Client communication

|

Office anthropology™

|

Client communication

/ˈklaɪənt kəˌmjuːnɪˈkeɪʃən/ (n.)

A mass-communication of something important — “importance” being in the eye of the beholder — to your whole client base. How a firm does this is a measure of its commercial sophistication, first, its technological sophistication, second, and its communication skill, third.

The usual means is to get a dedicated “client outreach team” to handle it by mass-market mailshot.

Is it really that important?

The professional managerial class’s structural self-obsession is such that it sees its own role as a sacred calling of utmost importance to the future safety and good order of the political economy itself. Its trouble is not so much seeing the wood for the trees, as understanding there is a wood at all.

“All there is this tree. My tree. The one with many thin branches, supporting many fat birds, like me.”

Through this prism, one is well insulated from the realities beyond the tree’s crown. If you are lucky, the reality will be studied indifference.

So first, ask: do we really need to communicate this to clients? Will the sky fall in on our heads if we do not?

Is bulk email the right way to do it?

Assume we do, and it will.

Then ask: okay, that being the case, do we really want to do that by spam?

Now here the size and public orientation of your business makes a difference. If you are a retail bank, mailing six million people about a change to their current account terms, then absolutely you want to do this by spam. The more spam-like, the better. Your main objective is to say, “look, I tried”.[1] Your best-case scenario is that your customers receive your message, but don’t notice it.

If you are an investment bank, your clients will pay you revenue in the hundreds of thousands or millions each year. If it is important enough to tell a million dollar client, it is worth doing in person. Have your sales people call. This is called relationship management.

Tone and presentation matters.

Whether you are a law firm composing client bulletins and seminars, a client outreach team creating mail-shots to meet financial services regulations or — speak it softly: preparing customer contracts; you know, actual legal verbiage[2] — there is a lot to be said for getting your tone and presentation right.

However much there is to be said, the state of contemporary professional services literature suggests not much of it is habitually listened to, so those who do listen have a chance to set their communications above all the others.

Starting proposition:

Client communications are spam.

This tends to surprise those professional class. But customers do not want spam arriving unbidden in their inboxes, much less problems they didn’t even know they had. If you are writing to all of your customers at once, your news is either outright bad — “we’ve screwed something up” — or tedious — “regulations have changed and there is some stuff you need to know, say or do” — or annoying — “there is something we forgot to tell you, or we need to correct what we’ve already told you”.

If your customers care at all about your communiqué, they will care less about it than you do. Perhaps they should care, but they won’t.

Rules of the road

With this in mind, the JC offers you some rules for optimising client communications.

Rule 1: be brief.

It ought to go without saying, but the modern professional seems unable to grasp the idea: keep it short. Do not use two words when one will do. Do not use one word when none will do. Writing to customers is like flying on the cheapest budget airline in the world. Your words are your luggage.

Sub-rule: get to the point

Your message should be a mullet: business up front; party at the back.

Presume that if a customer starts reading at all, she will stop far more quickly than you would like her to. If you need your client todo something, state it clearly and early in the communication.

| Don’t say | Do say |

|---|---|

|

The original fund status certificate needs to be in place at the Bank before the taxable income event is due to be paid. To avoid delay of certificate recording, customers are reminded to send the fund status certificates to the Bank. |

From 1 July, you must give us your new WHT certificates before the dividend record date. |

Sub-rule: don’t show your working

Having been mired in it for months, your subject matter experts will have dominion over every last detail and nuance of the topic. They will barely be able to resist regurgitating their acumen all over your letter. Don’t let them. Say only what a non-specialist needs to hear to grasp the gist. Say that as clearly as you can, and say no more.

| Don’t say | Do say |

|---|---|

| The Upper House of the German Parliament on 28 May 2021 approved the bill pertaining to the modernisation of withholding tax relief procedures (“AbzStEntModG”; Abzugsteuerentlastungsmodernisierungsgesetz), parts of which are due to enter into force on 1 July 2021, especially amendments to the German Investment Tax Act. The bill foresees a change in terms of the relief at source procedure applicable to income payments subject to German withholding tax (for example dividend and taxable interest payments) paid to a foreign investment fund (“beschränkt körperschaftsteuerpflichtiger Investmentfonds”). In this context, newly issued fund status certificates will contain information on the corporation tax status (“Körperschaftsteuerstatus”) of the certified investment fund. Current valid certificates that are already submitted, however, will stay valid according to a letter issued by the Ministry of Finance on 1 June 2021 (BMF – reference GZ: IV C 1 - S 1980-1/19/10027 :006 DOK: 2021/0577184). | On 1 July, Germany changed its withholding tax relief rules for dividend income. These changes affect your non-resident investment funds. |

