|

|

| (4 intermediate revisions by the same user not shown) |

| Line 1: |

Line 1: |

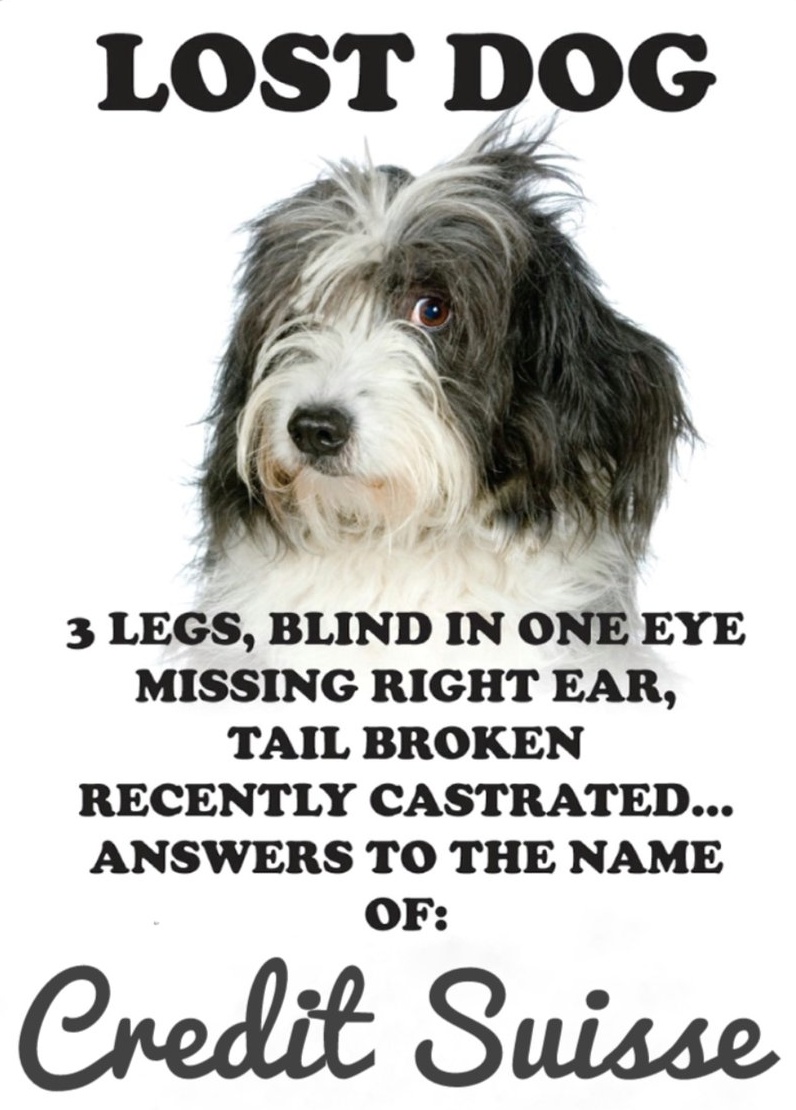

| {{a|myth|{{image|Lucky Dog|jpg|}} }}Old “[[Lucky]]”, the proverbial missing dog of modern international finance. Also known amongst banking analysts as “[[Debit Suisse]]”. | | {{a|disaster|{{image|Lucky Dog|jpg|}} {{subtable|{{Disaster roll|Credit Suisse}}}}}}Old “[[Lucky]]”, the proverbial missing dog of modern international finance. Also known amongst banking analysts as “[[Debit Suisse]]”. |

|

| |

|

| For some years it has been an immutable rule of the market that if an unfortunate, weird, dumb, or preposterous thing happens in the market, Credit Suisse is sure to be involved and, if it hasn’t actually ''caused'' it, will be on the wrong ''end'' of it. This is the role that Deutsche Bank used to play. | | For some years it was an immutable rule of the market that if an unfortunate, weird, dumb, or preposterous thing happens in the market, Credit Suisse was sure to be involved and, if it hadn’t actually ''caused'' it, would be on the wrong ''end'' of it. |

| ===Bullet dodged — or opportunity missed?===

| |

| Ironically — though, possibly ''causatively'' — Credit Suisse escaped the [[Global Financial Crisis]] comparatively unscathed. While its peers and competitors were being bailed out, nationalised, eviscerated, stress tested, analysed, supervised, inspected generally groped with great snapping regulatory rubber gloves on parts of their institutional anatomies they didn’t know ''could'' be groped, old Lucky got a pass, sat pretty and thumbed its nose at all the hubris.

| |

|

| |

|

| It may now wish it had been given the rubber glove treatment while the going was good. For its peers seem — and look, its ''always'' to early to say this sort of thing, but for now, they seem — the better for it: they look to have learned lessons about how banks should behave that Credit Suisse, apparently, did not.

