Transfer from Seller to Buyer at the applicable Delivery Point are met. The Parties acknowledge and agree that customary industry practices shall include, to the extent it has not already done so, each Party notifying the other at least thirty (30) calendar days prior to the Delivery Date of its Holding Account(s), (including account number details in a specified Registry) for, as applicable, its designated Transfer Point(s) or Delivery Point(s).”

- § 4.3 Physical Settlement Netting

- (a) If this § 4.3 is specified as applying in Part II of this Allowances Appendix; if on any date Allowances of the same Allowance Type and Compliance Period would otherwise be Transferable in respect of two or more Allowance Transactions between the Parties and between designated pairs of Holding Accounts specified as applying in Part II of this Allowances Appendix or otherwise agreed between the Parties (the “Physical Settlement Netting Accounts”), then, on such date, each Party’s obligation to Schedule and Transfer any such Allowances will be automatically satisfied and discharged and, if the aggregate number of Allowances that would otherwise have been Transferable by one Party exceeds the aggregate number of Allowances that would otherwise have been Transferable by the other Party, replaced by an obligation upon the Party from whom the larger aggregate number of Allowances would have been Transferable to Schedule and Transfer to the other Party a number of Allowances (of the same Allowance Type and Compliance Period) equal to the excess of the larger aggregate number of Allowances over the smaller aggregate number of Allowances (the “Net Contract Quantity”) (such process hereinafter referred to as “Physical Settlement Netting”). In such circumstances the Party Transferring the Net Contract Quantity shall be the “Net Seller” and the Party receiving the Net Contract Quantity shall be the “Net Buyer”. In instances where the Net Contract Quantity for a given date and Delivery Point is zero, the Parties shall be released from any obligation to Schedule and Transfer or accept such Transfer in respect of the applicable Allowance Transactions on such date. For the avoidance of doubt and subject to this § 4.3, the Parties fully intend at the time of entering into each Individual Contract that such Individual Contract will result in the physical Transfer of Allowances.

- (b) Unless otherwise provided, if there is more than one Allowance Transaction between the Parties providing for Transfer of Allowances of the same Allowance Type and Compliance Period at the same Delivery Point on the same date, all references in the General Agreement, this Allowances Appendix and an Individual Contract to a “Seller”, “Buyer”, “Contract Quantity” and “Individual Contract” shall be deemed to be references to, respectively, a “Net Seller”, a “Net Buyer”, a “Net Contract Quantity” and to all such Individual Contracts.

- (c) For the avoidance of doubt, specifying Physical Settlement Netting Accounts under this § 4.3 (Physical Settlement Netting) need not preclude the Parties from designating Delivery Point(s) and/or Transfer Points under § 4.1 (Delivery, Acceptance and Scheduling Obligations) nor is it intended to prohibit the Parties from limiting their rights and obligations in respect of any particular Allowance Transaction to Transfer and accept Transfer of Allowances in accordance with § 4.1.

- § 4.4 Payment for Allowances. In respect of each Individual Contract, the Buyer shall pay the Seller for the Delivered Quantity in accordance with the provisions of § 13 (Invoicing and Payment).

§ 5 Primary Obligations for Options

Except to the extent otherwise modified herein, there shall be no change to § 5 (Primary Obligations for Options) of the General Agreement with respect to Allowance Transactions.

6 Delivery, Measurement, Transfer and Risk

For purposes of Allowance Transactions, § 6 of the General Agreement is hereby amended by the deletion in their entirety of § 6.1 (Current/Frequency/Voltages), § 6.3 (Transfer of Rights of Title), and § 6.7 (Seller and Buyer Risks) and their replacement with the new § 6.1 (Compliance Period/Contract Quantity/Holding Account), the new §6.3 (No Encumbrances) and the new § 6.7 (Seller and Buyer Risks) below:

- § 6.1 Compliance Period/Contract Quantity/Holding Account: Allowances shall be Transferred in the Compliance Period and Contract Quantity and to the relevant Delivery Point in accordance with the Delivery Schedule agreed in the Allowance Transaction and in accordance with the Applicable Rule(s), including, without limitation, the standards of the relevant Emissions Trading Scheme and Registry responsible for the Delivery Point on the relevant Delivery Date. A Transfer shall be considered to be completed for the purposes of this Allowances Appendix when the Allowances are received at the relevant Delivery Point, whereupon risk of loss related to the Allowances or any portion of them passes from the Seller to the Buyer.

- § 6.2 as for EFET General Agreement

- § 6.3 No Encumbrances. In respect of each Allowance Transaction and at each Delivery Date, the Seller shall Transfer to the Buyer at the Delivery Point, Allowances free and clear of any liens, security interests, encumbrances or similar adverse claims by any person (the “No Encumbrance Obligation”). Where a Party is in breach of the No Encumbrance Obligation, the following shall apply:

- (a) The General Agreement and all other Individual Contracts agreed by the Parties under this General Agreement shall continue unaffected; and

- (b) Without prejudice to any defences available to the Seller (including, but not limited to, any defences of statutes of limitation or similar), following written notice of that breach from the Buyer to the Seller (irrespective of how long after the relevant Delivery Date such notice is provided) and subject to §6.3(d) below:

- (i) the Buyer shall determine the Encumbrance Loss arising from that breach (the “Encumbrance Loss Amount”) either on the date such notice is deemed to be received or as soon as reasonably practicable thereafter; and

- (ii) shall notify the Seller of such Encumbrance Loss Amount due, including detailed support for its calculation.

- The Buyer is not required to enter into replacement Individual Contracts in order to determine the Encumbrance Loss Amount.

- (c) By no later than the third (3rd) Business Day after the later of (i) receipt of a valid invoice in connection with such Encumbrance Loss Amount and (ii) receipt of the above-mentioned notice of detailed support of the Buyer's calculation of the Encumbrance Loss Amount, the Seller shall pay the Encumbrance Loss Amount to the Buyer, which amount shall bear interest in accordance with § 13.5 (Default Interest). Upon payment of the Encumbrance Loss Amount by the Seller, the Parties shall have no further obligations in respect of that Individual Contract and that breach. The Buyer acknowledges that its exclusive remedies in respect of such breach are those set out in this § 6.3.

- (d) Where a breach of the No Encumbrances Obligation is caused by the Transfer of an Affected Allowance, the Seller shall be liable for the Encumbrance Loss Amount if, at the date it first acquired, received or purchased such Affected Allowance, it was not acting in good faith; otherwise, the Seller shall only be liable for the Encumbrance Loss Amount (without prejudice to any other defences available to the Seller including, but not limited to, any defences of statutes of limitation or similar), if:

- (i) the Buyer, whether or not the holder of such Affected Allowance, who is subject to a claim of the Original Affected Party, has, in order to resist or avoid any Encumbrance Loss Amount from arising, used its best endeavours to defend such a claim in respect of that Affected Allowance (including, if available, by relying on Article 40 of the Registries Regulation or any equivalent legal principle under applicable national law) and was unsuccessful (other than for reasons of its own lack of good faith); or

- (ii) the Buyer, whether or not the holder of such Affected Allowance, who acted in good faith in respect of its purchase of such Affected Allowance and who is subject to a claim of a third party (other than the Original Affected Party) in respect of that Affected Allowance, has used all reasonable endeavours to mitigate the Encumbrance Loss Amount.

