Template:Record amount paid amount ex amount: Difference between revisions

Amwelladmin (talk | contribs) Created page with "===Careful: it’s about timing, not amount=== So what is the difference betwixt a {{eqderivprov|Record Amount}}, {{eqderivprov|Paid Amount}} and {{eqderivprov|Ex Amount}}? To..." |

Amwelladmin (talk | contribs) No edit summary |

||

| (19 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

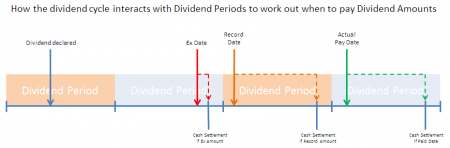

===Careful: it’s about timing, not amount=== | [[File:Dividend cycle.png|450px|thumb|right|How the dividend cycle interacts with the Dividend Periods in the {{eqderivdefs}}.]] | ||

===Careful: it’s (meant to be) about ''timing'', not amount=== | |||

So what is the difference betwixt a {{eqderivprov|Record Amount}}, {{eqderivprov|Paid Amount}} and {{eqderivprov|Ex Amount}}? To be clear, it is ''not'' about ''whether'' you get paid, nor ''how much'', but ''when''. A {{eqderivprov|Dividend Amount}} is a {{eqderivprov|Dividend Amount}}: in each case “100%<ref>Or whatever other percentage you agree, of course.</ref> of the gross cash dividend per Share”, end of the day. What this is all to do with is ''when'' a {{eqderivprov|Dividend Amount}} is deemed to occur, which in turn is a function of which {{eqderivprov|Dividend Period}} the trigger for the dividend falls in. | So what is the difference betwixt a {{eqderivprov|Record Amount}}, {{eqderivprov|Paid Amount}} and {{eqderivprov|Ex Amount}}? To be clear, it is ''not'' about ''whether'' you get paid, nor ''how much'', but ''when''. A {{eqderivprov|Dividend Amount}} is a {{eqderivprov|Dividend Amount}}: in each case “100%<ref>Or whatever other percentage you agree, of course.</ref> of the gross cash dividend per Share”, end of the day. What this is all to do with is ''when'' a {{eqderivprov|Dividend Amount}} is deemed to occur, which in turn is a function of which {{eqderivprov|Dividend Period}} the trigger for the dividend falls in. | ||

*The trigger where {{eqderivprov|Record Amount}} applies is the '''[[record date]]''' for the dividend in question. You should pay the gross cash dividend on the {{eqderivprov|Cash Settlement Payment Date}} for that {{eqderivprov|Dividend Period}} in which the [[record date]] falls. | *The trigger where {{eqderivprov|Record Amount}} applies is the '''[[record date]]''' for the dividend in question. You should pay the gross cash dividend on the {{eqderivprov|Cash Settlement Payment Date}} for that {{eqderivprov|Dividend Period}} in which the [[record date]] falls. | ||

*The trigger where {{eqderivprov|Ex Amount}} applies is the '''[[ex date]]''' for the dividend in question. You should pay the gross cash dividend on the {{eqderivprov|Cash Settlement Payment Date}} for that {{eqderivprov|Dividend Period}} in which the [[ex date]] falls. | *The trigger where {{eqderivprov|Ex Amount}} applies is the '''[[ex date]]''' for the dividend in question. You should pay the gross cash dividend on the {{eqderivprov|Cash Settlement Payment Date}} for that {{eqderivprov|Dividend Period}} in which the [[ex date]] falls. | ||

*The trigger where {{eqderivprov|Paid Amount}} applies is the '''payment date''' for the dividend in question. You should pay the gross cash dividend on the {{eqderivprov|Cash Settlement Payment Date}} for that {{eqderivprov|Dividend Period}} in which the dividend is paid. | *The trigger where {{eqderivprov|Paid Amount}} applies is the '''payment date''' for the dividend in question. You should pay the gross cash dividend on the {{eqderivprov|Cash Settlement Payment Date}} for that {{eqderivprov|Dividend Period}} in which the dividend is paid. | ||

===Hang on a minute. “Paid”? Is that, like, different to “declared”? On purpose?=== | |||

Is {{eqderivprov|Paid Amount}} meant to be different from {{eqderivprov|Record Amount}} or {{eqderivprov|Ex Amount}}, in referencing not what is ''declared'', but what the {{eqderivprov|Issuer}} actually physically, real-world, ''paid'' out? | |||

