Manufacturing: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (5 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

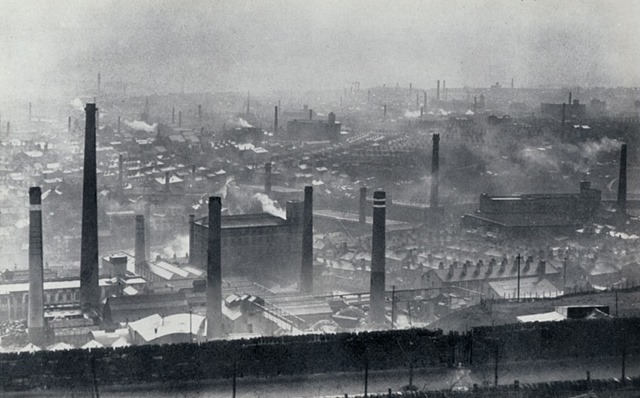

{{g}}To recreate the economics of a payment on a share or bond through a derivative. This happens in stock loans through the concept of [[Manufactured payments in respect of Loaned Securities - GMSLA Provision|Manufactured Payment]]s, repos ({{gmraprov|Income Payments}}), and [[equity derivatives]] ({{eqderivprov|Dividend | {{a|g|{{image|Mills|jpg|A dividend manufacturing plant, yesterday}}}}To recreate the economics of a payment on a share or bond — ''but not an [[index]] — through a derivative. This happens in stock loans through the concept of [[Manufactured payments in respect of Loaned Securities - GMSLA Provision|Manufactured Payment]]s, repos ({{gmraprov|Income Payments}}), and [[equity derivatives]] ({{eqderivprov|Dividend Amount}}s). | ||

{{dividends on index transactions}} | |||

{{sa}} | {{sa}} | ||

*[[Manufactured payments in respect of Loaned Securities - GMSLA Provision|Manufactured Payment]]s under the {{gmsla}} | *[[Manufactured payments in respect of Loaned Securities - GMSLA Provision|Manufactured Payment]]s under the {{gmsla}} | ||

*{{gmraprov|Income Payments}} under the {{gmra}} | *{{gmraprov|Income Payments}} under the {{gmra}} | ||

*{{eqderivprov|Dividend | *{{eqderivprov|Dividend Amount}}s under the {{eqdefs}} | ||

{{ref}} | {{ref}} | ||

Latest revision as of 15:41, 8 July 2024

|

To recreate the economics of a payment on a share or bond — but not an index — through a derivative. This happens in stock loans through the concept of Manufactured Payments, repos (Income Payments), and equity derivatives (Dividend Amounts).

Dividends on Index Transactions? No, sir. But yes, sir.

We shouldn’t really need to say it, but we will: You don’t — well ~ cough ~ shouldn’t — get dividend payments on an Index Transaction. The Index calculation methodology will either replicate the effect of dividend reinvestment on Index constituents, by proportionately re-weighting constituents when they pay dividends — in which case you will get the effect of those dividends just through “price return” of the Index level — or it won’t, in which case you won’t get the effect of those dividends, BECAUSE YOU BOUGHT A DERIVATIVE OF AN INDEX THAT DOESN’T REPLICATE THE EFFECT OF ANY DIVIDENDS.[1]

Either way, the dividend provisions of the 2002 ISDA Equity Derivatives Definitions aren’t — well ~ cough ~ shouldn’t be — relevant to Index and Index Basket Swap Transactions. So they don’t really countenance the idea of an Index paying through dividends. While, in the Russian-doll defined terms schema confected by ISDA’s crack drafting squad™ an Index Swap Transaction is a kind of Equity Swap Transaction, and therefore can have a Type of Return applied to it, when you dive down the rabbit hole, through the Total Return star-gate, along the Re-investment of Dividends axis and into the Dividend Amount portal, you hit the hard black nothingness of dark energy: A Dividend Amount is defined, of course, by reference to a Share’s Record Amount, Ex Amount or Paid Amount, and not that of an Index, for the compellingly straightforward reason that Indices are abstract numbers. They don’t pay dividends.

Now ISDA’s crack drafting squad™ made a half-hearted swipe — actually, it a was more like a full-blooded, half-hour long drubbing — in one of the Pan-Asia MCAs to build in manufactured dividends to Japanese index products, but it is fiendishly complicated, not to mention wrong-headed, and no-one uses it as far as we know.

However.

There is a fairly common market practice, for indices that don’t re-weight to replicate dividend reinvestment, for dealers to manufacture dividends on the Index constituents anyway. This is because a common means of hedging indices is by buying the underlying stocks, so since the dealer is getting the cashflows in and can pay them out. This is hard to reconcile with the drafting of the 2002 ISDA Equity Derivatives Definitions, unless either (i) for Index transactions, you rather wilfully deem “Shares” to mean “constituents of the Index”, or (ii) you treat the Index Transaction as really a dynamic custom Share Basket Swap Transaction. Your front office guys won’t like that suggestion, so do you know what the JC’s approach is? Just leave it. This is one of those beautiful places where the lawyers — who have only the faintest grasp of that the front office does at the best of times — do one thing, and the business — which broadly could not care a row of buttons what legal contracts say until it suddenly all goes Pete Tong — does another, ne’er the twain meet, and the respective groups carry on in blissful ignorance of the a gaping conceptual chasm between them.

And speaking of gaping chasms, you know what I’m going to say now, don’t you?

See also

- Manufactured Payments under the 2010 GMSLA

- Income Payments under the Global Master Repurchase Agreement

- Dividend Amounts under the 2002 ISDA Equity Derivatives Definitions