- § 6.4 as for EFET General Agreement

- § 6.5 as for EFET General Agreement

- § 6.6 as for EFET General Agreement

- § 6.7 Seller and Buyer Risks. Subject to § 8 (Remedies for Failure to Transfer or Accept), in respect of each Individual Contract, the Buyer and Seller shall, unless otherwise expressly agreed between them, each bear all risks associated with and shall be responsible for its own respective costs in performing its obligations under § 4 (Primary Obligations For Delivery and Acceptance of Allowances). Further, absent express agreement to the contrary between Buyer and Seller, all costs, fees and charges assessed or imposed by Relevant Authorities shall be the responsibility of the Party upon whom such cost, fee or charge is allocated by the Relevant Authority.

§ 7 Non-Performance Due to Force Majeure and Suspension Event

For purposes of Allowance Transactions, § 7 of the General Agreement is hereby deleted in its entirety and replaced with the following new § 7 (Non-Performance due to Force Majeure and Suspension Event):

§ 7.1 Definition of Force Majeure. “Force Majeure” in the context of an Allowance Transaction means the occurrence of an event or circumstance beyond the control of the Party affected by Force Majeure (the “Affected Party”) that cannot, after using all reasonable efforts, be overcome and which makes it impossible for the Affected Party to perform its Transfer or acceptance of Transfer obligations in accordance with the terms of this Agreement and the relevant Emissions Trading Scheme. For the avoidance of doubt, but without limitation, Force Majeure shall not include an event or circumstance where there are insufficient Allowances in the relevant Holding Account(s) to effect the required Transfer, whether that insufficiency is caused by the low or non-allocation of Allowances from a Member State or a Non-Member State, the delay or failure of a Member State or Central Administrator to replace Allowances of the Third Compliance Period with Allowances for the Fourth Compliance Period or the failure of that Party to procure sufficient Allowances to meet its Transfer obligations. If an event or circumstance which would otherwise constitute or give rise to Force Majeure also constitutes a Suspension Event, it will be treated as a Suspension Event and will not constitute a Force Majeure event.

§ 7.2 Suspension of Delivery and Acceptance Obligations. If a Party is fully or partly prevented due to Force Majeure from performing its obligations of Transfer or acceptance of Transfer, as applicable, under one or more Allowance Transactions, no breach or default on the part of the Affected Party shall be deemed to have occurred and the obligations of both Parties with respect to the relevant Allowance Transaction(s) will be suspended for the period of time and to the extent that such Force Majeure prevents their performance. During the continuation of Force Majeure, the Affected Party shall continue to use all reasonable endeavours to overcome the Force Majeure. Subject to § 7.4 (Settlement of Allowance Transaction Prevented by Force Majeure) below, upon the Force Majeure event being overcome or it ceasing to subsist, both Parties will, as soon as reasonably practicable thereafter (and in any event no later than the second Delivery Business Day following the cessation or Parties overcoming such Force Majeure event), resume full performance of their obligations under the Agreement in respect of the relevant Allowance Transaction(s) (including, For the avoidance of doubt, any suspended obligations).

§ 7.3 Notification and Mitigation of Force Majeure. The first Party learning of the occurrence of an event of Force Majeure shall, as soon as practicable, notify the other Party of the commencement of Force Majeure. Each Party shall then undertake in good faith to determine, and notify the other Party with, to the extent then available, a non-binding estimate of the extent and expected duration of the Force Majeure event and its impact on performance of all Allowance Transaction(s) affected by the event of Force Majeure. The Affected Party shall use all commercially reasonable efforts to mitigate the effects of Force Majeure and shall, during the continuation of Force Majeure, provide the other Party with reasonable updates, when and if available, of the extent and expected duration of its inability to perform.

§ 7.4 Settlement of Allowance Transaction Prevented by Force Majeure.

- (a) Termination for Force Majeure. Where Force Majeure continues for a period of time ending on the earlier to occur of: (a) a period of nine (9) Delivery Business Days from the date that, but for Force Majeure, would have been the Delivery Date of the relevant Allowance Transaction(s); (b) the Reconciliation Deadline; or (c) the day which falls three (3) Delivery Business Days prior to the End of Phase Reconciliation Deadline, either Party may, by written notice to the other Party, terminate all (but not less than all) of the Allowance Transaction(s) affected by Force Majeure.

- (b) Force Majeure Termination Payment. In the event and to the extent that an Allowance Transaction is terminated in accordance with § 7.4(a), the Parties’ corresponding Transfer and acceptance of Transfer obligations under the terminated Allowance Transaction(s) shall be released and discharged. By specifying in Part II of this Allowances Appendix which of the following subparagraphs (i), (ii) or (iii) they wish to be operative, the Parties shall designate the consequences that will follow as a result of the Force Majeure event and what, if any, rights and obligations they wish to apply between them in the event of termination of an Allowance Transaction due to Force Majeure:

- (i) No Termination Payment. No Termination Payment or other financial settlement obligation shall be applicable (other than, For the avoidance of doubt, payment for any Allowances Transferred under such Allowance Transaction which were not prevented due to Force Majeure and/or payment of any damages due for non-performance of any portion of the terminated Allowance Transaction not excused due to Force Majeure (hereinafter collectively, “Unpaid Amounts”) and each Party shall be permanently released and discharged of any further obligations with respect to the Allowance Transaction terminated by reason of Force Majeure.

- (ii) Two-Way Market Quotation Termination Payment. Each Party shall obtain three (3) mid-market quotations from Dealers for replacement Allowance Transaction(s) on the same terms as the unperformed portion(s) of the relevant Allowance Transaction(s) affected by Force Majeure (without taking into account the current credit-worthiness of the requesting Party or any Credit Support Documents or other Performance Assurance between the Parties). Each Party will then calculate the average of the quotations it obtained and the amount payable shall be equal to: (A) the sum of (i) one half of the difference between the higher amount determined by one Party (“X”) and the lower amount determined by the other Party (“Y”) and (ii) any Unpaid Amounts owing to X; less (B) any Unpaid Amounts owing to Y. If the resultant amount is a positive number, Y shall pay it to X; if it is a negative number, X shall pay the absolute value of such amount to Y. If the three (3) mid-market quotations cannot be obtained, all quotations will be deemed to be zero (0) and no payment shall be due in respect of the termination of such Allowance Transaction.

- (iii) Two-Way Loss Termination Payment. Each Party will determine its Loss in respect of the relevant Allowance Transaction(s) and an amount will be payable equal to one half of the difference between the Loss of the Party with the higher Loss (“X”) and the Loss of the Party with the lower Loss (“Y”). If the amount payable is a positive number, Y will pay it to X; if it is a negative number, X will pay the absolute value of such amount to Y.

- Payments due under this § 7.4(b) shall, unless otherwise agreed, be invoiced and made in accordance with the requirements of the Payment Cycle selected by the Parties in respect of § 13.2 (Payment).

