Early redemption: Difference between revisions

Amwelladmin (talk | contribs) Created page with "{{a|repack|}} ====Hedge Termination==== {{L3}}'''Early Redemption Event under Notes''': Promptly after becoming aware of an Event of Default or Termination Event under the Hedge Issuer must give an Early Redemption Notice to the Noteholders and the Affected Notes will become due and payable at their Early Redemption Amount on the Early Redemption Date. <li> '''Early Termination Date under Notes''': If Issuer becomes aware it can designate an Early Termination Date for al..." |

Amwelladmin (talk | contribs) No edit summary |

||

| (3 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

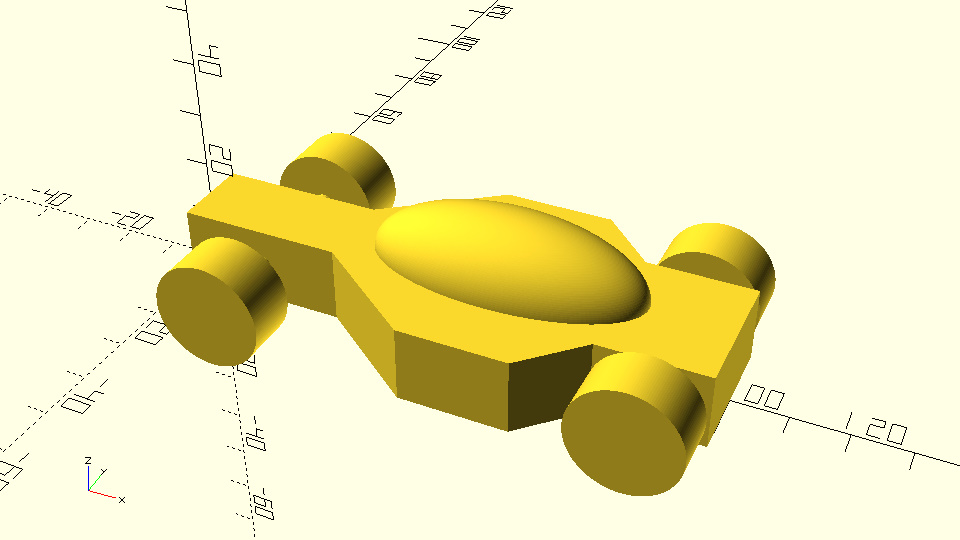

{{a|repack|}} | {{a|repack|{{image|racing car|jpg|A repack programme blueprint yesterday.}}}}One of the delicate encasements and springs of a repackaging structure is the relationship on termination between the Swap and the Note. They are curiously symbiotic things: the Note seems to be the important instrument, for this is what the Investor holds; however, the swap is the engine that does all the transformational magic, taking whatever the Asset does, and converting it into the cashflow required to fund the Note payoff. | ||

==== | ====The old “racing car” metaphor==== | ||

{{ | {{Drop|I|t’s a bit}} blokey, I know, and the JC is not a natural petrol-head, but the old “racing car” [[metaphor]] is a useful way of framing this — it is a vehicle after all: think of the assets as the petrol in the petrol tank, the swap as the engine taking in the asset juice and converting it into power and steering, and the Note as the chassis and wheels moving the vehicle along and of course those comfy leather seats and the uber-sexy carbon-fibre body. | ||

''' | |||

'' | *'''Assets are the petrol in the petrol tank''': Clearly, the petrol tank springing a leak is a problem — that is the equivalent of an Asset failure: not enough fuel getting to the engine to keep the swap going. | ||

*'''Swap is the engine and the steering''': And throwing a rod in the engine or snapping the differential — the Swap — will blow the whole thing up too: — doesn’t matter how much petrol you got if the motor has blown. | |||

*'''Notes are the wheelbase and body''': But if the chassis falls apart or the wheels fall off, you ain’t going anywhere either. This ought not to happen if you have a decent engineering team, but — you know — earthquakes. You can get shot at. | |||

Unforeseen events causing failures to each of these component groups need to have a halting effect on the rest of the structure. | |||

An asset failure will naturally do that, because the SPV won’t have assets to meet the swap payments, and the swap will terminate under its own steam. Likewise, a Swap Counterparty failure means the SPV has no one to pay its asset cashflows to, and no expectation of getting anything back if it did, so that is an obvious Early Redemption Event (and a cue to realise the market value of the Asset to fund the early redemption amount. | |||

