Prime brokerage transactions: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 16: | Line 16: | ||

===[[Margin loan]]=== | ===[[Margin loan]]=== | ||

In order to ''buy'' that share in the shop window, at which you’ve been gazing longingly each day as you pass on your way to and from work, you want to borrow some money. Good news: your broker — now we call it a [[Prime broker|“prime” broker]] — will ''lend'' you the wedge. But there’s a catch: ''first'', you have to pony up [[initial margin]], and if the stock drops in value, you’ll have to pony up ''more'' —and ''second'', you need to give your new shares to the [[prime broker]] so the prime broker can ''play with them''. It does this to offset its costs of lending the money to you in the first place. It will give them back to you only whjen you want to sell them. | |||

===[[Short selling]] | ===[[Short selling]]=== | ||

===Equity derivative (aka contract for difference)=== | ===[[Equity derivative]] (aka [[contract for difference]])=== | ||

{{sa}} | {{sa}} | ||

*[[Prime brokerage charging]] | *[[Prime brokerage charging]] | ||

*[[Prime brokerage]] | *[[Prime brokerage]] | ||

Revision as of 18:17, 6 January 2021

|

Hedge Funds & Prime Brokerage Anatomy™

The classic stock loan, yesterday

|

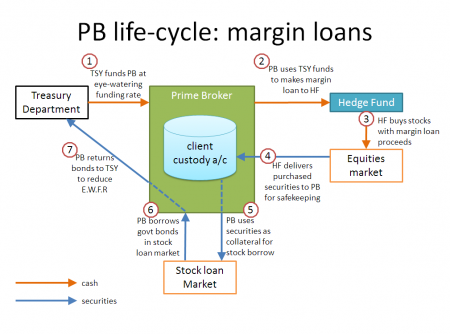

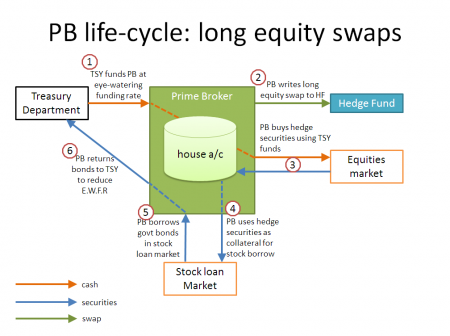

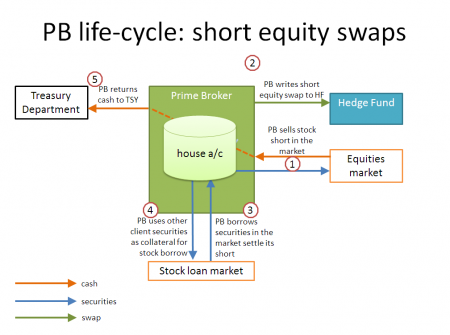

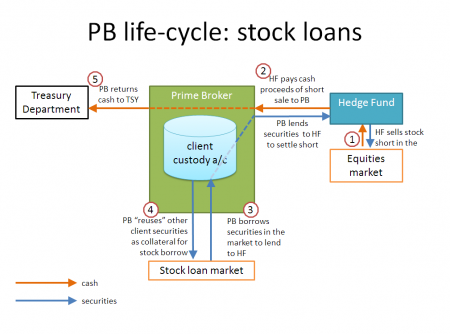

The classic prime brokerage transactions, illustrated in the panel:

- Physical long: A physical long position financed with a margin loan.

- Physical short: A physical short position created by selling a stock borrowed under a stock loan.

- Synthetic long: A “synthetic” economic equivalent of a physical long position created by entering a “long” equity derivative as a Floating Amount Payer.

- Synthetic short: A “synthetic” economic equivalent of a physical short position created by entering a “short” equity derivative as a Equity Amount Payer.

The ideas to get your head around are four, and in this order:

Brokerage

The business of getting a broker/dealer, being a regulated person with excellent connections to the market and access to all the best juicy sources of liquidity, to buy or sell shares for you. This is exactly the same idea as when you sell buy or shares through Charles Schwab: all that differs is the scale and volume. You give an order, the broker executes it, hyou are the proud owner of — or no longer the proud owner of — shares in XYZ.

Margin loan

In order to buy that share in the shop window, at which you’ve been gazing longingly each day as you pass on your way to and from work, you want to borrow some money. Good news: your broker — now we call it a “prime” broker — will lend you the wedge. But there’s a catch: first, you have to pony up initial margin, and if the stock drops in value, you’ll have to pony up more —and second, you need to give your new shares to the prime broker so the prime broker can play with them. It does this to offset its costs of lending the money to you in the first place. It will give them back to you only whjen you want to sell them.