- (a) Definition of Suspension Event. “Suspension Event) means the occurrence of any of the following events which makes it impossible for a Party affected by the Suspension Event (the “SE Affected Party”) to perform its Transfer or acceptance of Transfer obligations in accordance with the terms of the Allowance Transaction and the relevant Emissions Trading Scheme, through a Relevant Registry:

- (i) absence of Registry Operation; or

- (ii) the occurrence of an Administrator Event.

- (b) Suspension of Delivery and Acceptance Obligations. If a Party is prevented due to a Suspension Event from performing its obligations of Transfer or acceptance of Transfer, as applicable , under an Allowance Transaction (the “SE Affected Transaction), no breach or default on the part of the SE Affected Party shall be deemed to have occurred and the obligations of both Parties with respect to the Allowance Transaction affected by the Suspension Event will be suspended for the duration of the Suspension Event and, subject to § 7.5(e) (Settlement of Allowance Transaction Prevented by Suspension Event) below, will not be required to be performed until the day that is ten (10) Delivery Business Days after the Suspension Event is overcome or ceases to subsist (the “Delayed Delivery Date). Subject to § 7.5(e) (Settlement of Allowance Transaction Prevented by Suspension Event) below, upon the Suspension Event being overcome or ceasing to subsist, both Parties will resume full performance of their obligations (including, For the avoidance of doubt, any suspended obligations) under the Agreement in respect of the relevant Allowance Transaction.

- (c) Notification and Mitigation of Suspension Event. The first Party learning of the occurrence of a Suspension Event shall, as soon as practicable, notify the other Party of the commencement of the Suspension Event. Each Party shall then undertake in good faith to determine, and notify the other Party with, to the extent then available, a non-binding estimate of the extent and expected duration of the Suspension Event and its impact on performance of all Allowance Transactions affected by the Suspension Event. The SE Affected Party shall use all commercially reasonable efforts to mitigate the effects of the Suspension Event and shall, during the continuation of the Suspension Event, provide the other Party with reasonable updates, when and if available, of the extent and expected duration of its inability to perform. Each Party agrees in good faith to immediately notify the other Party once the Suspension Event is overcome or ceases to subsist.

- (d) Cost of Carry on Delayed Deliveries. In the event that all or part of the Contract Quantity of a SE Affected Transaction is Transferred to Buyer on or before the Delayed Delivery Date, Buyer shall pay to Seller an additional amount (the “Cost of Carry Amount”) calculated at the Cost of Carry Rate for the Cost of Carry Calculation Period on the product of the number of Allowances so Transferred and the Contract Price for the relevant Allowance Transaction, divided by three hundred and sixty (360). Such Cost of Carry Amount shall be identified in the relevant invoice.

- (e) Settlement of Allowance Transaction Prevented by Suspension Event. Where a Suspension Event for a SE Affected Transaction continues to exist on the applicable Long Stop Date, the SE Affected Transaction shall be deemed an Allowance Transaction affected by Force Majeure and either Party may, by written notice to the other Party, terminate all (but not less than all) of the SE Affected Allowance Transaction(s) in accordance with § 7.4(b) (Force Majeure Termination Payment) of the Allowances Appendix and in such instance § 7.4(b)(i) (No Termination Payment) shall apply.

8 Remedies for Failure to Transfer or Accept. For purposes of Allowance Transactions, § 8 of the General Agreement is hereby deleted in its entirety and replaced with the following new § 8 (Remedies for Failure to Transfer or Accept):

- (a) Two Business Days Grace Period. When the Seller fails to Transfer to the Buyer the Contract Quantity, in whole or in part, on a Delivery Date as required in accordance with the terms of an Allowance Transaction, and such failure is not excused by an event of Force Majeure, Suspension Event or the Buyer’s non-performance, the Seller may remedy such failure by Scheduling and Transferring such Contract Quantity (or undelivered portion thereof) to the Buyer on the second Delivery Business Day following the Delivery Date, provided that such day is not on or after the Reconciliation Deadline following the relevant Delivery Date, and further subject to the additional obligation of the Seller to pay the Buyer, as compensation for its late Transfer, interest calculated: (i) as follows for the two Delivery Business Day grace period; and (ii) as set forth in the applicable subpart of this § 8.1 for any longer period the Seller fails to deliver the Allowances thereafter.

- Interest for the two Delivery Business Day grace period shall accrue at the Interest Rate specified in § 13.5 (Default Interest) for the period from (and including) the Delivery Date to (but excluding) the second Delivery Business Day following the Delivery Date on the Total Contract Price of the undelivered Allowances, such Total Contract Price calculated as follows: the number of undelivered Allowances multiplied by a fraction determined by dividing the Total Contract Price[1] by the Contract Quantity.

- (b) Buyer’s Cover Costs. In the event that the Seller fails to Transfer to the Buyer all or any portion of a Contract Quantity as required by § 8.1(a) (Two Business Days Grace Period) in accordance with the terms of an Allowance Transaction and the Buyer has not agreed to a Deferred Delivery Date as provided for in § 8.1(c) (Buyer’s Right to Waive Its Cover Costs), the Seller shall incur the obligation to pay the Buyer, as compensation for its failure to Transfer, an amount (hereinafter “Buyer’s Cover Costs”) equal to either:

- (i) if no EEP or EEP Equivalent is operative or applicable to the Allowance Transaction, the sum of:

- (A) the price, if any, in excess of the portion of the Total Contract Price applicable to the Allowances not Transferred to the Buyer by the Seller, which the Buyer, acting in a commercially reasonable manner either did, or would have been able to, pay to purchase or otherwise acquire in an arm’s length transaction from a third party or parties, a quantity of Allowances necessary to replace the Allowances not Transferred by the Seller;

- (B) such reasonable additional incidental costs as the Buyer incurred in attempting to make or making such replacement purchase of Allowances to the extent those costs and expenses are not recovered in § 8.1(b)(i)(A) above; and

- (C) interest accrued during the two Delivery Business Day grace period as provided in §8.1(a); plus interest, at the Interest Rate specified in § 13.5 (Default Interest), accrued from (and including) the Delivery Business Date following the Delivery Date, to (but excluding) the receipt by the Buyer of damages for the Seller’s failure to Transfer, such amount calculated using the following formula:

- Amount on which interest accrues = UA x [(RP – CP)]

- where:

- UA means undelivered Allowances, the total number of Allowances the Seller failed to deliver;

- RP means replacement price, the price the Buyer paid (or, if it could have procured replacement Allowances but did not do so, the first price which the Buyer would have been able to pay) for each replacement Allowance in the UA; and

- CP means the aggregate Contract Price that the Buyer would have been required to pay to the Seller for all undelivered Allowances comprising the UA had the Seller not defaulted on its delivery obligation; or

- where:

- (ii) if an EEP or EEP Equivalent has been made applicable to the Allowance Transaction and has arisen, and further subject to the fulfillment of all applicable requirements imposed in § 8.3 (EEP and EEP Equivalent), the amount calculated using the following formula:

