Minsky moment: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (2 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

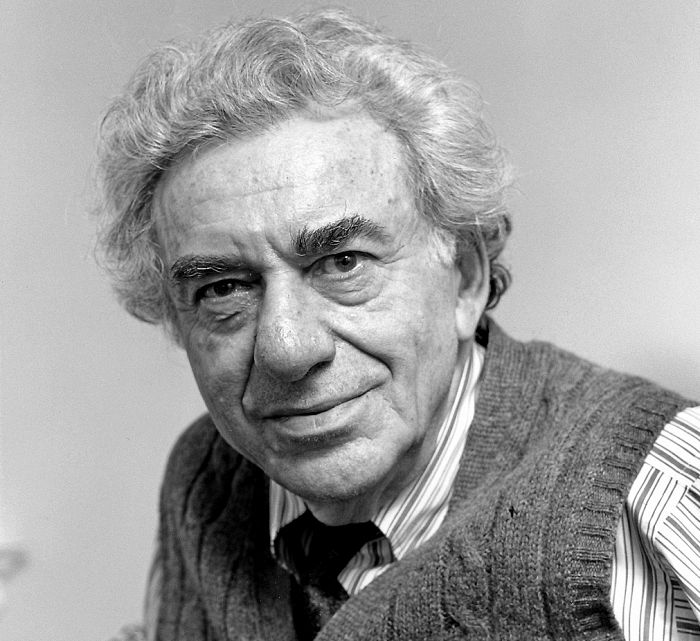

{{ | {{freeessay|banking|Minsky moment|{{image|hyman minsky|jpg|Hyman Minksy, yesterday.}} }} | ||

Latest revision as of 10:30, 17 November 2023

|

Banking basics

A recap of a few things you’d think financial professionals ought to know The Jolly Contrarian holds forth™

Resources and Navigation

|

Hyman Minsky’s “Minsky moment” comes at the end of a credit cycle which he sees as having five stages:

- Displacement: invention, war, change in economic policy:

- Boom: the invisible hand seeks and and exploits whatever opportunities are thrown up by the displacement (even bad displacements create opportunities: wars benefit the arms industry and the medical dressings industry)

- Euphoria: everything seems amazing, the world is picked out in vivid, sparkling light, awash with profit possibilities, and lending standards start to slide.

- Profit-taking: Smart people call the top of the market and sell

- Panic: Usually triggered by something dramatic or symbolic: the sudden failure of a hedge fund, or some such, everyone stampedes for the exits.

Minsky’s prescription is a little conjurer magic to temper the baser instincts of the invisible hand: “apt intervention and institutional structures are necessary for market economies to be successful.”

But still, the concept of the Minsky moment and, really, the whole five-stage credit cycle — still feels a little bit neat, convenient, and “survivor bias-y” — a story we might construct in hindsight to explain what the hell just happened, selecting suitable evidence for it as we go with the iron certainty of hindsight. Cycles, like waves, are not discrete, but operate on and in a bigger ocean with all kinds of cross-currents and perturbations — intersecting credit cycles of their own — making the market behave in unpredictable ways.

See also

Template:M sa banking Minsky moment

References

[[category:Template:Banking Essay]]