Repudiation

|

|

To repudiate a contract is to fundamentally breach it: to indicate one’s inability or unwillingness to perform it in such a way as to deprive the aggrieved party of substantially the whole benefit of the bargain represented by the contract.

A “repudiatory” or “fundamental” breach of contract is a one which is sufficiently serious to indicate a party has repudiated the contract, thereby entitling the innocent party to terminate the contract.

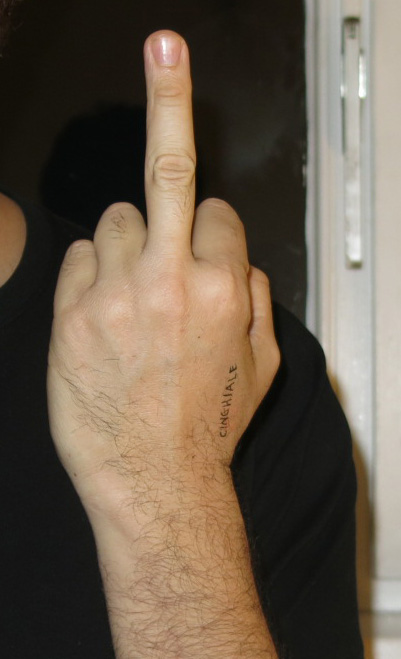

There is repudiation “proper” — which is words or conduct which makes it clear to the other party that you, wantonly, intend not to perform your obligations even though if you wanted to you could — the metaphorical middle finger — and then there are non-performances of obligations under the contract that are so significant to its fundamental purpose that they amount to the same thing. These do not require the same degree of wantonness. If I owe you money and cannot pay it, then I have repudiated the contract even though I honestly and fervently wish I could perform it.

In this case the innocent party has two options: It can accept the repudiation and treat the contract as at an end; or affirm the contract and insist on performance by the repudiating party.

How do you repudiate a contract?

Generally, but not necessarily, in writing, you make it clear you have no intention of being held to your obligations.

Are there any magic words? No, but, our nosy, often-drunk chatbot NiGEL butted in at this point to suggest wecould make some up, in the style of a hary poter magic spell.

“Confoundo pactotum!” He suggests.

“It fits with J.K. Rowling’s style of combining Latin words with a whimsical but scholarly vibe: “pactum” is Latin for “pact” or agreement. The echo of “factotum” (a person who does all kinds of work) gives it an almost comical suggestion of confounding an agreement-of-all-things or a do-everything-pact. You could imagine it being used to magically muddle or interfere with magical contracts or agreements.”

Thanks for that, NiGEL.

How serious is “serious”?

The $64,000 question: What counts as “sufficiently serious”?

Does “failure to pay an amount due by the time specified in a contract” constitute a repudiatory breach? Usually, in financing contracts, failure to pay will be a designated “event of default” prescribing exactly what should happen — so this question is moot — but it may apply where there is no such term: if your counterparty is a bank, offering you a loan, a revolving credit facility, or some such thing.

If your contract stipulates that “time is of the essence”, then yes. If not, then it will depend on the circumstances. If the failure to pay was due to a force majeure-style external event, probably not. If the failure to pay was accompanied by an extended middle finger, more likely.

The subtle difference between an event of default and a fundamental breach of contract

A fundamental breach of contract is a failure to perform its terms in such a way that deprives the other party of the basic benefit of the contract.

This could be anything — like a duck, you know it when you see it — but beyond being an outright failure to perform one’s material obligations it need not, and logically cannot, be comprehensively articulated in the contract.

An event of default, on the other hand, is articulated, usually at painful length, in the contract, which then contains detailed provisions setting out what should happen, to whom, by when, if an event of default befalls either party.

Now while the same set of circumstances might be an event of default and a fundamental breach of contract — almost certainly will be, in fact — treating a case as an event of default is to see it as “infra-contractual action”,[1] contemplated by and provided for within the four corners of the contract; while treating it as a fundamental breach is thereby to cast the whole contract into the fire. For what good are the promises in it, after all, if the other fellow won’t keep them?

Thus, alleging fundamental breach is to terminate the contract with prejudice to your remaining rights under it, and to prostrate yourself at the feet of the Queen’s Bench Division for redress by way of damages, being the liquidated net present value of those remaining rights, determined by reference to the golden streams of common law precedent, whose terms might not be quite as advantageous to you as those you might have asked for were you able to agree them in advance. These common law principles are about the contract, they are not rules of the contract. The contract itself it a smoldering husk.

Thus, an event of default leaves the contract on foot, while you exercise your options to extract the value of your party’s commitments under it, without resorting to the courts. A fundamental breach requires the intervention of our learned friends

Now in most scenarios, which route you take might not make a whole heap of difference: In a contract between a supplier and consumer, or lender and borrower, there is a fundamental asymmetry you can’t cure with fancy words: if the guy owes you stuff, or money, that he hasn’t ponied up, you will need the court’s help to get it out of him. But master trading contracts are normally more bilateral than that: you have exposure, I have collateral. Maybe, the next day, I have exposure and you have collateral. Close-out is a self-help option, and it is quicker and cleaner than praying for relief from the QBD. But exercising it requires the contract to still be there.

Compare

- Rescission of contract

See also

References

- ↑ I just made that expression up, by the way