- (A) the price at which the Buyer, using reasonable endeavours and in (an) arm’s length transaction(s), is or would be able to purchase, as soon as reasonably possible following the Reconciliation Deadline, replacement Allowances in the quantity of those not delivered to it by the Seller (such quantity reduced, if applicable, by the number of Allowances the Buyer was able to purchase prior to the Reconciliation Deadline as contemplated by § 8.1(b)(i), damages for the cost of which being recoverable pursuant to element (G) of this formula, herein below)(the net resulting number of Allowances corresponding to the, as applicable, EEP or EEP Equivalent, being referred to hereinafter as the “Undelivered EEP Amount” or “UEA”);

- (ii) if an EEP or EEP Equivalent has been made applicable to the Allowance Transaction and has arisen, and further subject to the fulfillment of all applicable requirements imposed in § 8.3 (EEP and EEP Equivalent), the amount calculated using the following formula:

- (B) minus the price that the Buyer would have been required to pay the Seller for those Allowances comprising the UEA, had the Seller delivered those Allowances to the Buyer in accordance with the terms of the Allowance Transaction;

- (C) plus the amount of, as applicable, the EEP or EEP Equivalent on the UEA;

- (D) plus interest accrued during the two Delivery Business Day grace period, calculated as provided in § 8.1(a);

- (E) plus interest, at the Interest Rate specified in § 13.5 (Default Interest), accrued from (and including) the first date on which the Buyer would be able to purchase, following the Reconciliation Deadline, the UEA of next Compliance Year replacement Allowances, to (but excluding) the date of the Buyer’s receipt of damages for the Seller’s failure to Transfer, on the amount determined using the following formula:

- REP means the Replacement EEP Price, which shall be the (per Allowance) price of next Compliance Year Allowances calculated pursuant to § 8.1(b)(ii)(A), above; and

- CP means the per Allowance Contract Price that the Buyer would have been required to pay to the Seller for each undelivered Allowances comprising the UEA had the Seller not defaulted on its delivery obligation;

- (F) plus such reasonable additional incidental costs as the Buyer incurred in, as applicable, both attempting unsuccessfully to make purchase of replacement Allowances in order to avoid the accrual of an EEP or EEP Equivalent, and in making replacement purchase(s) of next Compliance Year Allowances as described in § 8.1(b)(ii)(A), above; to the extent those costs and expenses are not recovered via § 8.1(b)(i)(A) above (which additional incidental damages, for the avoidance of doubt, may also include interest accrued at the Interest Rate specified in § 13.5 (Default Interest), from (and including) the date on which an EEP or EEP Equivalent is paid, to (but excluding) the receipt by the Buyer of damages for the Seller’s failure to Transfer); and

- (G) plus, if applicable, the Buyer’s Cover Costs incurred in replacing that portion of Allowances not Transferred to the Buyer by the Seller for which the Buyer did not incur an EEP or EEP Equivalent (and thus not comprising the UEA) (such portion of Allowances not Transferred being hereinafter referred to as the “Non-UEA”), calculated in accordance with the methodology set forth in § 8.1(b)(i), which methodology shall apply equally to this § 8(b)(ii)(G);

- (H) plus interest accrued on the value of the Non-UEA calculated in accordance with the methodology set forth in § 8.1(b)(i)(C), but in this context calculated on the amount of the Non-UEA, rather than the amount of the UA.

- provided, always, that in the event that the number calculated through application of elements (A) through (H) of the formula set forth immediately above in this § 8.1(b)(ii) results in a negative number, such number shall be deemed to be zero and no damages will be owed in respect of such elements of this damages formula.

- (c) Buyer’s Right to Waive Its Cover Costs. The Buyer shall be entitled to invoice the Seller for damages payable pursuant to § 8.1(b)(i) (Buyer’s Cover Costs) in accordance with the requirements of Payment Cycle B as defined in § 13.2 (Payment). However, the Buyer may alternatively, but shall be under no obligation to, defer the due date on the payment of such damages for a reasonable period of time (but in no event beyond the applicable Reconciliation Deadline) if the Seller has indicated to the Buyer an intent to attempt to cure its Transfer default within a period of time acceptable to the Buyer.

- (i) At any time prior to the due date applicable to the payment of damages due to the Buyer under §8.1(b), the Seller may offer to Transfer to the Buyer replacement Allowances on a new Delivery Date (the “Deferred Delivery Date”) for those it originally failed to Transfer. The Buyer may, but is not required to, agree to accept such Transfer of replacement Allowances in lieu of the damages it is entitled to recover under § 8.1(b), provided that in such case the Buyer shall be entitled to invoice the Seller for interest for the intervening period calculated as the sum of interest accrued during the two Delivery Business Day grace period as provided in § 8.1(a); plus interest, at the Interest Rate specified in § 13.5 (Default Interest), from (and including) the first Delivery Business Day following the Delivery Date, to (but excluding) the date of actual Transfer of the previously undelivered Allowance(s), accrued on the amount calculated in accordance with the formula set forth in § 8.1(b)(i)(C).

- (ii) If the Buyer agrees to accept the Seller’s offer for Transfer of replacement Allowances on a Deferred Delivery Date as provided above in subparagraph (i), but the Seller again defaults on its deferred Transfer obligation, the Buyer shall be entitled to invoice the Seller for an amount calculated in accordance with § 8.1(b) (Buyer’s Cover Costs) save that the amount it may so invoice the Seller shall account for both:

- (A) interest, (1) in the event that the Buyer is subsequently able to make a replacement purchase of Allowances, calculated as provided in § 8.1(b)(i)(C); or (2) in the event the Buyer is unable to make a replacement purchase of Allowances before the Reconciliation Deadline for the relevant Compliance Period, calculated as provided in §8.1(b)(ii)(D); and

- (B) any increase in the Buyer’s Cover Costs reflecting higher market prices pertaining to replacement Allowances on the Deferred Delivery Date when compared to those available in the market on the original Delivery Date.

- (a) Two Business Days Grace Period. When the Buyer fails to accept Transfer of a Contract Quantity in whole or in part on a Delivery Date as required in accordance with the terms of an Allowance Transaction, and such failure is not excused by an event of Force Majeure, Suspension Event or the Seller’s non-performance, the Seller shall afford the Buyer an opportunity to remedy its failure by again attempting to Schedule and Transfer such Contract Quantity (or undelivered portion thereof) to the Buyer on the second Delivery Business Day following the Delivery Date, provided that such day is not on or after the Reconciliation Deadline applicable to the undelivered Allowance(s), and further subject to the additional obligation of the Buyer to pay the Seller, as compensation for its failure to accept Transfer of the Allowances, interest calculated: (i) as follows for the two Delivery Business Day grace period; and (ii) as set forth in the applicable subpart of this § 8.2 for any longer period the Buyer fails to accept the Allowances thereafter.

- Interest for the two Delivery Business Day grace period shall accrue at the Interest Rate specified in § 13.5 (Default Interest) for the period from (and including) the Delivery Date to (but excluding) the second Delivery Business Day following the Delivery Date on the Total Contract Price of the Allowances not accepted by the Buyer, such Total Contract Price calculated as follows: the number of Allowances not accepted by the Buyer multiplied by a fraction determined by dividing the Total Contract Price by the Contract Quantity.

