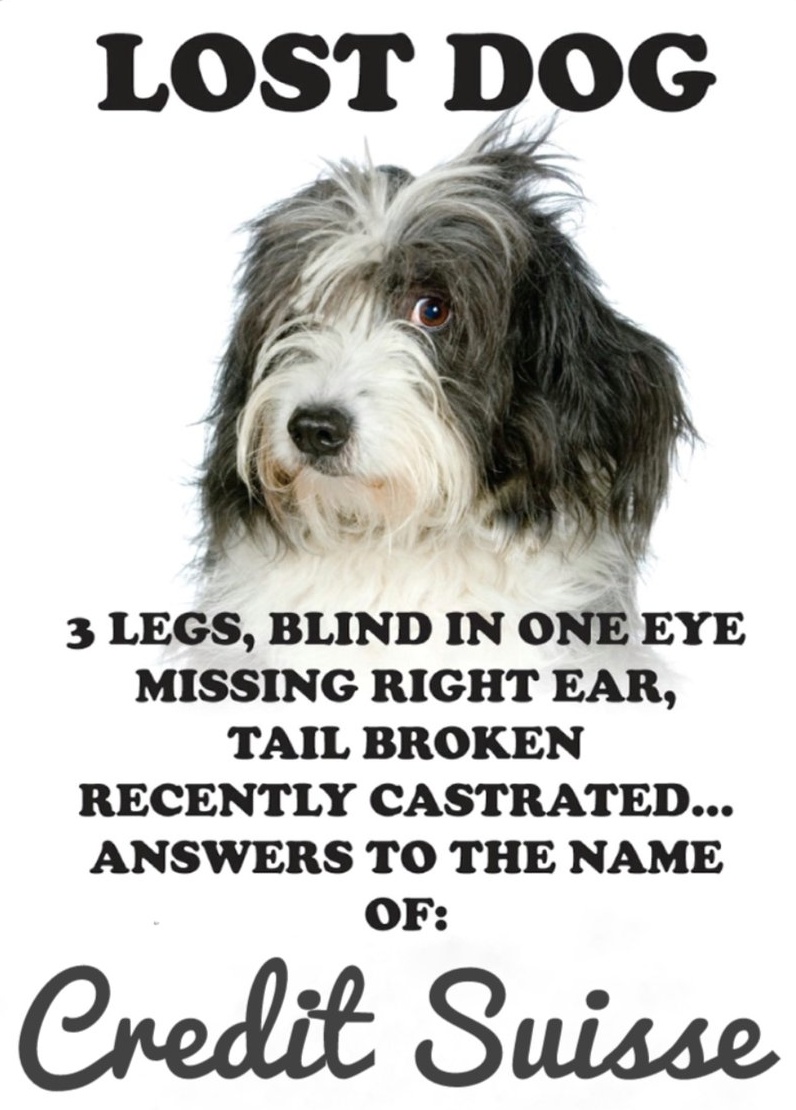

Credit Suisse

|

Chez Guevara — Dining in style at the Disaster Café™

|

Old “Lucky”, the proverbial missing dog of modern international finance. Also known amongst banking analysts as “Debit Suisse”.

For some years it was an immutable rule of the market that if an unfortunate, weird, dumb, or preposterous thing happens in the market, Credit Suisse was sure to be involved and, if it hadn’t actually caused it, would be on the wrong end of it.

Ironically — though, possibly causatively — Credit Suisse escaped the Global Financial Crisis comparatively unscathed. While its peers and competitors were being bailed out, nationalised, eviscerated, stress tested, analysed, supervised, inspected and generally groped with great snapping regulatory rubber gloves on parts of their institutional anatomies they didn’t know could be groped, old “Lucky” got a pass, sat pretty and thumbed its nose at all the hubris.

It may wish it had been given the rubber glove treatment while the going was good. For its peers seem — and look, its always to early to say this sort of thing, but for now, they seem — the better for it: they look to have learned lessons about how banks should behave that Credit Suisse, apparently, did not.

See also

- ↑ except where the individual cockups were themselves criminal of course