Contango: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

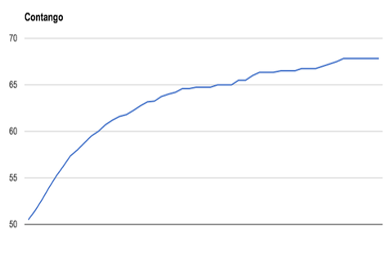

{{a|g|{{image|contango|png|A [[Forward|forward curve]] in [[contango]], and just begging for a [[carry trade]], yesterday.}}[[Contango]] describes the shape of a [[commodities]] forward curve where the [[Spot rate|spot price]] is lower than the [[Forward|forward]] price — especially one where the further into the future, and along the curve, you go, the higher the forward price gets. This implies that the commodity inquestion is expected to rise in price through time. In these days of growing inflation, that is the generally expected position. Contrast with [[backwardation]], which is the opposite scenario. | {{a|g|{{image|contango curve|png|A [[Forward|forward curve]] in [[contango]], and just begging for a [[carry trade]], yesterday.}}}}[[Contango]] describes the shape of a [[commodities]] forward curve where the [[Spot rate|spot price]] is lower than the [[Forward|forward]] price — especially one where the further into the future, and along the curve, you go, the higher the forward price gets. This implies that the commodity inquestion is expected to rise in price through time. In these days of growing inflation, that is the generally expected position. Contrast with [[backwardation]], which is the opposite scenario. | ||

Contango offers the opportunity for a [[carry trade]] for someone prepared to monkey around with spots and forwards. | Contango offers the opportunity for a [[carry trade]] for someone prepared to monkey around with spots and forwards. | ||

Latest revision as of 14:01, 29 July 2022

|

Contango describes the shape of a commodities forward curve where the spot price is lower than the forward price — especially one where the further into the future, and along the curve, you go, the higher the forward price gets. This implies that the commodity inquestion is expected to rise in price through time. In these days of growing inflation, that is the generally expected position. Contrast with backwardation, which is the opposite scenario.

Contango offers the opportunity for a carry trade for someone prepared to monkey around with spots and forwards.