Credit Suisse: Difference between revisions

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

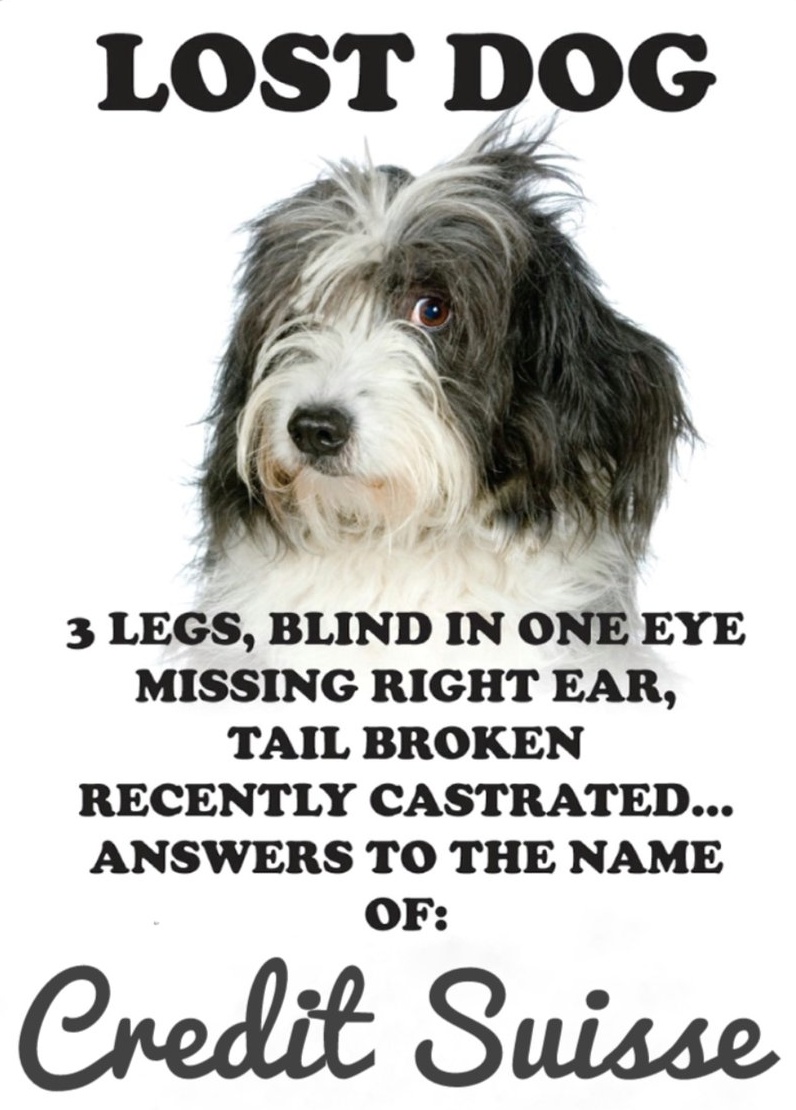

{{a|myth|{{image|Lucky Dog|jpg|}} }}The proverbial missing dog of modern international finance. If an unfortunate, weird, dumb, or preposterous thing happens in the market, chances are Credit Suisse will be involved and, most likely, on the wrong end of it. | {{a|myth|{{image|Lucky Dog|jpg|}} }}The proverbial missing dog of modern international finance. If an unfortunate, weird, dumb, or preposterous thing happens in the market, chances are Credit Suisse will be involved and, most likely, on the wrong end of it. After a period of seven or more years in which Credit Suisse seemingly was drawn to every prevailing financial catastrophe like a moth to a candle — or was actively creating them itself — events such as its spying on its own executives, Malachite, [[Archegos]], [[Greensill]], Evergrande, [[Covid-19]], [[1MDB]], [[tax]] evasion, lockdown breaches, serial [[KYC]] and [[money laundering]] breaches, Bulgarian drug trafficking, Mozambique tuna bonds corruption, sanction breaches, things looked like they were reaching an end game in 2023 following the failure of the [[Silicon Valley Bank]] — the irony being that this was the first major financial scandal in a decade that Credit Suisse had nothing to to with whatsoever. | ||

{{Sa}} | {{Sa}} | ||

*[[Archegos]] | *[[Archegos]] | ||

Revision as of 10:03, 17 March 2023

|

The proverbial missing dog of modern international finance. If an unfortunate, weird, dumb, or preposterous thing happens in the market, chances are Credit Suisse will be involved and, most likely, on the wrong end of it. After a period of seven or more years in which Credit Suisse seemingly was drawn to every prevailing financial catastrophe like a moth to a candle — or was actively creating them itself — events such as its spying on its own executives, Malachite, Archegos, Greensill, Evergrande, Covid-19, 1MDB, tax evasion, lockdown breaches, serial KYC and money laundering breaches, Bulgarian drug trafficking, Mozambique tuna bonds corruption, sanction breaches, things looked like they were reaching an end game in 2023 following the failure of the Silicon Valley Bank — the irony being that this was the first major financial scandal in a decade that Credit Suisse had nothing to to with whatsoever.