LIBOR rigging: Difference between revisions

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit Advanced mobile edit |

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit Advanced mobile edit |

||

| Line 6: | Line 6: | ||

:— Charles Dickens, ''Oliver Twist''}} | :— Charles Dickens, ''Oliver Twist''}} | ||

Tom Hayes’ appeal from his conviction for “[[LIBOR]] rigging” follows Matt Connolly’s and Gavin Black’s acquittals in 2022 on equivalent US charges relating to the same actions. It centres on a two-limbed question: | |||

{{L3}}What do the LIBOR and EURIBOR fixing rules mean and, given they were found in a previous trial to mean one thing, while the appellants believed them to mean another, and <li> | {{L3}}What do the LIBOR and EURIBOR fixing rules mean and, given they were found in a previous trial to mean one thing, while the appellants believed (and a US court) found them to mean another, and <li> | ||

Whose job was it to decide what they meant? Was | Whose job was it, and by reference to what, to decide what they meant? Was the meaning of the LIBOR Definition, in other words, a matter of fact or law? Or both?</ol> | ||

====“A conspiracy to defraud”==== | ====“A conspiracy to defraud”==== | ||

Hayes | Hayes et al were indicted on the ancient [[common law]] offence of “conspiracy to defraud”. Criminal law minutiae, perhaps, but they were not charged under the more modern Fraud Act 2006, which followed a Law Commission report which also recommended ''abolishing'' common law “conspiracy to defraud”, because it is “unfairly uncertain, and wide enough to have the potential to catch behaviour that should not be criminal”.<ref>{{plainlink|https://www.gov.uk/guidance/use-of-the-common-law-offence-of-conspiracy-to-defraud--6|Attorney General guidance to the legal profession on use of conspiracy to defraud}}, November 2012.</ref> | ||

Conspiracy to defraud was not, however abolished in 2006: | |||

{{Quote| | |||

“The government decided to retain it for the meantime, but accepted the case for considering repeal in the longer term.” <ref>Ibid.</ref> | |||

In any case, the elements of the common law offence are, more or less: | In any case, the elements of the common law offence are, more or less: | ||

{{ | {{Quote|That there was an agreement between two or more persons who intended to defraud another by doing something dishonest, like misrepresenting or making false promises and there was a likelihood of resulting loss it did not occur.<ref>This is in JC’s plainly non expert words.</ref>}} | ||

These are the legal principles. Their application, it seems to this old commercial hack, demands marrying the facts — who did what to whom — to their specific legal meanings as “terms of legal art”. | These are the legal principles. Their application, it seems to this old commercial hack, demands marrying the facts — who did what to whom — to their specific legal meanings as “terms of legal art”. | ||

The crux of these was Hayes ''dishonest'' when he submitted his LIBOR rates? That, in turn, came down to whether he “deliberately disregarded the ''proper basis'' for the submission of those rates”, intending thereby to prejudice the economic interests of others. | The crux of these was Hayes ''dishonest'' when he submitted his LIBOR rates? That, in turn, came down to whether he “deliberately disregarded the ''proper basis'' for the submission of those rates”, intending thereby to prejudice the economic interests of others. | ||

And ''that'' came down to whether Hayes’ submissions complied to the BBA’s “Instructions to BBA LIBOR Contributor Banks”. | |||

It does not seem to be disputed that if Hayes complied with the rules, QED he was conspiring to defraud anyone, though no particular emphasis fell on whether this was because it was not a fraud in the first place, or because Hayes was not therefore being dishonest. The court focused on the dishonesty. | |||

The critical part of the instructions — what the court called the “LIBOR Definition” ran as follows: | |||

{{Quote|“An individual BBA LIBOR Contributor Panel Bank will contribute '''''the rate at which it could borrow funds''''', were it to do so by asking for and then accepting inter-bank offers in reasonable market size just prior to 1100.”}} | {{Quote|“An individual BBA LIBOR Contributor Panel Bank will contribute '''''the rate at which it could borrow funds''''', were it to do so by asking for and then accepting inter-bank offers in reasonable market size just prior to 1100.”}} | ||

