Breakage costs: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{a|banking|}}{{qd|Breakage costs|/ˈbreɪkɪdʒ kɒsts/|n|{{l1}}(''[[Loan]]s'') The opportunity cost to a [[lender]] of a [[borrower]] repaying a [[loan]] before its stated [[maturity]].<li> | {{a|banking|{{wmc|breakage costs illustration.jpg|Some breakage costs, yesterday.}}}}{{qd|Breakage costs|/ˈbreɪkɪdʒ kɒsts/|n|{{l1}}(''[[Loan]]s'') The opportunity cost to a [[lender]] of a [[borrower]] repaying a [[loan]] before its stated [[maturity]].<li> | ||

(''[[Swap]]s'') the net [[present value]] of the remaining cashflows on a [[swap]].}} | (''[[Swap]]s'') the net [[present value]] of the remaining cashflows on a [[swap]].}} | ||

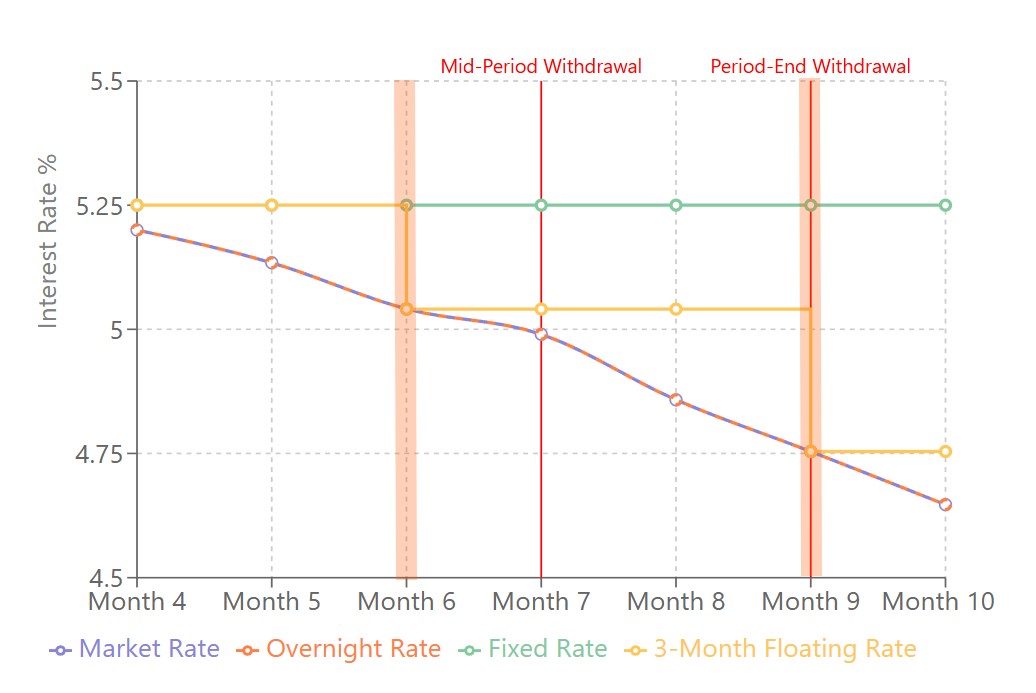

{{drop|B|reakage costs arise}} because the [[lender]] must [[unwind]] its [[interest rate]] [[hedge]]s — usually the difference between the rate payable on the loan for the specified period and the overnight rate. The difference between the [[present value]] of the remaining loan repayments at their stated rate and their present value at the prevailing market rate — that is, the difference between [[present value]] of what I would get if we stuck with the original deal and you repaid the loan at term, and how much I could get if I lent that money out today, at today’s rate, for the remaining term on the original [[loan]] | {{drop|B|reakage costs arise}} because the [[lender]] must [[unwind]] its [[interest rate]] [[hedge]]s — usually the difference between the rate payable on the loan for the specified period and the overnight rate. The difference between the [[present value]] of the remaining loan repayments at their stated rate and their present value at the prevailing market rate — that is, the difference between [[present value]] of what I would get if we stuck with the original deal and you repaid the loan at term, and how much I could get if I lent that money out today, at today’s rate, for the remaining term on the original [[loan]] | ||

Revision as of 11:41, 2 November 2024

|

Banking basics

A recap of a few things you’d think financial professionals ought to know

|

Breakage costs

/ˈbreɪkɪdʒ kɒsts/ (n.)

Breakage costs arise because the lender must unwind its interest rate hedges — usually the difference between the rate payable on the loan for the specified period and the overnight rate. The difference between the present value of the remaining loan repayments at their stated rate and their present value at the prevailing market rate — that is, the difference between present value of what I would get if we stuck with the original deal and you repaid the loan at term, and how much I could get if I lent that money out today, at today’s rate, for the remaining term on the original loan

On the trade date those values must have been equal and on any other day swap break costs will generally be simply the uncollateralised mark-to-market value, or the replacement cost, of the existing transaction. You could also reach that conclusion by going through the motions:

- If I terminated this swap today, what would its MTM be? This is the equivalent of “the present value of the remaining payments".

- If I traded a new swap at today’s prices, what would its MTM be? According to the theory of homo economicus, this ought necessarily to be zero — any other value would mean I was entering into an off-market swap.[1]