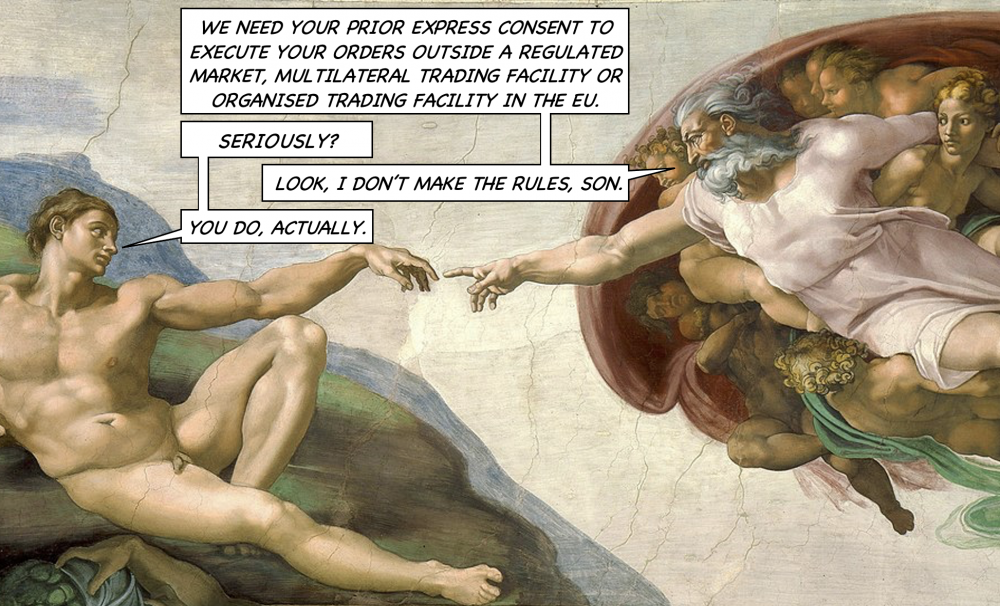

Sub-rule: don’t track regulatory language

It is fashionable among legal eagles to “track the language of the legislation” in client communications. This ensures utmost fidelity with the rules: one cannot be blamed for getting anything wrong if one copies out the text verbatim.

DO NOT WRITE TO AVOID BLAME FOR GETTING THINGS WRONG.

Write to get things right.

Own your expertise. Own your language. Be brave. Tracking legislation is lazy. It is timid. It rejects responsibility and puts it on the customer. It converts your regulatory problem into your customer’s.

Your job is to to make your customer’s life easier, not harder. You are meant to internalise the ugliness of your regulatory environment, not to lay it on your client. It is not your client’s problem. The legislation is, most likely meant to be for your client’s benefit. It doesn’t need anyone to regurgitate things that work for it anyway.

So: speak only in terms of consequences, and action. Where this points back to regulation, summarise. Extract. Contextualise. Put this in a format the customer can understand and relate to.

Think like a professional writer, because you are a goddamn professional writer.

Rule 2: be clear.

Sub-rule: Write plainly.

This is harder than it looks, because we are trained to sound clever as a first priority. Overcome this urge. Avoid passives.

Sub-rule: State consequences

Be clear what will happen if the customer doesn’t reply. Don’t be judgmental; just matter of fact.

| Don’t say | Do say |

|---|---|

| In accordance with the above-mentioned bill, any application for the reversal of overpaid tax, via presentation of a fund status certificate with retroactive validity, will no longer be possible via the Bank. Instead, the reclaim must be addressed directly to the Federal Central Tax Office (Bundeszentralamt für Steuern; BZSt). Consequently, as of 1 July 2021 customers providing a fund status certificate for a foreign investment fund after the payment date of the taxable income event cannot be refunded. Full tax must be withheld. The Bank will in turn issue a tax voucher upon customer request. | If you do not, you must file your WHT reclaim directly with the German tax authority. |

Rule 3: be persuasive.

Where following rules 1 and 2 don’t get you there, remember you are writing not just to discharge some regulatory obligation to your customer — that’s a second order objective — but to make your customer think well of you. Frame your letter to appeal to your correspondents, so they are more likely to read it.

Remember Robert Cialdini’s six rules of persuasion. Deploy them where you can.

Sub-rule: be personal

Personalise it. don’t say “Dear Client” — don’t ever do that — but address an individual by name, and send from an individual, by name.

Yes, it is a mass mailshot to every customer in the book. But we are in 2021, friends. It is not beyond the wit of technology, anymore, to use a freaking mail merge.[3] What’s stopping you? Oh, crappy client static data? Fix your damn client static data. If your salespeople aren’t keeping it up to date, they’re not doing their jobs. Either have good client static data, and use it to demonstrate you care enough about your customer to be justified in calling them “dear ~” — or don’t, accept your customers to you are a passive herd of cattle there only to be milked, and don’t try to be ingratiating while you do it.

Don’t say “please be advised”. Ever. Just don’t do it. These are your valuable customers, not truculent secondary school children plotting to burn down the staff room.

“Charm” is not for everyone: it can go across badly. If you aren’t comfortable with it, don’t do it.

Sub-rule: be emphatic

Say what you mean with strong, active, assertive nouns and verbs. Don’t use weasel words. Avoid “seems to”, “appears to be”, “slightly”, “almost”, “practically”, “virtually”. Write with energy. Take personal responsibility for what you say. Avoid passives. Identify yourself. Where you can, write as “me”; failing that “we” and never “the company”. Do not refer to yourself, or your company, in the third person. Own what you say.

Sub-rule: avoid disclaimers

Think first “what will my customer think of me if I say that”, rather than “what if I get it wrong and my customer sues me?” You are a professional. You are good at what you do. Trust yourself not to get it wrong. Disclaimers are like airbags. You only need airbags if you don’t steer straight. Concentrate on defensive driving, not crash mats. If you have to have a disclaimer — and, I know, you will have to have one — keep it brief, to the point and put it at the end. If the first thing your customer reads is “Please be advised we take no responsibility for this, we are only doing this because someone said we have to, so on your own head be it”, your customer is going to think, “gee, what a douche”. Generally, that’s not how you want your customer to be thinking now, is it?

See also

References

- ↑ Cynics might say this is really means “no bulk communication to retail clients is ever that important.” There is an element of truth to that.

- ↑ While true, considering contracts as a form of client communication to be dressed up and somehow made presentable is regarded as, if not a type of mental illness, then a bridge too far, by most in the legal community.

- ↑ You thought I was going to say “use neural networks to guess customer names” didn’t you?