Best execution

See also, for detailed FCA rules: Dealing and managing and generally the COBS Anatomy

Best execution is a standard imposed by regulators on the execution of traded financial services products by broker-dealers on nehalf of their clients. It will, therefore, depend to an extent on the jurisdiciton in question, but the general thrust will be consistent wherever it applies.

FCA

According the the FCA in its Thematic Review of Best Execution of July 2014, "Best execution is a core component in the regulation of financial services. Its aims are threefold:

- to ensure protection for investors,

- to sustain the integrity of the price formation process (which itself underpins all trading activity) and

- to promote competition among trading venues in an increasingly fragmented market."

The FCA adopts the European Commission's comprehensive four-fold test to determine whether best execution applies in any particular circumstance to the a firm's activities

European Commission

Extract from Commission Opinion on the scope of best execution under MiFID and the implementing directive: Working Document ESC-07-2007:

- 4. In our view, the key concept to focus on in interpreting Article 21 is the execution of orders on behalf of clients. This is consistent with the definition in Article 4(1)(5) of MiFID, which refers specifically to a firm acting to conclude agreements to buy or sell financial instruments on behalf of clients, and the description of the relevant investment service in Annex I to MiFID as the “execution of orders on behalf of clients”. Both provisions support the idea that the requirement that an order is being executed on behalf of a client is integral to the concept of best execution.

…

8. The application or otherwise of best execution will depend on whether the execution of the client’s order can be seen as truly done on behalf of the client. This is a question of fact in each case and ultimately depends on whether the client legitimately relies on the firm to protect his or her interests in relation to the pricing and other elements of the transaction – such as speed or likelihood of execution and settlement – that may be affected by the choices made by the firm when executing the order.

The four-fold test

The in its Opinion ESC-07-2007 of 19 March 2007 the European Commission set out a list of the four-fold cumulative test to help determine whether a client is legitimately relying on the firm:

- Initiation: Which party initiates the transaction;

- Market Practice: Questions of market practice and the existence of a convention to “shop around”;

- Price Transparency: The relative levels of price transparency within a market;

- Available information: The information provided by the firm and any agreement reached.

Quoth the European Commission:

The application or otherwise of best execution will depend on whether the execution of the client's order can be seen as truly done on behalf of the client. This is a question of fact in each case which ultimately depends on whether the client legitimately relies on the firm to protect his or her interests in relation to the pricing and other elements of the transaction - such as speed or likelihood of execution and settlement - that may be affected by the choices made by the firm when executing the order. The following considerations, taken together, will help to determine the answer to this question:

Initiation

"Whether the firm approaches (initiates the transaction with) the client or the client instigates the transaction by making an approach to the firm. In those cases where the firm approaches a retail client and suggests him to enter into a specific transaction it is more probable that the client will be relying on the firm, to protect his or her interests in relation to the pricing and other elements of the transaction.

Market Practice

Questions of market practice will help to determine whether it is legitimate for clients to rely on the firm. For example, in the wholesale OTC derivatives and bond markets buyers conventionally "shop around" by approaching several dealers for a quote, and in these circumstances there is no expectation between the parties that the dealer chosen by the client will owe best execution.

Price Transparency

The relative levels of transparency within a market will also be relevant. For markets where clients do not have ready access to prices while investment firms do, the conclusion will be much more readily reached that they rely on the firm in relation to the pricing of the transaction.

Available information

The information provided by the firm about its services and the terms of any agreement between the client and the investment firm will also be relevant, but not determinative of the question. The use of standard term agreements to characterise commercial relationships otherwise than in accordance with economic reality should be avoided.

Consent

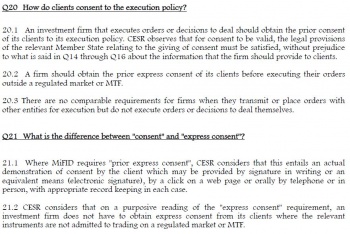

The requirement for client prior consent arises in two places:

- The client is required to provide its "prior consent" to the firm's best execution policy. That is something that can be deemed by the client’s action in placing an order with the firm.

- However the client is required to provide its "prior express consent" to a firm handling its orders outside a regulated market or MTF. These two standards are officially different, as the captioned extract from the ESMA guidance makes clear, however potty that may seem.

See Also

- CESR Question and Answer paper on best execution under MiFID

- Best Execution opinion - European Commission

Conduct of Business

This is an article about the FCA’s conduct of business rules, known by its chapter in the FCA Sourcebook, COBS, which implement, among other things, MiFID (directive 2004/39/EC (EUR Lex) and implementing directive 2006/73/EC (EUR Lex)).