Heterogeneity

Heterogeneity

/ˌhɛtərəʊʤɪˈniːɪti/ (n.)

|

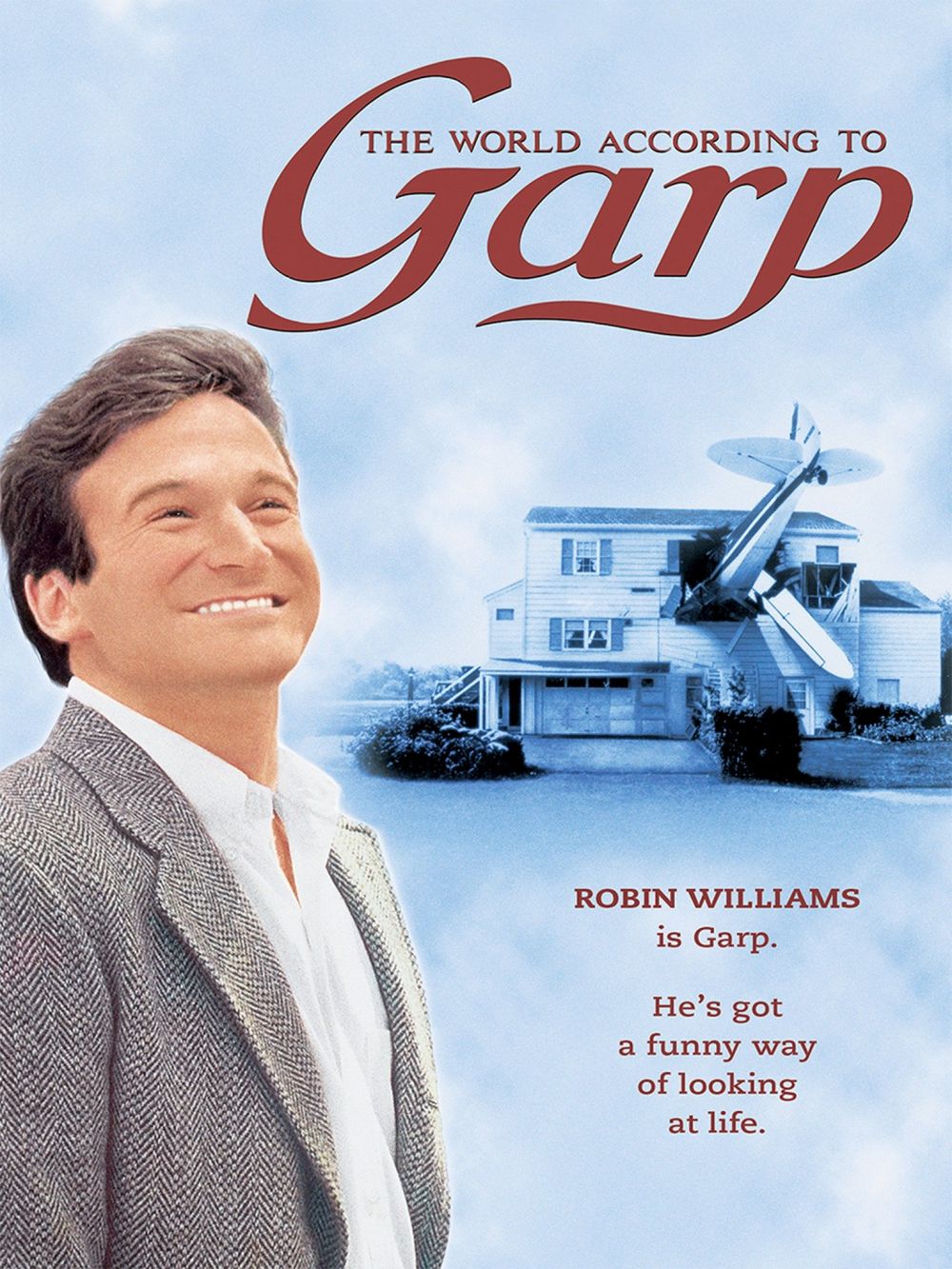

Contrarianism. A fancy word for the impulse to look at the world in a different way to everyone else. To ask, “what if?”

We like heterogeneity. Not everyone does.

Thought leaders — the same ones who, with the hive mind, fetishise diversity — may declare that heterogeneity — contrarianism to you, dear reader — is a bad thing.[1]

“Homogeneity is important to bind your people to a common purpose and vision,” they will say. “Heterogeneity can weaken and undermine that sacred, fragile flame.”

We happy heterogeneticists would beg to differ. The problem, in our darkened times, is not that there is too much diversity of thought, but not enough. The diversity we do have — that we fetishise — is a superficial, plastic, optical diversity. Under its cover, our hive mind stampedes after shiny but basically stupid ideas. We jump on bandwagons: cryptocurrencies, non-fungible tokens, AI, ESG and critical theory, some of which are engineered — ironically enough — to quash contrary voices.

There is very little “wacky contrarian” risk. Squeaky wheels can’t hurt you. Fashionable yogababble can.

Now: contrarianism fails only when it produces incontrovertibly pernicious ideas — ones that cannot be quickly assessed and, if need be, rejected on their merits. Most tend not to be a problem as long as they remain contrarian ideas. It is only when the hive mind lunges at them that trouble begins to brew. Cryptocurrencies, non-fungible tokens, AI, ESG and critical theory — all of these are good, useful ideas as long as they remain contrarian. They challenge orthodoxy. They remind us to be humble. They remind us that the status quo in which we have flourished is an unjustifiable contingency with which we shouldn’t become besotted. This is a valuable unreality check. As orthodoxy they are not.

In a wicked environment there are very few of these, and in a “tame” — closed, bounded, fully understood — environment they are easy to dismiss: in a game of football, the undoubtedly heterogeneous idea to pick up the ball is stupid and no-one will do it. But even there … well, just ask William Webb Ellis whether it was a stupid idea to pick up the ball and run with it.[2]

Situations where the consensus view is so unarguably right that there’s no scope to challenge it are as good as non-existent in commerce. Many of the our great crises of the past have come out of apparently sensible homogeneous consensus, and in the face of a small, vocal, but ignored heterogenous dissent. LIBOR. The global financial crisis. Madoff. Enron. FTX.

We operate in a non zero-sum, not-bounded, incomplete, ambiguous environment it is hard to see how having some level of dissent doesn’t put you in a better place.