Triparty agent: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

One who manages a [[tri-party collateral system]]. A [[custodian]] who opens separate accounts in the name of a borrower and lender, and transfers collateral between them at their joint instruction, in satisfaction of [[margin]] obligations under a separate master agreement. | [[File:Triparty Diagram.png|500px|thumb|A triparty agent structure yesterday]] | ||

One who manages a [[tri-party collateral system]]. A [[custodian]] who opens separate accounts in the name of a {{gmslaprov|borrower}} and {{gmslaprov|lender}}, and transfers collateral between them at their joint instruction, in satisfaction of [[margin]] obligations under a separate [[master agreement]]. | |||

Can be a useful fellow if you want to grant [[Security interest|security]] over a revolving pool of securities and retain a right of substitution. | Very popular with [[agent lending]] participants as a handy way of managing collateral flows, as this handy diagram purports to illustrate. | ||

Can be a useful fellow if you want to grant [[Security interest|security]] over a revolving pool of securities and retain a right of substitution. Some useful discussion there at [[Financial Collateral Regulations]]. | |||

{{Seealso}} | {{Seealso}} | ||

Revision as of 17:20, 9 April 2019

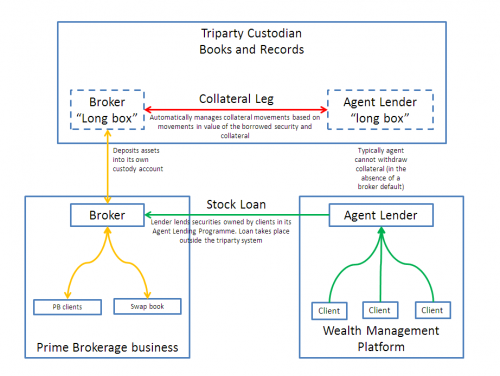

One who manages a tri-party collateral system. A custodian who opens separate accounts in the name of a borrower and lender, and transfers collateral between them at their joint instruction, in satisfaction of margin obligations under a separate master agreement.

Very popular with agent lending participants as a handy way of managing collateral flows, as this handy diagram purports to illustrate.

Can be a useful fellow if you want to grant security over a revolving pool of securities and retain a right of substitution. Some useful discussion there at Financial Collateral Regulations.