Account control agreement: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{a|gmslaanat| | {{a|gmslaanat|[[File:Triparty Diagram.png|500px]]}} | ||

[[File:Triparty Diagram.png|500px]] | |||

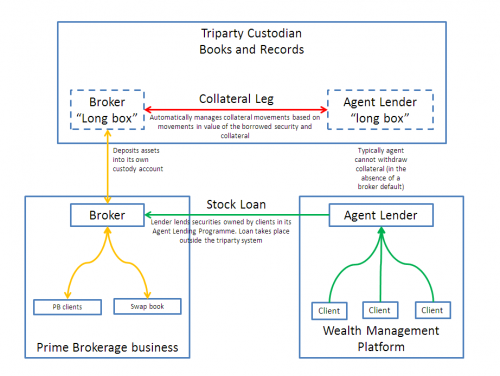

also known as a [[tri-party collateral arrangement]]; an arrangement wherein a debtor [[pledge]]s collateral to a [[custodian]] to hold it for that [[pledgor]], but subject to a security in favour of a [[pledgee]]. The agreement generally provides that neither party may instruct the custodian to do anything with the asset without the other's consent, except in the direst of circumstances. | also known as a [[tri-party collateral arrangement]]; an arrangement wherein a debtor [[pledge]]s collateral to a [[custodian]] to hold it for that [[pledgor]], but subject to a security in favour of a [[pledgee]]. The agreement generally provides that neither party may instruct the custodian to do anything with the asset without the other's consent, except in the direst of circumstances. | ||

Revision as of 17:24, 9 April 2019

|

also known as a tri-party collateral arrangement; an arrangement wherein a debtor pledges collateral to a custodian to hold it for that pledgor, but subject to a security in favour of a pledgee. The agreement generally provides that neither party may instruct the custodian to do anything with the asset without the other's consent, except in the direst of circumstances.

Indemnity

Even in those dark days the custodian will be reluctant to do anything and may ask for an indemnity. Why would you indemnify the Custodian for actions it takes under an account control agreement?

The logic runs something like this:

- Custodian is in the middle. It has no skin in the game.

- If there’s an enforcement event and Pledgee wants to take control of the collateral:

- If Pledgee instructs Custodian wrongly then:

- If Pledgor loses any money as a result:

- Doubtful Custodian has a contractual breach claim against Pledgee, because it was complicit in the breach. Therefore:

- Pledgee can control the liability under the indemnity easily:

- Don’t take control of the collateral when it is not entitled to

- The liability is in any case determinate – it is the contractual damages that the Pledgor can claim from Custodian as a result.

- Assuming Pledgee doesn’t go bust, Pledgee can return the collateral and maybe suffer some buy in costs but that’s realistically it.

- Pledgee would have exactly the same liability if it held the collateral itself as Custodian and didn’t return it when Pledgor was entitled to it.