It was not disputed that on any day there would be a range of rates available to a bank at which it ''could'' borrow, whether these took the shape of firm offers, or good faith estimates, or model outputs, but which of these rates was, for the purpose of the LIBOR Definition, “the rate at which it could borrow funds”. | It was not disputed that on any day there would be a range of rates available to a bank at which it ''could'' borrow, whether these took the shape of firm offers, or good faith estimates, or model outputs, but which of these rates was, for the purpose of the LIBOR Definition, “the rate at which it could borrow funds”. | ||

Plainly, a submitter could not submit all of them. It seems to JC the logical options were: | |||

{{L1}}Choose one rate from those that were genuinely available per the bank’s good faith enquiry as above; <li> | |||

Contrive some artificial rate from within that range, reflecting a weighted average. <li> | |||

Submit a rate that did not fall within that range.</ol> | |||

Option 3 plainly falls outside the scope of the LIBOR Definition. Option 2 does not quite match the literal text, but perhaps captures its spirit. | |||

Option 1 is what Hayes actually did. The complication is that in choosing the rate to submit for a given day, Hayes actively sought out opinions as to what was in the best interests of the bank’s derivative trading books. | |||

The bank trades interest rates with its customers: one customer might swap fixed for floating, another floating for fixed. Fixed rates, obviously, are fixed. Floating rates fluctuate daily based on a fixed spread over a fluctuating “benchmark rate”. Until this gory business, LIBOR was that benchmark. | |||

If you swap a fixed rate for a floating rate, and LIBOR goes up, by definition you make money. The replacement value of that incoming floating rate, while the replacement cost of the outgoing fixed rate stays the same.increases. | |||

Largely, it has a flat position, but may well end the day “long” or “short” | |||

In particular, did a submitter have any leeway, when choosing between rates which otherwise might be valid, to consider its own best trading interests? The back might be positioned some days to benefit from raised interest rates, other days lower ones. | In particular, did a submitter have any leeway, when choosing between rates which otherwise might be valid, to consider its own best trading interests? The back might be positioned some days to benefit from raised interest rates, other days lower ones. | ||

Revision as of 07:53, 4 April 2024

|

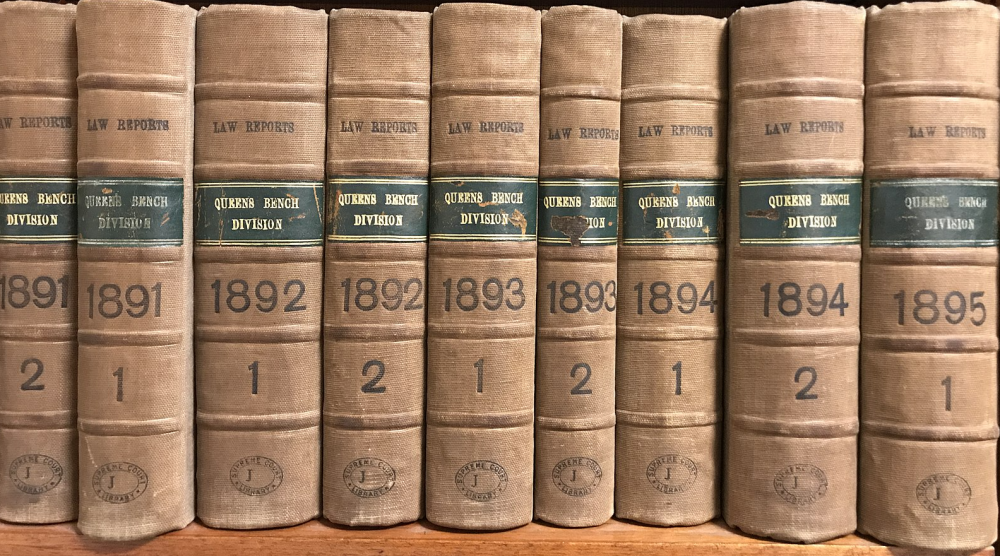

The Jolly Contrarian Law Reports

Our own, snippy, in-house court reporting service.

|

“The courts have for many years been developing and using a broad concept which at times has threatened to bring chaos rather than light to the solution of the legal problems it has affected. This concept enunciates the division between questions of law and questions of fact.