- (b) Seller’s Cover Costs. In the event that the Buyer fails to accept Transfer of all or any portion of a Contract Quantity as required by § 8.2(a) (Two Business Days Grace Period) in accordance with the terms of an Allowance Transaction and the Seller has not agreed to a Deferred Acceptance Date as provided for in § 8.2(c) (Seller’s Right to Waive Its Cover Costs), the Buyer shall incur the obligation to pay the Seller, as compensation for its failure to accept Transfer of the Allowances, an amount (hereinafter “Seller’s Cover Costs”) equal to the sum of:

- (i) the price, if any, less than the portion of the Total Contract Price applicable to the Allowances not accepted by the Buyer, which the Seller, acting in a commercially reasonable manner either did, or would have been able to, receive, in an arm’s length transaction with a third party or parties, from the resale of the Allowances not accepted by the Buyer;

- (ii) such reasonable additional incidental costs as the Seller incurred in attempting to make or making such resale of the Allowances; and

- (iii) interest accrued during the two Delivery Business Day grace period as provided in § 8.2(a); plus interest, at the Interest Rate specified in § 13.5 (Default Interest), accrued from (and including) the first Delivery Business Date following the Delivery Date, to (but excluding) the date of receipt by the Seller of damages for the Buyer’s failure to accept, such amount calculated using the following formula:

- Amount on which interest accrues = ANA x CP

- Where:

- ANA means Allowances not accepted, the total number of Allowances the Buyer failed to accept; and

- CP means the aggregate Contract Price that the Buyer would have been required to pay to the Seller for all Allowances not accepted by it.

- (c) Seller’s Right to Waive Its Cover Costs. The Seller shall be entitled to invoice the Buyer for damages payable pursuant to § 8.2(b) (Seller’s Cover Costs) in accordance with the requirements of Payment Cycle B as defined in § 13.2 (Payment). However, the Seller may alternatively, but shall be under no obligation to, defer the due date on the payment of such damages for a reasonable period of time (but in no event beyond the applicable Reconciliation Deadline) if the Buyer has indicated to the Seller its intent to attempt to cure its acceptance default within a period of time acceptable to the Seller.

- (i) At any time prior to the due date applicable to the payment of damages due to the Seller under §8.2(b), the Buyer may offer to accept Transfer from the Seller on a new Delivery Date (the “Deferred Acceptance Date”) of the Allowances it failed to accept Transfer of on the original Delivery Date. The Seller may, but is not required to, agree to attempt to again Transfer such replacement Allowances to the Buyer on the Deferred Acceptance Date. If it so agrees, the Seller, in lieu of the damages it is entitled to recover under § 8.2(b), shall be entitled to both Transfer and receive payment of the Contract Price for the Allowances on the Deferred Acceptance Date and to further invoice the Buyer for interest for the intervening period calculated as the sum of the interest accrued during the two Delivery Business Day grace period as provided in § 8.2(a) plus interest at the Interest Rate specified in § 13.5 (Default Interest), from (and including) the second Delivery Business Day following the Delivery Date to (but excluding) the date of actual acceptance of Transfer of the Allowance(s) previously not accepted, accrued on the amount calculated in accordance with the formula set forth in § 8.2(b)(iii).

- (ii) If the Seller agrees to the Buyer’s offer to accept Transfer of the Allowances on a Deferred Acceptance Date as provided above in subparagraph (i), but the Buyer again defaults on its acceptance of Transfer obligation, the Seller shall be entitled to invoice the Buyer for an amount calculated in accordance with § 8.2(b) (Seller’s Cover Costs) save that the amount it may so invoice the Buyer shall account for both:

- (A) interest, calculated as provided in § 8.2(b)(iii); and

- (B) any depreciation in the Seller’s Cover Costs reflecting lower prevailing market prices available for the resale of Allowances on the Deferred Acceptance Date when compared to those available in the market on the original Delivery Date.

§ 8.3 Excess Emissions Penalty (“EEP”) and EEP Equivalent:

- (a) Applicability. The Parties to any Allowance Transactions desiring to make EEP or EEP Equivalent inapplicable and inoperative to the calculation of the Buyer’s Cover Costs for any Allowance Transactions between them may do so either globally by specifying EEP or EEP Equivalent as not applying in Part II of this Allowances Appendix, or specifically, with respect to a particular Allowance Transaction, by so agreeing in the terms of that Allowance Transaction itself.

- (b) Excess Emissions Penalty. If EEP is applicable, the Buyer may invoice the Seller in the amount of an EEP it incurs as the result of the Seller’s failure to Transfer to it Allowances when required pursuant to the terms of an Allowance Transaction.

- (c) Excess Emissions Penalty Equivalent. If EEP Equivalent is applicable, the Buyer may invoice the Seller for an EEP Equivalent it incurs as the result of the Seller’s failure to Transfer to it Allowances when required pursuant to the terms of an Allowance Transaction.

- (d) Duty to Mitigate. The Seller’s obligation to pay the EEP or the EEP Equivalent is subject always to the Buyer’s overriding obligation to use commercially reasonable endeavours (including, without limitation, making use of any excess Allowances it may have available to it at the time, and/or procuring such Allowances as are available in the market) to satisfy its obligation to surrender the required number of Allowances necessary to avoid or otherwise mitigate its EEP or EEP Equivalent liability. For the avoidance of doubt, the Buyer’s duty to mitigate its EEP or EEP Equivalent exposure is limited to management of its Allowance portfolio and shall not impose upon it any further obligation regarding its operation of any installation with an obligation to surrender Allowances to a Relevant Authority.

- (e) Evidence of Commercially Reasonable Efforts. Upon request, the Buyer shall confirm to the Seller:

- (i) that it has incurred EEP or EEP Equivalent consequent upon the Seller’s failure to Transfer Allowances to it;

- (ii) the extent to which the requirement for the Buyer to pay the EEP or the EEP Equivalent results from the Seller’s failure to make such a Transfer;

- (iii) that it was unable to mitigate its EEP or EEP Equivalent exposure,

- and shall provide the Seller with evidence: (A) that the EEP or EEP Equivalent, as applicable, was incurred by it; (B) that such EEP or EEP Equivalent was incurred as a result of the Seller’s failure to perform its Transfer obligation; and (C) of its commercially reasonable endeavours to mitigate its exposure to such EEP or EEP Equivalent as it has invoiced to the Seller; provided, however, that should the Seller elect to challenge the Buyer in respect of any of the above matters, then the burden for demonstrating: (A) that such EEP or EEP Equivalent was not actually incurred by the Buyer; (B) that such EEP or EEP Equivalent was not incurred by the Buyer as a result of the Seller’s non-performance; and/or (C) the insufficiency, lack of thoroughness or unreasonableness of such endeavours shall be on the Seller and, if § 22.3 (Expert Determination) is specified as applying in Part II of this Allowances Appendix the process by which such challenge will be determined shall be in accordance with the procedures set forth in § 22.3 (Expert Determination).

