Prime brokerage transactions: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) m Amwelladmin moved page Prime brokerage physical long to Prime brokerage transactions |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{a|PB|[[File:PB margin loans.png|450px|thumb|center|The classic margin loan, yesterday]]}} | {{a|PB|[[File:PB margin loans.png|450px|thumb|center|The classic margin loan, yesterday]] | ||

The classic prime brokerage | [[File:PB stock loans.png|450px|thumb|center|The classic [[stock loan]], yesterday]] | ||

[[File:PB long swap.png|450px|thumb|center|The classic long swap, yesterday]] | |||

[[File:PB short swap.png|450px|thumb|center|The classic short swap, yesterday]] | |||

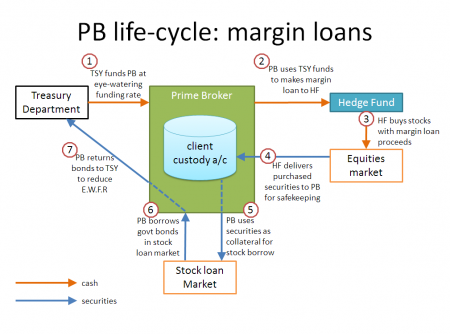

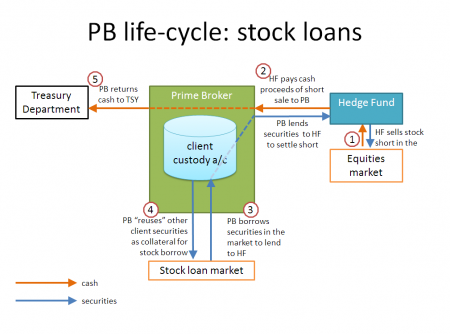

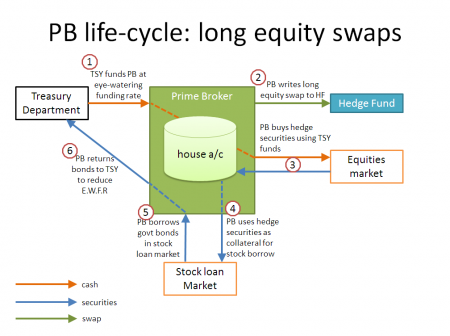

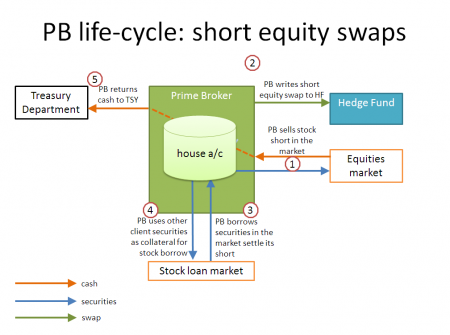

}}The classic prime brokerage transactions, illustrated in the panel: | |||

*'''Physical long''': A physical long position financed with a [[margin loan]]. | |||

*'''Physical short''': A physical short position created by selling a stock borrowed under a [[stock loan]]. | |||

*'''Synthetic long''': A “[[synthetic]]” economic equivalent of a physical long position created by entering an equity derivative as a {{eqderivprov|Floating Amount Payer}}. | |||

*'''Synthetic short''': A “[[synthetic]]” economic equivalent of a physical short position created by entering an equity derivative as a {{eqderivprov|Equity Amount Payer}}. | |||

{{sa}} | {{sa}} | ||

*[[Prime brokerage]] | *[[Prime brokerage]] | ||

Revision as of 17:51, 6 January 2021

|

Prime Brokerage Anatomy™

|

The classic prime brokerage transactions, illustrated in the panel:

- Physical long: A physical long position financed with a margin loan.

- Physical short: A physical short position created by selling a stock borrowed under a stock loan.

- Synthetic long: A “synthetic” economic equivalent of a physical long position created by entering an equity derivative as a Floating Amount Payer.

- Synthetic short: A “synthetic” economic equivalent of a physical short position created by entering an equity derivative as a Equity Amount Payer.