Goldman

|

Always “Goldman”, a singular noun for a singular firm.

Never “Goldmans”.

Look what happens when you are fast and loose with plurals in a storied trading firm. Now, maybe Lehman would have been better off had they stuck to[1] faithfully serving the Amish community online. Who knows?

Anyway, Goldman. Word has it[2] a former senior partner of this storied Wall Street broker sold his, and the firm’s undead soul[3] to Beelzebub, not realising he was an equity partner at Sullivan and Cromwell[3]. Well, how else do you go from discounting jewellers bills on a bicycle in Park Slope to being a “great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money”[4]?

The apocryphal Goldman story

There is a story[5] that a titan at Goldman sufficiently important to the firmament that he was known to all by only his familiar Christian name (let’s call him “Bob”[6]) once had occasion to call a Goldman trading desk, at the time equipped with only a multi-line dealer board.

A voice — youthful, lacking the tell-tale timbre of age and experience — picked up and, as on a trading desk one does, said:

- Trader: Goldman. (This is a statement. there is no inquiry, no rising inflection of curiousness. It's a statement.)

- Bob: Yeah, can I get Jerry? (Now, when you are known to all by your Christian name you don’t bother with formalities. But nor, for that matter, do traders.)

- Trader: He’s off the desk.

- ~click~

Now Bob might not bother with formalities, but he rather thinks he’s entitled to them. No message, even? Perhaps this young man didn’t realise to whom he was speaking. Bob calls back.

- Trader: Goldman.

- Bob: Look, it’s Bob here. Can I get Jerry?

- Trader: I just told you he’s off the desk.

- ~click~

This will not do. Bob, having dispensed with any doubt he may have been benefiting this young fellow with, calls back a final time.

- Trader: Goldman.

- Bob: Now, listen to me, son. I just called to ask for Jerry

- Trader: I listened. And I told you: he’s off the desk.

- Bob (exploding): DO YOU KNOW WHO I AM?!

- Trader: Yes. You’re Bob. You’re the executive chairman of the firm.

- Bob: Right.

- Trader: Bob, do you know who I am?

- Bob: Ahh, ... no?

- Trader: Right.

- ~click~

Negotiation, Goldman style

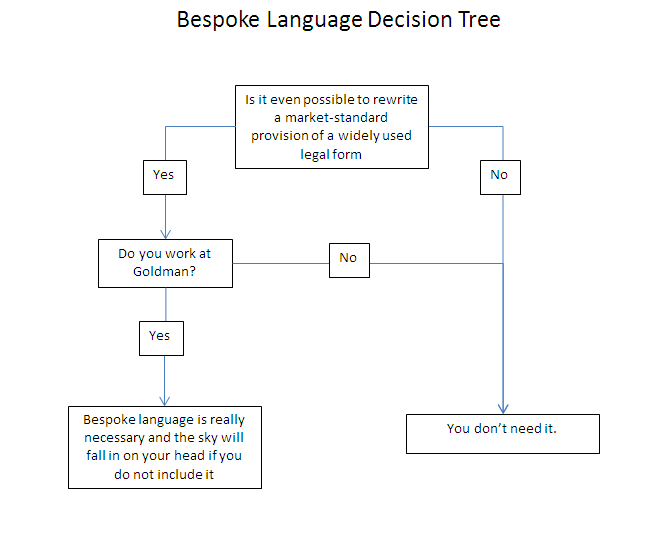

Most firms will crave adherence to market standards. Not Goldman. This is a handy decision tree in the box to the left.

Immaterial losses

While other brokers to Archegos shipped losses most conveniently measured in the billions, one — Goldman — yes, that Goldman — reported “immaterial losses”.

Be assured, other brokers will be stamping their feet, cracking their cheeks, cursing obstreperous ill fortune, beating their fists on the ground, beseeching whichever mischievous God looks after the fates of regulated broker-dealers and wailing “how in the name of all that is holy can it be that while I took a regular shellacking, again, that Goldman outfit got away with it, without so much as a crease in its trousers, again?”

“What kind of second sight, what extra-sensory perception, what gift, what compromising photographs of the Almighty must Goldman have to lead such a honeyed life? What does the Vampire Squid have over the Fates that we other mortal dealers do not?”

Perhaps, I gingerly venture, nothing? Perhaps it is as simple as this: Goldman didn’t have much risk on in the first place. This may be prudent business selection; it may be that Goldman didn’t have much of a relationship with Archegos at all. According CS’s credit risk team in April 2020 — ten months before apocalypse — “Archegos had disclosed that its long positions with CS were “representative” of the positions Archegos held with its six other prime brokers at the time.”

Those six brokers, listed in the report, do not include Goldman.

If this is right, then less than a year before Götterdämmerung, Archegos wasn’t on Goldman’s books at all. If, as it claimed, Archegos preferred to “leg into” positions pro rata across its prime brokers, then a very-late-to-the-party prime broker would not have had much Archegos risk on its book. And with little risk, similarly few revenues to forfeit.

Without a long, deep, fearful, profitable client relationship, a broker had less skin in the game, may have treated Archegos with less reverence than its peers, may have declined to put positions on in such a cavalier fashion, and then been less bothered about upsetting its customer by closing it out at the first sign of trouble. This is consistent with how, by all accounts, Goldman conducted its book during Archegos’ end game.

See also

References

- ↑ I know they're totally different businesses. Obviously they are: Lehmans is still trading! So, just enjoy the ride or go home, you know?

- ↑ To be absolutely clear here, word doesn't have any such thing. I made this up out of whole cloth.

- ↑ Jump up to: 3.0 3.1 Important Disclaimer: See the important disclaimer above.

- ↑ Whatever you think of the market, finance and bankers, you should read Matt Taibi’s celebrated hit on Goldman, just for the virtuoso writing.

- ↑ Lord I wish it were true, but I doubt it.

- ↑ Not his real name, because this didn't happen, remember?