====Vehicle failures==== | |||

{{drop|B|ut what about}} when Notes fail for reasons unrelated to the Asset or Swap Counterparty? As noted, this ''shouldn’t'' happen in the ordinary course: one builds a secured, limited recourse note vehicle precisely so it ''can’t'' fail — but laws and circumstances can change. Extra-judicial things can happen. Taxes can be imposed. These events will trigger unwind of the Note, which means the Swap must terminate. | |||

This creates a tension for the swap, especially where the Swap is [[out-of-the-money]] to the (innocent) Swap Counterparty, who might not ''want'' to terminate the swap and therefore book a [[mark-to-market]] loss. and as we know, a non-defaulting Party, when presented with an opportunity to designate an Early Termination Date, is not obliged to take it. This is less of a priority in our days of bilateral margining — but typically repackaging vehicles ''do not pay or receive margin''. | |||

In a repackaging, the counterparty must take it. Older repack programmes hard-wired the termination in as a mandatory Additional Termination Event which the Swap Counterparty ''and'' Issuer (and its agents) are designated as Non-affected Parties and therefore entitled to designate an {{isdaprov|Early Termination Date}}. In modern ones, like SPIRE, the Issuer must notify the Noteholders and Trustee, and therefore must only terminate the Swap on the Trustee’s direction, which in turn entitles the Trustee to seek Noteholder indemnification before giving that instruction. We don’t understand that additional protection. | |||

What is the order of ceremonies under your hedging agreement if there is an unrelated early redemption event under the Notes? | |||

Latest revision as of 14:59, 13 June 2024

|

The Law and Lore of Repackaging

|

One of the delicate encasements and springs of a repackaging structure is the relationship on termination between the Swap and the Note. They are curiously symbiotic things: the Note seems to be the important instrument, for this is what the Investor holds; however, the swap is the engine that does all the transformational magic, taking whatever the Asset does, and converting it into the cashflow required to fund the Note payoff.

The old “racing car” metaphor

It’s a bit blokey, I know, and the JC is not a natural petrol-head, but the old “racing car” metaphor is a useful way of framing this — it is a vehicle after all: think of the assets as the petrol in the petrol tank, the swap as the engine taking in the asset juice and converting it into power and steering, and the Note as the chassis and wheels moving the vehicle along and of course those comfy leather seats and the uber-sexy carbon-fibre body.

- Assets are the petrol in the petrol tank: Clearly, the petrol tank springing a leak is a problem — that is the equivalent of an Asset failure: not enough fuel getting to the engine to keep the swap going.

- Swap is the engine and the steering: And throwing a rod in the engine or snapping the differential — the Swap — will blow the whole thing up too: — doesn’t matter how much petrol you got if the motor has blown.

- Notes are the wheelbase and body: But if the chassis falls apart or the wheels fall off, you ain’t going anywhere either. This ought not to happen if you have a decent engineering team, but — you know — earthquakes. You can get shot at.

Unforeseen events causing failures to each of these component groups need to have a halting effect on the rest of the structure.

An asset failure will naturally do that, because the SPV won’t have assets to meet the swap payments, and the swap will terminate under its own steam. Likewise, a Swap Counterparty failure means the SPV has no one to pay its asset cashflows to, and no expectation of getting anything back if it did, so that is an obvious Early Redemption Event (and a cue to realise the market value of the Asset to fund the early redemption amount.

Vehicle failures

But what about when Notes fail for reasons unrelated to the Asset or Swap Counterparty? As noted, this shouldn’t happen in the ordinary course: one builds a secured, limited recourse note vehicle precisely so it can’t fail — but laws and circumstances can change. Extra-judicial things can happen. Taxes can be imposed. These events will trigger unwind of the Note, which means the Swap must terminate.

This creates a tension for the swap, especially where the Swap is out-of-the-money to the (innocent) Swap Counterparty, who might not want to terminate the swap and therefore book a mark-to-market loss. and as we know, a non-defaulting Party, when presented with an opportunity to designate an Early Termination Date, is not obliged to take it. This is less of a priority in our days of bilateral margining — but typically repackaging vehicles do not pay or receive margin.

In a repackaging, the counterparty must take it. Older repack programmes hard-wired the termination in as a mandatory Additional Termination Event which the Swap Counterparty and Issuer (and its agents) are designated as Non-affected Parties and therefore entitled to designate an Early Termination Date. In modern ones, like SPIRE, the Issuer must notify the Noteholders and Trustee, and therefore must only terminate the Swap on the Trustee’s direction, which in turn entitles the Trustee to seek Noteholder indemnification before giving that instruction. We don’t understand that additional protection.

What is the order of ceremonies under your hedging agreement if there is an unrelated early redemption event under the Notes?