| | Ironically — though, possibly ''causatively'' — Credit Suisse escaped the [[Global Financial Crisis]] comparatively unscathed. While its peers and competitors were being bailed out, nationalised, eviscerated, stress tested, analysed, supervised, inspected and generally groped with great snapping regulatory rubber gloves on parts of their institutional anatomies they didn’t know ''could'' be groped, old “Lucky” got a pass, sat pretty and thumbed its nose at all the hubris. |

| ===A gradual, but insistent, descent into the abyss===

| |

| So here we now are: after a period of seven or more years in which Credit Suisse seemingly was drawn, like a moth to a candle, to every financial catastrophe going — its spying on its own executives, Malachite, [[Archegos]], Greensill, Evergrande, [[Covid-19]], 1MDB, [[tax]] evasion, lockdown breaches, serial [[KYC]] and [[money laundering]] breaches, Bulgarian drug trafficking, a $500 million insurance fraud on the Georgian prime minister, $850m Mozambique tuna bonds fraud, and diverse sanction breaches — things looked like they were reaching an end-game in 2023 following the failure of the [[Silicon Valley Bank]] and a sudden market-wide loss of confidence in the Swiss lender.

| |

| ===Ironic endgame===

| |

| The irony in all of this? The [[SVB]] collapse was perhaps the first major financial scandal in a decade that old “Lucky” the one-eyed dog had nothing to to with whatsoever.

| |

| | |

| But, when market confidence in the global banking sector sank, it sank even more for Credit Suisse, dropping 30% in a day on the Ides of March. When its cornerstone investor, the Saudi National Bank, baulked at a capital call, Credit Suisse was forced to beg for a public statement of confidence from the Swiss National Bank and, when that didn’t work, a CHF50bn liquidity facility. That was enough to end Credit Suisse’s prospects as a credible global banking institution.

| |

| | |

| The consensus remains that, while the bank isn’t dead as such, it is only not dead thanks to the iron lung it is presently strapped to, so we might as well wind it down now, since it ain’t coming back.

| |

| | |

| Who would want it? Good question.

| |

|

| |

|

| | It may wish it had been given the rubber glove treatment while the going was good. For its peers seem — and look, its ''always'' to early to say this sort of thing, but for now, they ''seem'' — the better for it: they look to have learned lessons about how banks should behave that Credit Suisse, apparently, did not. |

| {{Sa}} | | {{Sa}} |

| *[[Archegos]] | | *[[Archegos]] |

| *[[The dog in the night-time]] | | *[[The dog in the night-time]] |

| *[https://www.dailymail.co.uk/news/article-11869227/Credit-Suisses-sandals-missteps-losses-turmoil-recent-years.html The Daily Mail’s catalogue of Credit Suisse’s recent disasters] | | *[https://www.dailymail.co.uk/news/article-11869227/Credit-Suisses-sandals-missteps-losses-turmoil-recent-years.html The Daily Mail’s catalogue of Credit Suisse’s recent disasters] |

|

Chez Guevara — Dining in style at the Disaster Café™

|

Extract from the JC’s financial disasters roll of honour

| Scandal |

Date |

Where |

Loss |

Reason |

Firings |

Jail-Time?

|

| Credit Suisse |

Switzerland |

Gradual decline into entropy with a 92% decline in share price since 2015. |

Hubris, widespread incompetence, stupidity, spying, uselessness. |

Billions and billions over a series of avoidable cockups. |

Like the old man in Monty Python and the Holy Grail, “I’m not dead. I think I’m going for a walk. I feel happy.” Market (to SNB): “Isn’t there anything you can do?” |

It is not, yet, a crime to make a series of howling cockups[1] over a credulity-defying period any more than it is a crime to not read an AT1 prospectus. Reputations damaged for ever, but alas no porridge, however richly deserved it may seem.

|

Suisse&action=edit edit template

|

Index: Click ᐅ to expand:

|

|

Old “Lucky”, the proverbial missing dog of modern international finance. Also known amongst banking analysts as “Debit Suisse”.

For some years it was an immutable rule of the market that if an unfortunate, weird, dumb, or preposterous thing happens in the market, Credit Suisse was sure to be involved and, if it hadn’t actually caused it, would be on the wrong end of it.

Ironically — though, possibly causatively — Credit Suisse escaped the Global Financial Crisis comparatively unscathed. While its peers and competitors were being bailed out, nationalised, eviscerated, stress tested, analysed, supervised, inspected and generally groped with great snapping regulatory rubber gloves on parts of their institutional anatomies they didn’t know could be groped, old “Lucky” got a pass, sat pretty and thumbed its nose at all the hubris.

It may wish it had been given the rubber glove treatment while the going was good. For its peers seem — and look, its always to early to say this sort of thing, but for now, they seem — the better for it: they look to have learned lessons about how banks should behave that Credit Suisse, apparently, did not.

See also

- ↑ except where the individual cockups were themselves criminal of course