Springing lien: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) (Created page with "{{def|Springing lien|/ˈsprɪnʤɪŋ/ /lɪən/|n|}} A security interest that takes everyone by surprise. A lien on a debtor’s property that kicks in should a pre-de...") |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{def|Springing lien|/ˈsprɪnʤɪŋ/ /lɪən/|n|}} | {{def|Springing lien|/ˈsprɪnʤɪŋ/ /lɪən/|n| | ||

[[File:Springen-verboten.jpg|450px|frameless|center]] | |||

}} | |||

A [[security interest]] that takes everyone by surprise. A [[lien]] on a debtor’s property that kicks in should a pre-defined event happen. For example, a loan may include a springing lien that requires the borrower to pledge its assets to secure the loan if the borrower's [[Ratings notches|credit rating]] is downgraded. Compare with a floating charge. | A [[security interest]] that takes everyone by surprise. A [[lien]] on a debtor’s property that kicks in should a pre-defined event happen. For example, a loan may include a springing lien that requires the borrower to pledge its assets to secure the loan if the borrower's [[Ratings notches|credit rating]] is downgraded. Compare with a floating charge. | ||

Revision as of 14:33, 10 February 2021

|

|

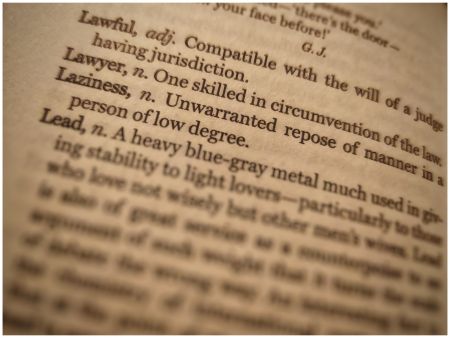

Springing lien /ˈsprɪnʤɪŋ/ /lɪən/ (n.)

A security interest that takes everyone by surprise. A lien on a debtor’s property that kicks in should a pre-defined event happen. For example, a loan may include a springing lien that requires the borrower to pledge its assets to secure the loan if the borrower's credit rating is downgraded. Compare with a floating charge.