- (f) Later Mitigation of Recovered EEP or EEP Equivalent. To the extent an initially assessed and recovered EEP is later reduced and/or fully or partly returned or credited to the Buyer by a Relevant Authority for any reason whatsoever, only such reduced and finally assessed EEP shall apply. EEP recovered by the Buyer in the form of damages under this § 8 which are later reduced or returned to such Buyer shall be returned upon demand to the Seller who paid such damages, and the Buyer shall provide the Seller with prompt notification of any such reduction or return. Similarly, in the event the Seller has made the Buyer whole for an EEP Equivalent, and all or any portion of the underlying EEP or EEP Equivalent upon which the Seller’s EEP Equivalent payment was based is later returned to the Buyer by its resale customer, the Buyer shall return an equivalent amount of its own EEP Equivalent payment to the Seller.

§ 8.4 Amounts Payable. Amounts that are due according to this § 8 shall be invoiced and paid in accordance with Payment Cycle B as defined in § 13.2 (Payment).

§ 8.5 Remedies for Failure to Transfer or Accept after Cessation of Suspension Event

- (a) Where the Buyer fails to accept Transfer from the Seller of the Contract Quantity in whole or in part on a Delayed Delivery Date and such failure is not excused by an event of Force Majeure, another Suspension Event or the Seller’s non-performance, the Seller’s Cover Costs shall consist of the sum of the following elements:

- (i) the Seller’s Cover Costs as provided in § 8.2(b) of this Allowances Appendix;

- (ii) an amount (the “Default Cost of Carry Amount”) calculated at the Default Cost of Carry Rate for the Default Cost of Carry Calculation Period multiplied by the product of the Contract Price and the number of Allowances not Transferred or accepted for the relevant Allowance Transaction, divided by three hundred and sixty (360). Such Default Cost of Carry Amount shall be identified in the relevant invoice; and

- (iii) interest on the Default Cost of Carry Amount accrued from (and including) the Delivery Business Day following the Default Cost of Carry Calculation Period, to (but excluding) the receipt by the Seller of damages for the Buyer’s failure to accept Transfer, calculated at the Interest Rate specified in § 13.5 (Default Interest) of the Agreement.

- (i) the Seller’s Cover Costs as provided in § 8.2(b) of this Allowances Appendix;

- (b) Where Seller fails to Transfer to the Buyer the Contract Quantity in whole or in part on a Delayed Delivery Date and such failure is not excused by an event of Force Majeure, another Suspension Event or the Buyer’s non-performance, Buyer’s Cover Costs shall consist of the aggregate of the following elements:

- (i) Buyer’s Cover Costs, as provided in either:

- (a) § 8.1(b)(i) of this Allowances Appendix; or,

- (b) where an EEP or EEP Equivalent has been made applicable to an Allowance Transaction and has arisen, § 8.1(b)(ii) of this Allowance Appendix;

- (a) § 8.1(b)(i) of this Allowances Appendix; or,

- in either case, reduced by

- (ii) the Default Cost of Carry Amount;

- (i) Buyer’s Cover Costs, as provided in either:

provided, always, that in the event that the number resulting from application of the applicable formula set forth immediately above in either § 8.5(a) or § 8.5(b) results in a negative number, such number shall be deemed to be zero and no damages will be owed.

Template:EFET Allowance Annex 9

§ 10 Term and Termination Rights. § 10 of the General Agreement is hereby amended with respect to both Individual Contracts for Electricity and Individual Contracts for Allowances at any time in which the Parties have outstanding Allowance Transactions remaining between them to be partially or fully performed by: (i) the addition in the second line of § 10.3(a) (Termination for Material Reason) after the words “may terminate the Agreement” of the words “or the Allowances Appendix only”; and (ii) the following amendments:

§ 10.5 Definition of Material Reason. The addition at the end of the second line of § 10.5 after the words “(each a “Material Reason”)” of the words “save that in the event of termination pursuant to § 10.5(a) (Non Performance) or § 10.5(f) (Representation or Warranty) of the General Agreement, the Non-Defaulting Party may, at its sole discretion, elect to terminate only the Allowances Appendix and not the previously executed General Agreement, if and only when such uncured non-performance, warranty breach or misrepresentation concerns only one or more Allowance Transactions. If the Non-Defaulting Party elects to terminate only the Allowances Appendix together with all Allowance Transactions thereunder, it may do so in the manner prescribed in § 10 (Term and Termination Rights) and § 11 (Calculation of Termination Amount), but only with respect to its Allowance Transactions and in such manner as to result in the accrual of an amount due from one Party to the other Party analogous to a Termination Amount but concerning only the Allowance Transaction(s) terminated (an “Allowances Termination Amount”).”

§ 10.5(d) Failure to Transfer or Accept. § 10.5(d) is deleted in its entirety.

§ 10.5(e) Force Majeure. § 10.5(e) is deleted in its entirety and replaced with the words: “Unless expressly agreed to the contrary by the Parties, Force Majeure’s or Suspension Event’s impairment of a Party’s ability to perform its obligations with respect to any single Allowance Transaction shall not give rise to a Material Reason for initiating an Early Termination of either the Agreement or this Allowances Appendix and all then outstanding Allowance Transactions.” § 11 Calculation of the Termination Amount. § 11 of the General Agreement is hereby amended for purposes of calculating any Allowances Termination Amount concerning one or more Allowance Transactions by:

- (i) the addition of the following words to § 11.2 (Settlement Amount) at the end of the definition of § 11.2(a) (Costs):

- “including, in the event that an EEP or EEP Equivalent is applicable to an Allowance Transaction, any EEP or EEP Equivalent actually assessed and not later reduced or recovered”; and

- (ii) the addition of the following words after the words: “any replacement transactions.”, at the end of the last sentence:

- “For the avoidance of doubt, where applicable, the Cost of Carry Amount or the Default Cost of Carry Amount (together with any interest then due thereon) shall be included in the Terminating Party’s calculation of all relevant Settlement Amounts.”

- “For the avoidance of doubt, where applicable, the Cost of Carry Amount or the Default Cost of Carry Amount (together with any interest then due thereon) shall be included in the Terminating Party’s calculation of all relevant Settlement Amounts.”

§ 12 Limitation of Liability. For the avoidance of doubt, the Parties agree that if an EEP or EEP Equivalent applies to an Allowance Transaction such EEP or EEP Equivalent shall not be considered an indirect or consequential damage of the type excluded from recovery of damages by § 12.3 (Consequential Damage and Limitation of Liability) of the General Agreement, and that such maximum amount of such EEP or EEP Equivalent, being an amount identifiable by them at the time of entering into their Allowance Transaction, is neither speculative nor difficult to ascertain. The Parties further agree and acknowledge that the formulae providing for calculating the amount of EEP and EEP Equivalent in this Allowances Appendix are reasonable in light of the anticipated harm that would be incurred by a Buyer and are therefore a genuine pre-estimate of the nature and magnitude of such harm. Further, the payment of such damages is not viewed by either Party as a penalty or in the nature of a penalty and each Party waives the right to contest those payments as an unreasonable penalty. In addition, the Parties agree to amend § 12.3(a) (Consequential Damage and Limitation of Liability) of the General Agreement by adding the words “(other than with respect to a claim under § 6.3 (No Encumbrances))” after the words “consequential Damages” in the first line thereof. Except to the extent otherwise modified herein by the Parties, there shall be no further changes to § 12 (Limitation of Liability) of the General Agreement with respect to Allowance Transactions.