- —What is a “Question of Law”?, Arthur W. Phelps, 1949, bringing yet more chaos to the table.

“If the law supposes that,” said Mr. Bumble,… “the law is a ass—a idiot. If that’s the eye of the law, the law is a bachelor; and the worst I wish the law is that his eye may be opened by experience—by experience.”

- — Charles Dickens, Oliver Twist

Tom Hayes’ appeal from his conviction for “LIBOR rigging” follows Matt Connolly’s and Gavin Black’s acquittals in 2022 on equivalent US charges relating to the same actions. It centres on a two-limbed question:

- What do the LIBOR and EURIBOR fixing rules mean and, given they were found in a previous trial to mean one thing, while the appellants believed (and a US court) found them to mean another, and

- Whose job was it, and by reference to what, to decide what they meant? Was the meaning of the LIBOR Definition, in other words, a matter of fact or law? Or both?

“A conspiracy to defraud”

Hayes et al were indicted on the ancient common law offence of “conspiracy to defraud”. Criminal law minutiae, perhaps, but they were not charged under the more modern Fraud Act 2006, which followed a Law Commission report which also recommended abolishing common law “conspiracy to defraud”, because it is “unfairly uncertain, and wide enough to have the potential to catch behaviour that should not be criminal”.[1] Conspiracy to defraud was not, however abolished in 2006: {{Quote| “The government decided to retain it for the meantime, but accepted the case for considering repeal in the longer term.” [2]

In any case, the elements of the common law offence are, more or less:

That there was an agreement between two or more persons who intended to defraud another by doing something dishonest, like misrepresenting or making false promises and there was a likelihood of resulting loss it did not occur.[3]

These are the legal principles. Their application, it seems to this old commercial hack, demands marrying the facts — who did what to whom — to their specific legal meanings as “terms of legal art”.

The crux of these was Hayes dishonest when he submitted his LIBOR rates? That, in turn, came down to whether he “deliberately disregarded the proper basis for the submission of those rates”, intending thereby to prejudice the economic interests of others.

And that came down to whether Hayes’ submissions complied to the BBA’s “Instructions to BBA LIBOR Contributor Banks”.

It does not seem to be disputed that if Hayes complied with the rules, QED he was conspiring to defraud anyone, though no particular emphasis fell on whether this was because it was not a fraud in the first place, or because Hayes was not therefore being dishonest. The court focused on the dishonesty.

The critical part of the instructions — what the court called the “LIBOR Definition” ran as follows:

“An individual BBA LIBOR Contributor Panel Bank will contribute the rate at which it could borrow funds, were it to do so by asking for and then accepting inter-bank offers in reasonable market size just prior to 1100.”

It was not disputed that on any day there would be a range of rates available to a bank at which it could borrow, whether these took the shape of firm offers, or good faith estimates, or model outputs, but which of these rates was, for the purpose of the LIBOR Definition, “the rate at which it could borrow funds”.

Plainly, a submitter could not submit all of them. It seems to JC the logical options were:

- Choose one rate from those that were genuinely available per the bank’s good faith enquiry as above;

- Contrive some artificial rate from within that range, reflecting a weighted average.

- Submit a rate that did not fall within that range.

Option 3 plainly falls outside the scope of the LIBOR Definition. Option 2 does not quite match the literal text, but perhaps captures its spirit.

