Contractual negligence: Difference between revisions

Amwelladmin (talk | contribs) |

Amwelladmin (talk | contribs) |

||

| Line 8: | Line 8: | ||

==={{tag|Fraud}}=== | ==={{tag|Fraud}}=== | ||

[[File:Contractual loss.PNG|450px|thumb|right|Damage against Wantonness. Mapped.]] | [[File:Contractual loss.PNG|450px|thumb|right|Damage against Wantonness. Mapped.]] | ||

You can't exclude contractual liability for fraud: to do so is to step beyond the hermeneutic boundaries of the game one plays in entering a legal arrangement, so it's hardly a great concession to say so in a contract. A contract where, by its terms, one could behave fraudulently would be a rather arch affair. | You can't exclude contractual liability for fraud: to do so is to step beyond the hermeneutic boundaries of the game one plays in entering a legal arrangement (did you like that ''{{google|Gadamer}}'' I'm good!), so it's hardly a great concession to say so in a contract. A contract where, by its terms, one could behave fraudulently would be a rather arch affair. | ||

''Nul points'' for remembering to exclude [[fraud]], therefore. | ''Nul points'' for remembering to exclude [[fraud]], therefore. | ||

Revision as of 09:05, 28 June 2016

An attorney eyes you wistfully and slides a draft across the table to you.

- Party A shall not be liable for any losses, howsoever caused, unless they arise directly from its own negligence, fraud or wilful default.

What should one make of this? At a glance it seems perfectly reasonable. To be sure, it is time-honoured boilerplate, thrown into contracts to close them out like chump change tossed into the bill platter at the end of an agreeable meal with passable company of whom one has now had enough.

But does it make sense to fritter away a contractual claim this way?

Fraud

You can't exclude contractual liability for fraud: to do so is to step beyond the hermeneutic boundaries of the game one plays in entering a legal arrangement (did you like that Let me Google that for you I'm good!), so it's hardly a great concession to say so in a contract. A contract where, by its terms, one could behave fraudulently would be a rather arch affair.

Nul points for remembering to exclude fraud, therefore.

Wilful default

A heartily-bandied phrase which sounds like it ought to mean something. This fellow's best guess is something like a "deliberate refusal to perform one's obligations under a contract": not too far removed from fraud (it raises a presumption of fraudulence on the part of the actor in agreeing to the obligation in the first place) but, in any weather, a subset of the class of events "breaches of contract".

Now breaches of contract, under the law of contract, entitle an innocent, wronged fellow to redress. That's what it means to be a breach. So it ought not cause your heart to leap to have your counterparty offering to be responsible for wanton examples of this behaviour. It is hardly a mark of generosity. Indeed; you might wonder why he seeks to exclude less wilful "defaults" - or even unwilled defaults - being, as they are, defaults.

For here's the point, lazengem: The point of a contractual obligation is to have some means of making the person who owes it do it - or, failing that - compensating you for not doing it. Why else have an obligation?

So is that what negligence is meant to do?

Negligence

See - Fardell v Potts. No, really. Go there. You won't regret it.

Maybe. But negligence is the standard of behavior expected in tort, where, by definition, there is no contract to which one can appeal for guidance on how one is meant to behave.

Now negligence is all good fun - reasonable men (and women), Clapham omnibuses, snails, ginger-beer, escaping domestic animals - but it evolved ad hoc to address a particular human dilemma - the plight of an unseen neighbour. That dilemma simply doesn't exist where you have a contract. Here you know damn well who your neighbour is, having spent six months hammering out a legal agreement with the blighter. So it seems all rather forlorn that one should fall back, weakly, on a standard devised by imaginative judges to look after the interests of contractless folk who found themselves struck by a punt being carelessly navigated the wrong way up a flooded avenue.

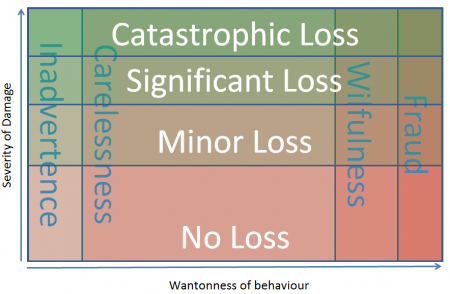

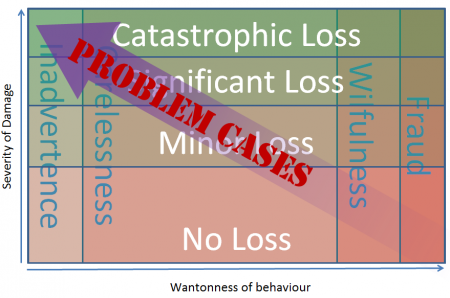

Consider the handsome table to the right. This charts all conceivable breaches of contract. The easiest cases are in the bottom right: not much loss, but the defaulting party has been gratuitous in its behavior and however paltry the claim, has no leg to stand on.

The hard cases are in the top left: here there has been little culpable misbehaviour as such (but note our condition to entry: the terms of the contract have been transgressed), but a significant loss as come about nonetheless.

Are these the examples an exclusion from liability for negligence is meant to cover? Surely not: a contractual obligation is a contractual obligation. Doing things this way betrays laziness or a lack of legal acuity from your counsel. It is not that you wish to apply an exclusion from contractual liability if a party hasn't been negligent - what you mean to say is that your counterparty is only obliged in the first place to exercise a certain standard of care. If you craft the contract that way, there's no need to carve out liability for non-negligent behaviour, because that behaviour wouldn't breach the contract in the first place.

But isn't this an easier catch-all?

"But", yon lazy attorney wails, "adopting that approach means we have to write in a standard of care to every obligation under the contract. As a plain English denizen you can't really want that? Surely it's easier to carve it out!"

But a contract is meant to stipulate what you are expected to do. For some obligations, a "reasonable standard of care" rider is not appropriate. The payment of money, for example.

- Bill borrows Ben's car. He agrees to return it to Ben on Thursday at 3pm. At the appointed time Bill presents himself to Ben, but announces that he has just been mugged, and the car has been stolen. His mugger was quite unexpected, applied overwhelming force, and immediately drove the car into a wall and wrote it off. Through no fault of his own, Bill is unable to perform his obligation. Should he be able to rely on a carve out from liability because he has not been negligent?