Template:M intro work What will It look like: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

Another thoughtpiece from yours truly on the prospect of technology overhauling legal processes. Legal processes are, in their essence, ''human'' processes: small slivers of mortal psychology rendered through the medium of words and phrases, but that substrate is not the point: it is the pantomime that matters. | |||

The [[head of documentation]] at a broker I once knew<ref>Names and dates have been changed to protect my reputation.</ref> was offered free internal consulting time, ostensibly, to workshop what kinds of technology could be applied to her operation to enhance and streamline the documentation and onboarding process. | The [[head of documentation]] at a broker I once knew<ref>Names and dates have been changed to protect my reputation.</ref> was offered free internal consulting time, ostensibly, to workshop what kinds of technology could be applied to her operation to enhance and streamline the documentation and onboarding process. | ||

Revision as of 15:25, 14 July 2023

Another thoughtpiece from yours truly on the prospect of technology overhauling legal processes. Legal processes are, in their essence, human processes: small slivers of mortal psychology rendered through the medium of words and phrases, but that substrate is not the point: it is the pantomime that matters.

The head of documentation at a broker I once knew[1] was offered free internal consulting time, ostensibly, to workshop what kinds of technology could be applied to her operation to enhance and streamline the documentation and onboarding process.

(Onboarding is a perennial thorn in the paw of any good-sized financial institution. It takes forever, is fiddly, covers many basic risks, but the process is regarded as a dead weight amongst revenue generating staff: a four-month period that essentially retards the basis business of making money. The resting attitude of sales towards negotiation teams is basically resentment.)

Free money and resources in a financial services organisation are rare, so she leapt at the chance.

Documenting master trading arrangements across all business fronts of a full-service global broker/dealer is immensely complicated. There are ten basic products, fifteen basic counterparty types and as many as a hundred jurisdictions: just maintaining consistent templates is a monstrous task.

So the head of docs said, “this is great. A robust document assembly application will cut out an enormous amount of work.”

The internal consultant said, “perhaps so. But we should test that.”

What the consultant proposed was this:

Break down process

Divide your documentation process as best you can, into its major components.

The doc team’s components were something like this:

- Allocation to a negotiator

- Liaise with Credit to finalise credit terms - often the file would carry incomplete instructions from Credit

- Assemble and send draft

- Await comments

- Resolve comments, liaising with relevant internal stakeholders as required

- Amend and send redraft

- Repeat previous three steps until all comments cleared and agreement reached.

- Compile closing memo containing record of all deviations from pre-approved template

- Send for execution

- Send executed document for filing and formal logging in firm’s risk systems.

Estimate critical path

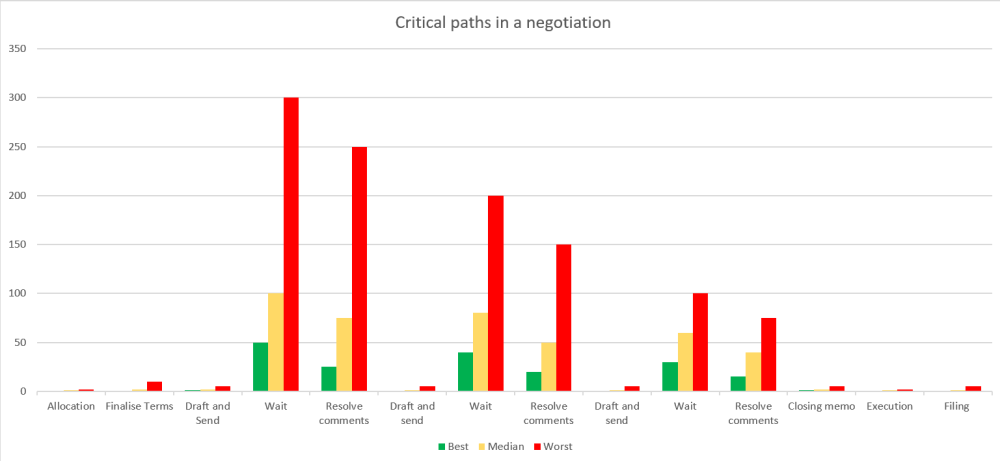

Next, the consultant said: okay, “for each stage in that process, estimate the fastest possible time you could conceivably carry out that job, assuming you were doing it thoroughly, and all stars were aligned, and everyone on whom the process depends responds promptly and accurately.”

“Then estimate what would would expect the median time for that process, assuming normal operating conditions: normal amounts of confusion, delay, interruption and interpersonal interaction.”

“Then estimate a realistic bad outcome for each phase, where things did not go well at all. Not impossibly bad, but “within a range of actual experience” bad.”

| Time | Preparation | Round 1 | Round 2 | Round 3 | Finalising | |||||||||

| Allocation | Credit Terms | Draft | Send & wait | Resolve | Redraft | Send & wait | Resolve | Redraft | Send & wait | Resolve | Closing Memo | Execution | Filing | |

| Best case | 0.5 | 0 | 1 | 50 | 25 | 0.25 | 40 | 20 | 0.25 | 30 | 15 | 1 | 0.5 | 0.5 |

| Median Case | 1 | 2 | 2 | 100 | 75 | 1.5 | 80 | 50 | 1.5 | 60 | 40 | 2 | 1 | 1 |

| Bad case | 2 | 10 | 5 | 300 | 250 | 5 | 250 | 150 | 5 | 150 | 125 | 5 | 2 | 5 |

Now, plot these three lines on a chart.

|

As you can see in each case, there is significant variation. The more requirement for horizontal interaction within the firm to complete the task, the greater the variance — because the negotiator lost effective control of the process. Where the negotiator had to interact with people outside the firm, she lost total control of the process. Here the variance was greatest. With some clients, the process was resolved in a single round in a couple of days. With others, it could take months or even years. One organisation took four years to conclude a basic stock lending agreement between two of its own European affiliates.

- ↑ Names and dates have been changed to protect my reputation.