Option 1 is what Hayes actually did. The complication is that in choosing the rate to submit for a given day, Hayes actively sought out opinions as to what was in the best interests of the bank’s derivative trading books.

The bank trades interest rates with its customers: one customer might swap fixed for floating, another floating for fixed. Fixed rates, obviously, are fixed. Floating rates fluctuate daily based on a fixed spread over a fluctuating “benchmark rate”. Until this gory business, LIBOR was that benchmark.

If you swap a fixed rate for a floating rate, and LIBOR goes up, by definition you make money. The replacement value of that incoming floating rate, while the replacement cost of the outgoing fixed rate stays the same.increases.

Largely, it has a flat position, but may well end the day “long” or “short”

In particular, did a submitter have any leeway, when choosing between rates which otherwise might be valid, to consider its own best trading interests? The back might be positioned some days to benefit from raised interest rates, other days lower ones.

Facts and law

Now, US Courts, in acquitting Connolly and Black,[4] had considered the question before them to be one of fact: the text of the “LIBOR Definition” as filtered through the prisms of grammar, usage, subject matter expert opinion and industry practice. This question of law — whether it was dishonest — depended a great deal on matters of fact — what did Hayes believe the LIBOR Definition required, and if that seemed far-fetched, what a reasonable person reading the definition would think it required.

The English court considered it to be purely a question of law: if the interpretation of a (quasi) contractual term is not “a question of law,” then what is?

Crimes and contracts

Nor should we forget the “legal question” to be answered here is one of criminal law, not contract.

Under the intellectual theory of criminal law, ignorance or misunderstanding of the law is no excuse. This is axiomatic for an effective criminal justice system, the same way “all interests in cash pass by delivery” is to finance. The system would not work if it were otherwise: unlike contract law, it has no natural equilibrium. Ignorantia legis non excusat, if you are blameless in your inadvertebce, is a moral iniquity but still a logical imperative of government.

The same imperative does not hold for a contract. Au contraire; the whole theory of contract is that the parties are fully cognisant of the whole thing. That is what offer and acceptance requires. The rules of contractual interpretation have forged a different path:

Interpretation is the ascertainment of the meaning which the document would convey to a reasonable person having all the background knowledge which would reasonably have been available to the parties in the situation in which they were at the time of the contract. [...] The background was famously referred to by Lord Wilberforce as the “matrix of fact,” but this phrase is, if anything, an understated description of what the background may include. Subject to the requirement that it should have been reasonably available to the parties and to the exception to be mentioned next, it includes absolutely anything which would have affected the way in which the language of the document would have been understood by a reasonable man.

- —Lord Hoffman in Investors Compensation Scheme Ltd v West Bromwich Building Society [1998] 1 WLR 896

A couple of observations: one: plainly, what a contract means is, in some way, fact-dependent. It is not, purely, a matter of law.

Another is that how everyone else behaved when interacting with the same LIBOR Definition is instructive in determining what a reasonable person would have understood. There is no better indication of reasonableness that direct evidence of the actual belief of fellow passengers on the Clapham omnibus.

That one was under a misapprehension goes only to mitigation and not liability, though — as we will see — in a market where plainly everyone shared an opinion, different from the judge’s one, about what the “LIBOR Definition” meant, this risks rendering the law “a ass”.

There is also the odd spectre of the law of contract forming the backdrop, and comprising some of the elements of a criminal allegation. This is rare. Usually, the criminal authorities stay well out of commercial disputes, even where allegations of fraud are flying around — there is a civil tort of fraud — seeing it as a matter of civil loss between merchants perfectly able to look after themselves, and not one requiring the machinery of the state.

LIBOR, on whom the mortgage repayments of unwitting retail punters depend, made things a bit different. This is no private matter to be sorted out between gentlemen with revolvers. But nonetheless, still one must apply contractual principles, not criminal ones, to matters of contractual practice.