Template:EFET Allowance Annex 13

Template:EFET Allowance Annex 14

Template:EFET Allowance Annex 15

Template:EFET Allowance Annex 16

Template:EFET Allowance Annex 17

Template:EFET Allowance Annex 18

Template:EFET Allowance Annex 19

Template:EFET Allowance Annex 20

Template:EFET Allowance Annex 21

Terms used in this Allowances Appendix shall have the following meanings:

“Administrator Event” means the suspension of all or some of the processes in respect of a Registry or the EUTL in accordance with the Registries Regulation by the National Administrator or the Central Administrator (as applicable) (i) where that Registry is not operated and maintained in accordance with the provisions of the Registries Regulation, or any other applicable law, or (ii) for the purposes of carrying out scheduled or emergency maintenance, or (iii) where there has been or following reasonable suspicion of, a breach of security which threatens the integrity of the registries system (including any back up facilities);

“AEUA” means a unit of account that is an “allowance” as defined in the EU ETS Directive and is issued under Chapter II thereof;

“Affected Allowance” means an Allowance which is or is alleged to have been the subject of an Unauthorised Transfer as confirmed by an Appropriate Source;

“Aircraft Operator” means an “aircraft operator” as defined in the EU ETS Directive;

“Allowance” means an allowance to emit one tonne of carbon dioxide (C02) equivalent during a specified period, or such other type of unit as may be recognised as, valid for the purposes of meeting the requirements of applicable law and the relevant Emissions Trading Scheme on the Delivery Date, including, without limitation, for the purpose of meeting emissions’ related commitment obligations under the EU ETS;

“Allowances Appendix” means this Allowances Appendix to the General Agreement (inclusive of its Annexes);

“Allowance Type” means a specific type of Allowance as defined by the Applicable Rule(s) including, without limitation, an AEUA, an EUA or other Allowance Type which the Parties have specified as applying in Part II of this Allowances Appendix or in an Individual Contract which may be used for determining compliance with emissions related commitment obligations under the EU ETS;

“Allowances Termination Amount” shall have the meaning given in § 10.5 of this Allowances Appendix;

“Allowance Transaction” shall have the meaning given in the first paragraph of this Allowances Appendix;

“Applicable Rule(s)” means that subset of the Rules which govern, relate to or otherwise concern the valid Transfer of Allowances to Buyer’s Holding Account in satisfaction of Seller’s obligation under an Allowance Transaction and, when applicable in context, which govern an entity’s emission-related obligations under the EU ETS to its Relevant Authority;

“Appropriate Source” means any “competent authority” and/or the “Central Administrator” (as those terms are defined in the Registries Regulation), National Administrator or any other authority having power pursuant to the Directive and/or the Registries Regulation to block, suspend, refuse, reject, cancel or otherwise affect the Transfer (whether in whole or in part) of Allowances, any recognized law enforcement or tax authorities of a Member State, European Anti-fraud Office of the European Commission or Europol;

“Central Administrator” means the person designated by the EU Commission to maintain the EUTL pursuant to Article 20(1) of the EU ETS Directive;

“Compliance Period” means the Fourth Compliance Period unless otherwise specified by the Parties in the Confirmation to the Allowance Transaction;

“Compliance Year” means that period of time between each Reconciliation Deadline (if more than one) in respect of a Compliance Period;

“Contract Price” means, in respect of an Allowance Transaction (and, where applicable, for a particular Compliance Period) the amount agreed to be the purchase price for that Contract Quantity, excluding applicable taxes;

“Contract Quantity” means, in respect of an Allowance Transaction, the number of Allowances (of one or more Compliance Periods, where applicable, as agreed to be bought and sold between the Parties;

“Cost of Carry Amount” has the meaning specified in § 7.5(d) (Cost of Carry);

“Cost of Carry Calculation Period” means the number of calendar days from and including the original Due Date which would have applied but for delayed delivery to, but excluding, the delayed Due Date resulting from delayed delivery;

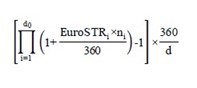

“Cost of Carry Rate” means the “EUR-EuroSTR-COMPOUND” interest rate in respect of each day in the Cost of Carry Calculation Period, provided that if the interest rate would otherwise be less than zero, the interest rate shall be floored at zero and any margin applied thereto;

“Default Cost of Carry Amount” has the meaning specified in § 8.5(a)(ii);

“Default Cost of Carry Calculation Period” means the number of calendar days from and including the original Due Date which would have applied but for delayed delivery to, but excluding, the delayed Due Date that would have applied assuming that the Seller sent an invoice at the earliest date it would have been entitled to do so in accordance with the methodology elected in § 13.2 (Payment) in Part II of the Allowances Appendix;

“Default Cost of Carry Rate” means the “EUR-EuroSTR-COMPOUND” interest rate in respect of each day in the Default Cost of Carry Calculation Period, provided that if the interest rate would otherwise be less than zero, the interest rate shall be floored at zero and any margin applied thereto;

“Delayed Delivery Date” has the meaning specified in § 7.5(b). In order that a two Delivery Business Day grace period and consequent obligation to pay compensation shall also apply to an Allowance Transaction when the Seller, on a Delayed Delivery Date, fails to Transfer to the Buyer or the Buyer fails to accept Transfer from the Seller of, all or part of the undelivered Contract Quantity of an SE Affected Transaction, for the purposes of § 8 (Remedies for Failure to Transfer or Accept), a Delayed Delivery Date shall be deemed a Delivery Date; provided, however, that such two Delivery Business Day grace period does not extend the Delayed Delivery Date in respect of an Allowance Transaction to a day that is either:

(i) on or after the Reconciliation Deadline following the relevant Delayed Delivery Date; or (ii) on or after the Long Stop Date in respect of the relevant Allowance Transaction;

“Delivery Business Day” means, in respect of an Allowance Transaction, and for the purposes of this Allowances Appendix only, any day which is not a Saturday or Sunday, on which commercial banks are open for general business at the places where each Party specifies as applying to it in Part II of this Allowances Appendix. In the event that a Party does not so specify a place in Part II of this Allowances Appendix, then (that/those) place(s) shall be deemed to be the Seller and the Buyer’s addresses, as applicable, specified in § 23.2 (Notices, Invoices and Payments) of the General Agreement or, if no such addresses have been specified in § 23.2, at the place(s) where (that/those) Party(ies) (has/have) (its/their) registered office;

“Delivered Quantity” means, in respect of an Allowance Transaction, the number of Allowances (of a Compliance Period, where applicable) of a Contract Quantity Transferred by the Seller and accepted by the Buyer at the Delivery Point;

