Myths and legends of the market

The JC’s guide to the foundational mythology of the markets.™

Index: Click ᐅ to expand:

|

|

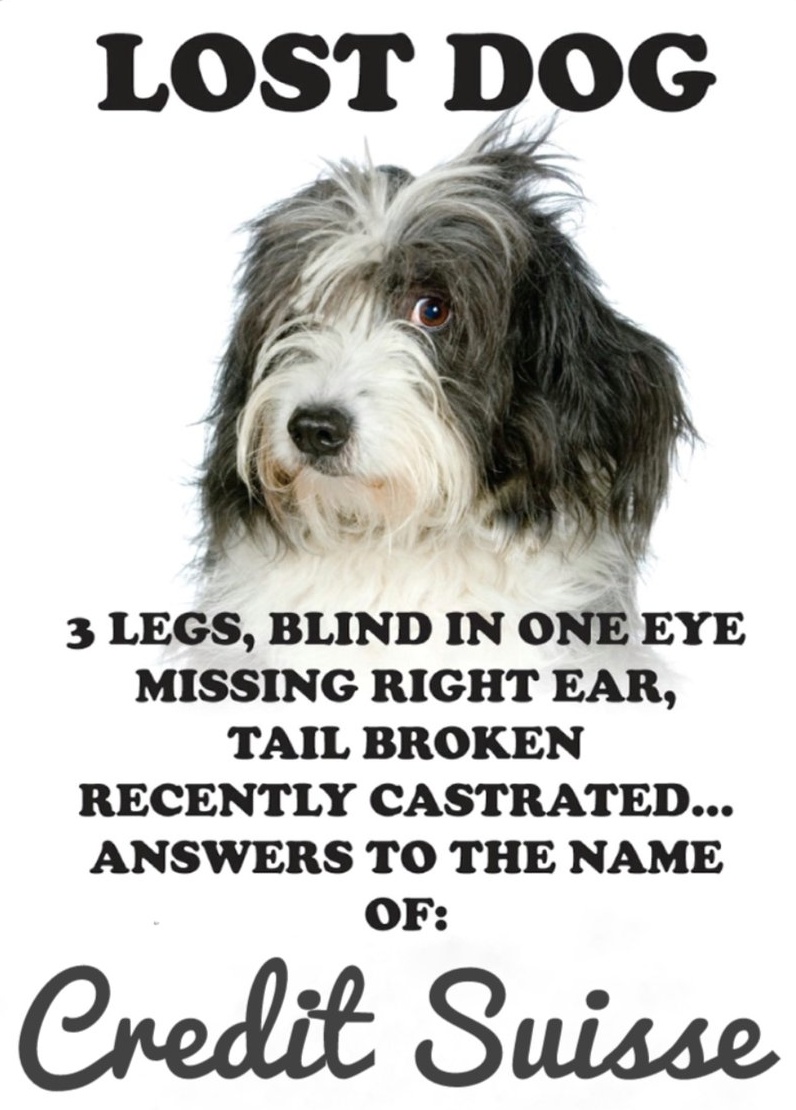

The proverbial missing dog of modern international finance. If an unfortunate, weird, dumb, or preposterous thing happens in the market, chances are Credit Suisse will be involved and, most likely, on the wrong end of it. After a period of seven or more years in which Credit Suisse seemingly was drawn to every prevailing financial catastrophe like a moth to a candle — or was actively creating them itself — events such as its spying on its own executives, Malachite, Archegos, Greensill, Evergrande, Covid-19, 1MDB, tax evasion, lockdown breaches, serial KYC and money laundering breaches, Bulgarian drug trafficking, a $500 million insurance fraud on the Georgian prime minister, $850m Mozambique tuna bonds fraud, sanction breaches, things looked like they were reaching an end game in 2023 following the failure of the Silicon Valley Bank — the irony being that this was the first major financial scandal in a decade that Credit Suisse had nothing to to with whatsoever.

See also