Everyone was at it

A fun game, if you have twenty minutes, is to google the names of the Seventeen LIBOR panel banks to see which of them were not somehow implicated in so-called “LIBOR rigging”.

If you haven’t got twenty minutes, then the WSJ’s brilliant spider network interactive graphic will give you the answer in an instant.

Everyone was at it.

Either (a) there was a colossal conspiracy at which everyone was trying to rip off the general public for personal gain and, since their efforts would naturally cancel each other out, probably failing or (b) this is how everyone understood to the LIBOR system to work. It might not be edifying, but employees have fiduciary obligations to their shareholders, and if everyone acts according to those fiduciary obligations — or even their own personal self interests — the selfishness cancels itself out. This is exactly the logic of Adam Smith’s invisible hand.

Now, seeing as the different desks and functions of a universal bank borrow in different markets, from different counterparties and in different circumstances, clearly, there will be no single unitary rate that the market will offer. The submitter will be confronted with a range of rates. Plainly it would be odd to submit a rate that was completely outside that range, but each of those rates counts as “a rate at which it could borrow funds”.

The judgment interpreted that as the lowest of the submitted rates in the range.

In the LIBOR Definition what is required is an assessment of the rate at which the panel bank “could borrow”. That must mean the cheapest rate at which it could borrow. A borrower “can” always borrow at a higher rate than the lowest on offer. But the higher rate would not reflect what the LIBOR benchmark is seeking to achieve, namely identification of the bank’s cost of borrowing in the wholesale cash market at the relevant moment of time. If in a stable and liquid market a submitting bank seeks and receives offers for a reasonable market size at the very time it is to make its submission, and receives offers ranging from 2.50% to 2.53%, it would accept the offer at 2.50%. It would be absurd to suggest that the LIBOR question could then properly be answered by a submission of 2.53%. The bank “could” borrow at that rate in the sense that it was a rate which was available, but that is obviously not what “could” means.

There is some economic logic to this argument, though it seems a brutal grounds for sending someone to prison for 14 years given how easy it would have been for those drafting the LIBOR rules to have put the matter beyond any doubt: namely, by inserting the word “lowest”:

“An individual BBA LIBOR Contributor Panel Bank will contribute the lowest rate at which it could borrow funds ...

And the argument here is not about economic reality, but legal meaning, and legal meaning follows natural, ordinary meanings, and in the world of contractual interpretation, they tend to be construed from the perspective of the person endeavouring to perform the contract and against the draftsperson’s interest, giving the benefit of the doubt to the reader.

As a matter of plain English, the court openly concedes that “could” does not logically rule out a higher rate, but implies it: “a borrower can always borrow at a higher rate than the lowest one on offer”.

But — per the wording in the LIBOR definition — there is not an unlimited upper bound to that: it is delimited by the range of “inter-bank offers in reasonable market size just prior to 1100”.

A submitted could not submit a rate higher than that actually offered range any more than it could submit a rate lower than the actually offered range.

To conclude this “could” does not mean that, therefore, involves implying a term into the contract. Inserting an adjective that the drafters of the rules could easily have included but chose not to.

Evidence was not led as to how the rules were drafted, and what flexibility the British Bankers’ Association had in mind. and after all, history has borne out that, sometimes, there are times where Banks and their regulators are rightly motivated by considerations other than the actual (lowest) rate at which one could borrow.

It is not often JC favours a US interpretation of things, but consider this from United States v Connolly and Black:

The precise hypothetical question to which the LIBOR submitters were responding was at what interest rate “could” DB borrow a typical amount of cash if it were to seek interbank offers and were to accept. If the rate submitted is one that the bank could request, be offered, and accept, the submission, irrespective of its motivation, would not be false.

See also

References

- ↑ Attorney General guidance to the legal profession on use of conspiracy to defraud, November 2012.

- ↑ Ibid.

- ↑ This is in JC’s plainly non expert words.

- ↑ United States v Connolly and Black (2d Cir. 2022) No. 19-3806