Swap: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (25 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{a|glossary|{{Layman|Swap}}}}Generally, those [[derivative]] contracts entered into under an {{isdama}}. Two rookie mistakes to avoid: | |||

*Firstly, it’s pronounced “'''sw-ŏp'''” (to rhyme with chop), but | *Firstly, it’s pronounced “'''[[sw-ŏp]]'''” (to rhyme with chop), but it’s spelled “swap”. Any fan of 1970s children's television will know this. It is not, however, true that [[Noel Edmonds]] was a pioneering derivative salesman, but that would make a great play. On no account should you say “'''[[sw-æp]]'''” (to rhyme with “crap”), unless you want derivatives insiders to dine out on your misfortune for many years. I still tell people about an [[Condition precedent|unfortunate partner of Stephenson Harwood]] who made this mistake in 1997. | ||

*Secondly, when articulating the word {{ISDA}} you say | *Secondly, when articulating the word {{ISDA}} you say “'''[[izder]]'''”, not “'''[[eye-ess-dee-aye]]'''”. This was a closely guarded industry in-joke, designed to reveal ingénues, but sadly the spoil-sport makers of ''The Big Short''<ref>{{google3|The|Big|Short}}.</ref> have rumbled it. | ||

===History=== | |||

Where did they come from? What were their architects thinking? For this and more, see [[Swap history]]. | |||

===Present day=== | |||

What? You want actual ''information'' about swaps? Go, then, to the [[ISDA Anatomy]] | |||

{{sa}} | |||

*[[Financial weapons of mass destruction]] | |||

*[[ISDA Anatomy]] | |||

{{ref}} | |||

Latest revision as of 13:30, 14 August 2024

|

“Swap” as explained to my neighbor Phil

Financial concepts my neighbour Phil was asking about when I borrowed his mower. Index: Click ᐅ to expand:

|

Generally, those derivative contracts entered into under an ISDA Master Agreement. Two rookie mistakes to avoid:

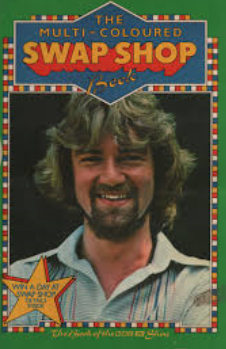

- Firstly, it’s pronounced “sw-ŏp” (to rhyme with chop), but it’s spelled “swap”. Any fan of 1970s children's television will know this. It is not, however, true that Noel Edmonds was a pioneering derivative salesman, but that would make a great play. On no account should you say “sw-æp” (to rhyme with “crap”), unless you want derivatives insiders to dine out on your misfortune for many years. I still tell people about an unfortunate partner of Stephenson Harwood who made this mistake in 1997.

- Secondly, when articulating the word ISDA you say “izder”, not “eye-ess-dee-aye”. This was a closely guarded industry in-joke, designed to reveal ingénues, but sadly the spoil-sport makers of The Big Short[2] have rumbled it.

History

Where did they come from? What were their architects thinking? For this and more, see Swap history.

Present day

What? You want actual information about swaps? Go, then, to the ISDA Anatomy

See also

References

- ↑ Don’t do this. I mean, really, don’t.

- ↑ Let me Google that for you.