On one hand, on a natural reading it seems so: {{eqderivprov|Record Amount}} and {{eqderivprov|Ex Amount}} specify an amount by reference to the amount “declared by the {{eqderivprov|Issuer}} to [[holder of record|holders of record]] of a {{eqderivprov|Share}}”, whereas {{eqderivprov|Paid Amount}} references the amount “''paid'' by the {{eqderivprov|Issuer}} during the relevant {{eqderivprov|Dividend Period}} to [[holder of record|holders of record]]”. On the other hand there’s no sensible reason for supposing an {{eqderivprov|Equity Amount Payer}} would want to keep the risk of solvency of an {{isdaprov|Issuer}} if it pays early<ref>or ever, really: that defeats the purpose of an equity derivative</ref> but ''not'' have it if it pays on the payment date. Examination of the world wide web seems to offer little help. | |||

But here’s a common-sense explanation. Remember the timing of the dividend process: first it is declared, then, a short [[settlement cycle]] before the [[Record date|record date]] the share trades “ex-div” (this is the “[[ex date]]”), and only then, two or three weeks ''after'' the [[record date]], is the actual {{eqderivprov|Dividend Payment Date}}. And remember this whole farrago is to determine ''in which {{eqderivprov|Dividend Period}} the {{eqderivprov|Dividend Amount}} gets paid''. | |||

Now, if you chose {{eqderivprov|Ex Amount}}, your {{eqderivprov|Cash Settlement Payment Date}} may well fall ''before'' the actual {{eqderivprov|Dividend Payment Date}}, in which case ''it doesn’t make sense to talk about the dividend paid by the issuer, because it won’t have been paid yet''. If you selected {{eqderivprov|Paid Amount}}, the {{eqderivprov|Cash Settlement Payment Date}} necessarily will fall ''after'' the {{eqderivprov|Dividend Payment Date}}, so it is safe to talk about the dividend having been paid. Because it must have been — and in the disaster scenario where it hasn’t — ie, the corporate failure of the underlying issuer — the {{eqderivprov|Equity Amount Payer}} won’t want to be paying out a {{eqderivprov|Dividend Amount}} anyway. | |||

But as for the very good question ''why'' would ''any'' [[equity derivative]] purport to pay out a {{eqderivprov|Dividend Amount}} ''before'' the actual real-world payment date for the Dividend it is synthetically replicating? This is a question only {{icds}} would be placed to answer, and they’re not talking. | |||

Latest revision as of 08:50, 17 May 2022

Careful: it’s (meant to be) about timing, not amount

So what is the difference betwixt a Record Amount, Paid Amount and Ex Amount? To be clear, it is not about whether you get paid, nor how much, but when. A Dividend Amount is a Dividend Amount: in each case “100%[1] of the gross cash dividend per Share”, end of the day. What this is all to do with is when a Dividend Amount is deemed to occur, which in turn is a function of which Dividend Period the trigger for the dividend falls in.

- The trigger where Record Amount applies is the record date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the record date falls.

- The trigger where Ex Amount applies is the ex date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the ex date falls.

- The trigger where Paid Amount applies is the payment date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the dividend is paid.

Hang on a minute. “Paid”? Is that, like, different to “declared”? On purpose?

Is Paid Amount meant to be different from Record Amount or Ex Amount, in referencing not what is declared, but what the Issuer actually physically, real-world, paid out?

On one hand, on a natural reading it seems so: Record Amount and Ex Amount specify an amount by reference to the amount “declared by the Issuer to holders of record of a Share”, whereas Paid Amount references the amount “paid by the Issuer during the relevant Dividend Period to holders of record”. On the other hand there’s no sensible reason for supposing an Equity Amount Payer would want to keep the risk of solvency of an Issuer if it pays early[2] but not have it if it pays on the payment date. Examination of the world wide web seems to offer little help.

But here’s a common-sense explanation. Remember the timing of the dividend process: first it is declared, then, a short settlement cycle before the record date the share trades “ex-div” (this is the “ex date”), and only then, two or three weeks after the record date, is the actual Dividend Payment Date. And remember this whole farrago is to determine in which Dividend Period the Dividend Amount gets paid.

Now, if you chose Ex Amount, your Cash Settlement Payment Date may well fall before the actual Dividend Payment Date, in which case it doesn’t make sense to talk about the dividend paid by the issuer, because it won’t have been paid yet. If you selected Paid Amount, the Cash Settlement Payment Date necessarily will fall after the Dividend Payment Date, so it is safe to talk about the dividend having been paid. Because it must have been — and in the disaster scenario where it hasn’t — ie, the corporate failure of the underlying issuer — the Equity Amount Payer won’t want to be paying out a Dividend Amount anyway.

But as for the very good question why would any equity derivative purport to pay out a Dividend Amount before the actual real-world payment date for the Dividend it is synthetically replicating? This is a question only ISDA’s crack drafting squad™ would be placed to answer, and they’re not talking.