“Delivery Date” means, in respect of an Allowance Transaction, the day agreed between the Parties on which the relevant Transfer from the Seller to the Buyer is to take place at the Delivery Point, subject to any adjustment in accordance with §7.5 (Suspension Event). If the Delivery Date is not a Delivery Business Day, it shall be deemed to be the first Delivery Business Day following the agreed day;

“Delivery Point” means, in respect of an Allowance Transaction, the Buyer’s Holding Account(s) that it has nominated in one or more Registry(ies) or such other Holding Account(s) as the Parties may agree in an Allowance Transaction;

“Delivery Schedule” means, in respect of an Allowance Transaction, the Schedule of Delivery Dates for the Transfer of (each) Contract Quantity(ies) as the Buyer and Seller may agree in an Allowance Transaction;

“Directive” means any EU directive or directives which govern the purchase, sale and Transfer of Allowances;

“Encumbrance Loss Amount” means an amount reasonably determined by the Buyer in good faith to be its total losses and costs in connection with an Individual Contract including, but not limited to, any loss of bargain, cost of funding or, at the election of the Buyer but without duplication, loss or costs incurred as a result of its terminating, liquidating, obtaining or re-establishing any hedge or related trading position. Such amount includes losses and costs in respect of any payment already made under an Individual Contract prior to the delivery of the written notice by the Buyer and the Buyer's legal fees and out-of-pocket expenses but does not include Excess Emissions Penalty or any amount which the Buyer must pay to a third party in respect of any such penalty payable to any other party (or Relevant Authority) by that third party. The Parties agree that in circumstances where there was a breach of the No Encumbrances Obligation by the Seller caused by the Transfer of an Affected Allowance, the Buyer will be entitled to recover any losses arising out of or in connection with any claim, demand, action or proceeding brought against the Buyer by a third party consequent upon the Transfer by the Buyer of an Affected Allowance Transferred to it by the Seller under an Individual Contract;

“End of Phase Reconciliation Deadline” means, in respect of an Allowance Transaction, the final Reconciliation Deadline determined in accordance with Applicable Rule(s) for the surrender of Allowances in respect of a Compliance Period;

“Emissions Trading Scheme(s)” means the scheme(s) to effect the Transfer of Allowances between participants in both or either of Member or Non-Member States as implemented by and including its Applicable Rule(s);

“EU” means the European Community as it exists from time to time;

“EUA” means a unit of account that is an “allowance” as defined in the EU ETS Directive and is issued pursuant to

Chapter III thereof;

“EU ETS” means the EU Emissions Trading Scheme established by the EU ETS Directive;

“EU ETS Directive” means the Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 establishing a scheme for greenhouse gas emissions allowance trading and amending Council Directive 96/61/EC, as amended from time to time;

“EUR-EuroSTR-COMPOUND” where EUR-EuroSTR-COMPOUND will be calculated as follows, and the resulting percentage will be rounded, if necessary to the nearest one ten-thousandth of a percentage point (0.0001%):

where:

- “Calculation Period” means either the Cost of Carry Calculation Period or the Default Cost of Carry Calculation Period, as the context requires;

- “d” is the number of calendar days in the relevant Calculation Period;

- “d0”, for any Calculation Period, is the number of TARGET Settlement Days in the relevant Calculation Period;

- “EuroSTRi”, for any day “i” in the relevant Calculation Period, is a reference rate equal to EuroSTR in respect of that day as published on the website of the European Central Bank at https://www.ecb.europa.eu/home/html/index.en.html, or any successor source (the “ECB’s Website”);

- “i” is a series of whole numbers from one to d0, each representing the relevant TARGET Settlement Day in chronological order from, and including, the first TARGET Settlement Day in the relevant Calculation Period;

- “ni” is the number of calendar days in the relevant Calculation Period on which the rate is EuroSTRi;

“EuroSTR” or “€STR” means the euro short term rate administered by the European Central Bank (or any successor administrator) as administrator of the benchmark and published on the ECB’s Website;

- No Index Cessation Effective Date with respect to EuroSTR[2]

If neither the administrator nor authorized distributors provide or publish EuroSTR and an Index Cessation Effective Date with respect to EuroSTR has not occurred, then, in respect of any day for which EuroSTR is required, references to EuroSTR will be deemed to be references to the last provided or published EuroSTR.

- Index Cessation Effective Date with respect to EuroSTR

If an Index Cessation Effective Date occurs with respect to EuroSTR, then the rate for a day on or after the Index Cessation Effective Date will be such rate as replaces EuroSTR pursuant to the prevailing fallbacks mechanics ISDA (the International Swaps and Derivatives Association), or any successor to ISDA, has in place (the “Applicable Fallback Rate”), as at the Index Cessation Effective Date, and all provisions in this section shall be read as though references to EuroSTR are instead references to the Applicable Fallback Rate.

“EUTL” or “European Union Transaction Log” means the independent transaction log provided for in Article 20(1) of the EU ETS Directive, the operation of which is further detailed in Article 5 of the Registries Regulation;

“Excess Emissions Penalty” or “EEP” means a financial payment required to be made to a Relevant Authority pursuant to and in accordance with Article 16(4) of the EU ETS Directive (which, for the avoidance of doubt, shall not include any costs relating to or arising from the obligation to purchase and/or surrender Allowances in the following Compliance Year), or its equivalent under any other Emissions Trading Scheme;

“Excess Emissions Penalty Equivalent” or “EEP Equivalent” means an amount which the Buyer must pay to a third party in respect of any amount payable by that third party which arose as a result of the Buyer’s failure to Transfer the required Allowances to that third party and which in turn was a consequence of the Seller’s failure to Transfer the Contract Quantity to the Buyer under this Agreement (which, for the avoidance of doubt, shall not include any costs relating to the obligation to purchase and/or surrender Allowances in the following Compliance Year);

“Expert” means a person qualified by education, experience and/or training with the applicable Emissions Trading Schemes, Applicable Rule(s) and Allowance Transactions who is able to review and understand the contents of a Party’s emission allowance trading portfolio and who neither is nor has been directly or indirectly under the employ of, affiliated with, or under the influence of either of the Parties or otherwise has any conflicting interest or duty;

“Fourth Compliance Period” means, with respect to EUAs and AEUAs, the period starting 1 January 2021 to 31 December 2030;

“Holding Account” means the form of record maintained by and in the relevant Registry to record the allocation (if applicable), Transfer and holding of Allowances;

“Index Cessation Effective Date” means, in respect of an Index Cessation Event, the first date on which EuroSTR, or if an Applicable Fallback Rate is being used, such Applicable Fallback Rate is no longer provided. If EuroSTR, or as the case may be, such Applicable Fallback Rate, ceases to be provided on the same day that it is required to determine the rate for a day pursuant to the terms of the contract, but it was provided at the time at which it is to be observed pursuant to the terms of the contract (or, if no such time is specified in the contract, at the time at which it is ordinarily published), then the Index Cessation Effective Date will be the next day on which the rate would ordinarily have been published.

“Index Cessation Event” means, in respect of EuroSTR or, in the event an Applicable Fallback Rate is being used, such Applicable Fallback Rate: